Russia’s cryptocurrency laws have not convinced most mining businesses to register with authorities, as only 30% of the miners have entered the Federal Tax Service Register since late 2024. The Russian government began enforcing two crypto mining-related bills in October and November 2024, introducing legal definitions and registration requirements for mining businesses. Still, 70% of the miners remain underground, Finance Ministry official Ivan Chebeskov said, according to a report by local news agency TASS on Thursday. “When introducing mining regulations, our general approach was to bring this industry out of…

Tag: Report

Spanish bank BBVA advises wealthy clients to invest in Bitcoin: report

Spanish banking giant BBVA is reportedly advising its wealthiest clients to buy Bitcoin, just months after announcing plans to offer cryptocurrency trading to its customers. According to a report by Reuters, BBVA has advised its top money clients to have 3% to 7% of their portfolio allocated to Bitcoin (BTC) and cryptocurrencies. The suggested allocation depends on an investor’s risk appetite, said Philippe Meyer, Head of Digital & Blockchain Solutions at BBVA Switzerland. Speaking at the DigiAssets conference in London, Meyer revealed that the bank has been advising its private…

Interchain Labs, Asymmetric Research, and SEAL Alliance Publish Report on Contained DPRK-Linked Social Engineering Attempt; Report Confirms No Impact on Cosmos Stack Security – Branded Spotlight Bitcoin News

Interchain Labs, Asymmetric Research, and SEAL Alliance Publish Report on Contained DPRK-Linked Social Engineering Attempt; Report Confirms No Impact on Cosmos Stack Security – Branded Spotlight Bitcoin News You need to enable JavaScript to run this app. Original

Coinbase and Gemini Eyeing Multiple EU MiCA Licenses: Report

Key Notes The EU’s MiCA framework is becoming more attractive to top crypto exchanges. Coinbase and Gemini are among the firms looking to expand their regional footprint. Despite the growing number of MiCA licenses issued, concerns about fraud are growing. Coinbase and Gemini, two of the world’s largest cryptocurrency firms, are getting set to secure licences from countries in the European Union. These licences will grant the exchanges access to operate across the region. Notably, this news comes when regulators in certain jurisdictions are beginning to voice their concerns about…

Anthony Pompliano plots $750m Bitcoin buy via SPAC merger: report

Anthony Pompliano, one of crypto’s most recognizable names, is reportedly preparing to take the helm of a new public company with a singular mission: buying Bitcoin. Pompliano, known for his influential podcast and massive following on X, is expected to become CEO of ProCapBTC, a new entity planning to raise $750 million to purchase Bitcoin (BTC) directly. The company aims to go public through a merger with Columbus Circle Capital 1, a special purpose acquisition company backed by investment firm Cohen & Company, according to Financial Times reporting. The deal…

Amazon and Walmart Plotting Stablecoin Issuance Moves: Report

Key Notes American multinationals Amazon and Walmart are considering issuing their USD-pegged stablecoins. Taking this route may strain the traditional financial system that relies on these firms. This development signals an increase in mainstream adoption of stablecoins. . The era of stablecoins has successfully reached the doorsteps of top merchandise platforms Amazon.com Inc (NASDAQ: AMZN) and Walmart Inc (NYSE: WMT). According to the Wall Street Journal (WSJ), both firms are considering the possibility of issuing stablecoins backed by the United States dollar. Handing Liquidity from TradFi to DeFi With Stablecoins With…

Walmart and Amazon eye dollar-pegged stablecoins to cut payment costs: report

U.S. retail powerhouses Walmart and Amazon are reportedly weighing the launch of their own dollar-pegged stablecoins. Per a June 13 WSJ report, the companies are said to be exploring how stablecoin launch and integration could help streamline payment systems, significantly cut processing fees, and reduce reliance on the traditional banking infrastructure. By issuing their own tokens, both firms could shift massive volumes of daily transactions onto the blockchain, offering more efficient payment flows. Citing sources familiar with the matter, the report also noted that other major players, including Expedia Group…

Crypto Exchange Backed by Peter Thiel Confidentially Files for IPO With SEC: Report

The crypto exchange backed by tech billionaire Peter Thiel has reportedly filed for a US initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). Citing two people familiar with the matter, the Financial Times reports that in recent weeks, Bullish has confidentially filed the paperwork to start offering its shares to the public. Confidential filings enable companies to pursue their listing plans sans immediately revealing their financials to minimize public scrutiny. Bullish also attempted to go public in 2021 through a special purpose acquisition vehicle, but the…

Report: Jack Ma’s Ant Group Plots Global Stablecoin Power Grab

Jack Ma–backed Ant Group is said to be pursuing stablecoin licenses across multiple jurisdictions, including Singapore, according to a recent report by Bloomberg’s Lulu Yilun Chen. Ant Group’s Global Stablecoin Strategy Leaks As regulatory frameworks evolve at breakneck speed, traditional finance (TradFi) powerhouses are increasingly turning their attention to the expanding stablecoin arena. A recent […] Source CryptoX Portal

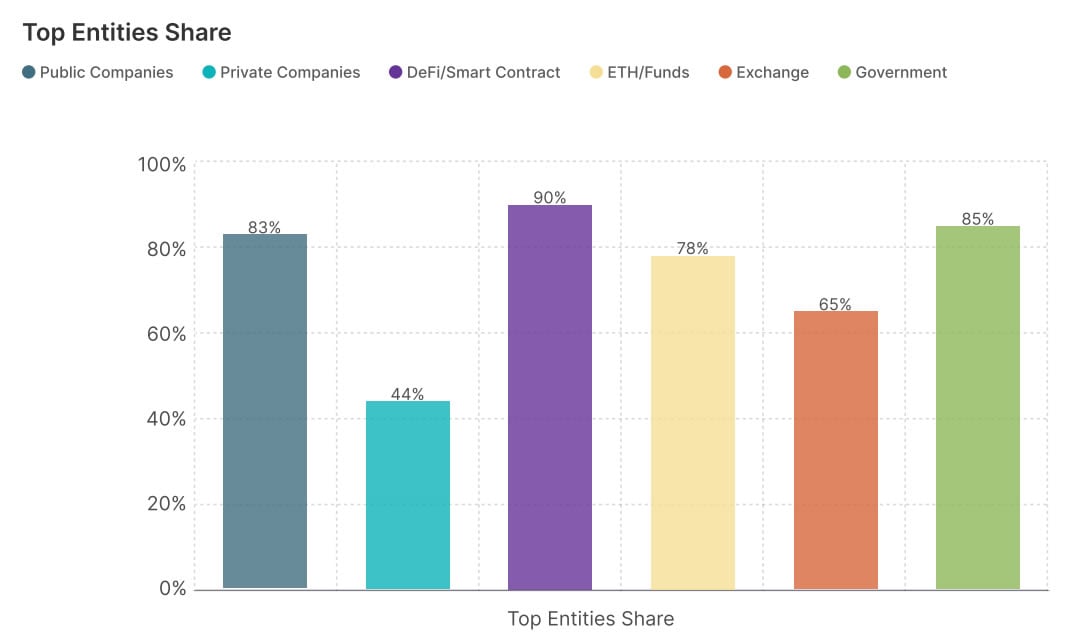

Over a third of Bitcoin’s circulating supply is in instituitional hands: report

Over a third of Bitcoin’s circulating supply is now held by centralized treasuries, including centralized exchanges, exchange-traded funds, and governments. According to the recent Gemini and Glassnode’s Report, over 30% of Bitcoin (BTC) circulating supply is now held by just 216 centralized entities across six categories: centralized exchanges, ETFs and funds, public companies, private companies, DeFi protocols, and governments. This consolidation of Bitcoin into institutional hands coincides with its rapid price appreciation—from under $1,000 in 2015 to over $100,000 today, suggesting that major institutions now view Bitcoin as a strategic,…