Tether Holdings, the issuer of the market’s largest stablecoin, USDT, has revealed that it maintains a vault in Switzerland to safeguard an impressive $8 billion stockpile of gold. According to Bloomberg, the firm’s significant reserve of nearly 80 tons positions Tether as one of the largest gold holders globally, surpassed only by central banks and sovereign nations with the company based in El Salvador expressing intentions to expand its gold reserves further. Tether Reveals 5% Of Reserves In Precious Metals In a recent interview, Tether’s CEO, Paolo Ardoino, emphasized the…

Tag: Stablecoin

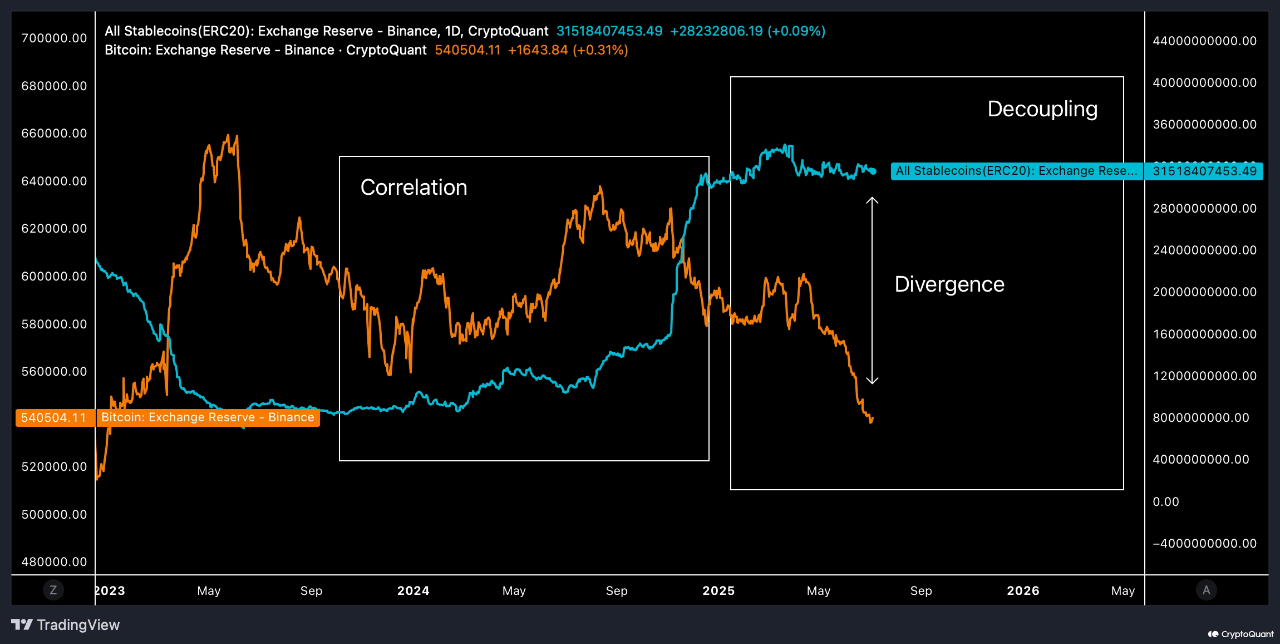

Bitcoin & Stablecoin Reserves Diverge On Binance: Liquidity Explosion Brewing?

On-chain data shows the Binance Exchange Reserve has diverged between Bitcoin and the stablecoins. Here’s what this could mean for the market. Bitcoin & Stablecoin Exchange Reserves Have Decoupled On Binance In a CryptoQuant Quicktake post, an analyst has talked about the latest trend in the Binance Exchange Reserve for Bitcoin and the stablecoins. The “Exchange Reserve” here refers to an on-chain metric that keeps track of the total amount of a given asset that’s sitting on the wallets attached to a centralized exchange. When the value of this metric…

ERC-20 Stablecoin Supply Hits All-Time High At $121B – Liquidity On The Rise

While Bitcoin struggles to break above its all-time high and altcoins face difficulty finding solid support, one corner of the crypto market continues to expand: stablecoins. Since the beginning of the bull run, the stablecoin market has shown consistent growth, cementing its reputation as one of crypto’s most reliable and scalable use cases. Unlike volatile assets, stablecoins offer stability, liquidity, and utility across DeFi, trading, and settlement. Related Reading Top analyst Darkfost recently shared fresh data and highlighted a key development many have overlooked — the total supply of ERC-20…

$31B Stablecoin Balance At Binance Points To Altcoin Season

Key takeaways: USDT and USDC balances on Binance hit a record $31 billion in June 2025. One analyst sees the reserve build-up as a “brewing liquidity explosion,” with investors waiting for clear altcoin trading opportunities. Over the past 90 days, Bitcoin dominance has steadily declined, hinting at a potential shift toward altcoins. According to crypto analyst Timo Oinonen, a long-awaited altseason may be on the horizon, highlighting a massive build-up of stablecoin reserves on Binance as a key catalyst. Oinonen noted that Binance’s USDT and USDC balances hit a record…

Dozens of Firms Eye Stablecoin Licenses in Hong Kong

Key Notes At least forty firms plan on applying for stablecoin licences in Hong Kong. Only a handful of licences are expected to be approved. Companies are expected to meet strict requirements before they are approved by the authorities. At least 40 firms in Hong Kong plan to apply for stablecoin licenses ahead of the expected launch in August 2025. However, only a few are likely to be approved due to strict regulatory requirements. This development is expected to follow the implementation of Hong Kong’s stablecoin legislation on August 1,…

Why Companies Like JP Morgan And Visa Are Creating Crypto Tokens

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Mainstream financial companies from JP Morgan to Visa are creating their own crypto currencies, known as stablecoins. Market analysts predict they could disrupt the credit card industry. Watch the video to learn why corporate giants are racing to launch their own crypto tokens. Chapters: 0:00 Introduction 1:48 The corporate embrace 7:06 Crypto risks 8:53 Regulation pushes ahead Hosted by MacKenzie Sigalos Reporting by Tanaya Macheel, Kaan Oguz Senior Managing Producer Jordan Smith Edited by Nora Rappaport Animation by Mithra Krishnan Senior Director…

South Korean Bank Stocks Surge After Stablecoin Trademark Filings

Shares of major South Korean banks surged following trademark filings for stablecoins, signaling growing institutional interest in digital assets. According to Google Finance data, at least three South Korean banks that recently applied for Korean won stablecoin trademarks saw their stock prices increase by 10% to almost 20%. The market reaction suggests investor optimism around the banks’ potential entry into the cryptocurrency sector. The filings came shortly after the inauguration of the country’s 21st president, Lee Jae‑myung, on June 4. His campaign included crypto-friendly promises, including the development of a…

Chinese Task Force Flags Illegal Stablecoin Schemes Amid Growing Interest

A Chinese task force has issued a warning to Shenzhen residents about fraudulent investment schemes targeting stablecoins. Growing Stablecoin Popularity A Chinese task force created to combat illicit financial activities has warned Shenzhen residents to be wary of fraudulent investment projects preying on the public’s limited understanding of stablecoins. In an alert issued July 7, […] Source CryptoX Portal

US Dollar May Weaken as Stablecoin Regulations Reshape Global Finance

Europe’s largest asset manager is sounding alarms as U.S.-regulated stablecoins surge, threatening to erode dollar dominance and destabilize global money flows at massive scale. US Dollar’s Global Role Challenged by Surge in Regulated Stablecoins A sweeping shift in global financial dynamics could be triggered by the U.S. push to regulate dollar-backed stablecoins, prompting fears of […] Source CryptoX Portal

Silent Climb: Stablecoin Market Inches Toward $260B Breakout

Although bitcoin has seen its fair share of price swings this week, the stablecoin market has quietly ballooned by $2.114 billion—edging ever closer to the $260 billion milestone. USDT Leads the Charge as Stablecoins Creep Toward $260B Summit Over the last seven days, the stablecoin market has climbed 0.84%, ticking up from $253.25 billion to […] Source CryptoX Portal