The biggest stock exchange in Russia is adding futures trading for asset management titan BlackRock’s iShares Bitcoin Trust ETF (IBIT), one of the biggest exchange-traded funds in the world, to its suite of products. In a new announcement, Moscow Exchange (MOEX) – the government of Russia’s venture into the world of crypto assets – says that starting on June 4th, it’s adding support for the product, though only to accredited investors. “Please note that today, June 4, 2025, trading in the IBIT-9.25 (IBU5) futures contract, permitted only to qualified investors,…

Tag: Stock

Vanadi plans major Bitcoin accumulation after 90% stock plunge

The struggling coffee chain hopes to reinvigorate its stock price by pivoting to a Bitcoin-first strategy. Bitcoin (BTC) is becoming increasingly attractive to companies looking to revitalize their businesses. One such company is Spanish coffee chain Vanadi, which on Wednesday, announced plans to invest $1.1 billion in Bitcoin. Vanadi Coffee SA Board Chairman Salvador Martí stated that the publicly traded company would completely reorient its strategy from coffee to Bitcoin. Martí plans to seek board approval at the next meeting, scheduled for June 29. “I ask the board for authorization…

Bitcoin Edges Higher as Stock and Crypto Markets Rally

The cryptocurrency’s price rose past $106K on Tuesday morning, as both stock and crypto markets saw positive gains. Stocks Climb, Bitcoin Follows Bitcoin resumed its upward trend on Tuesday, climbing as high as $106,813.58 as stocks and the broader crypto market posted similar gains. Tech stocks led the rally for the S&P 500 and positive […] Original

Bitcoin-focused Matador Technologies lists on Frankfurt Stock Exchange

Matador Technologies Inc. announced on Tuesday that it has begun trading on the Frankfurt Stock Exchange under the ticker “IU3,” adding a key European listing to its existing U.S. and Canadian markets. The listing supports Matador’s goal of offering near round-the-clock trading access to its shares globally, a structure modeled after the 24/7 availability of Bitcoin (BTC). With the addition of Europe, investors in three major regions can now trade Matador stock in their local time zones. “This listing completes a key part of our global capital markets strategy,” said…

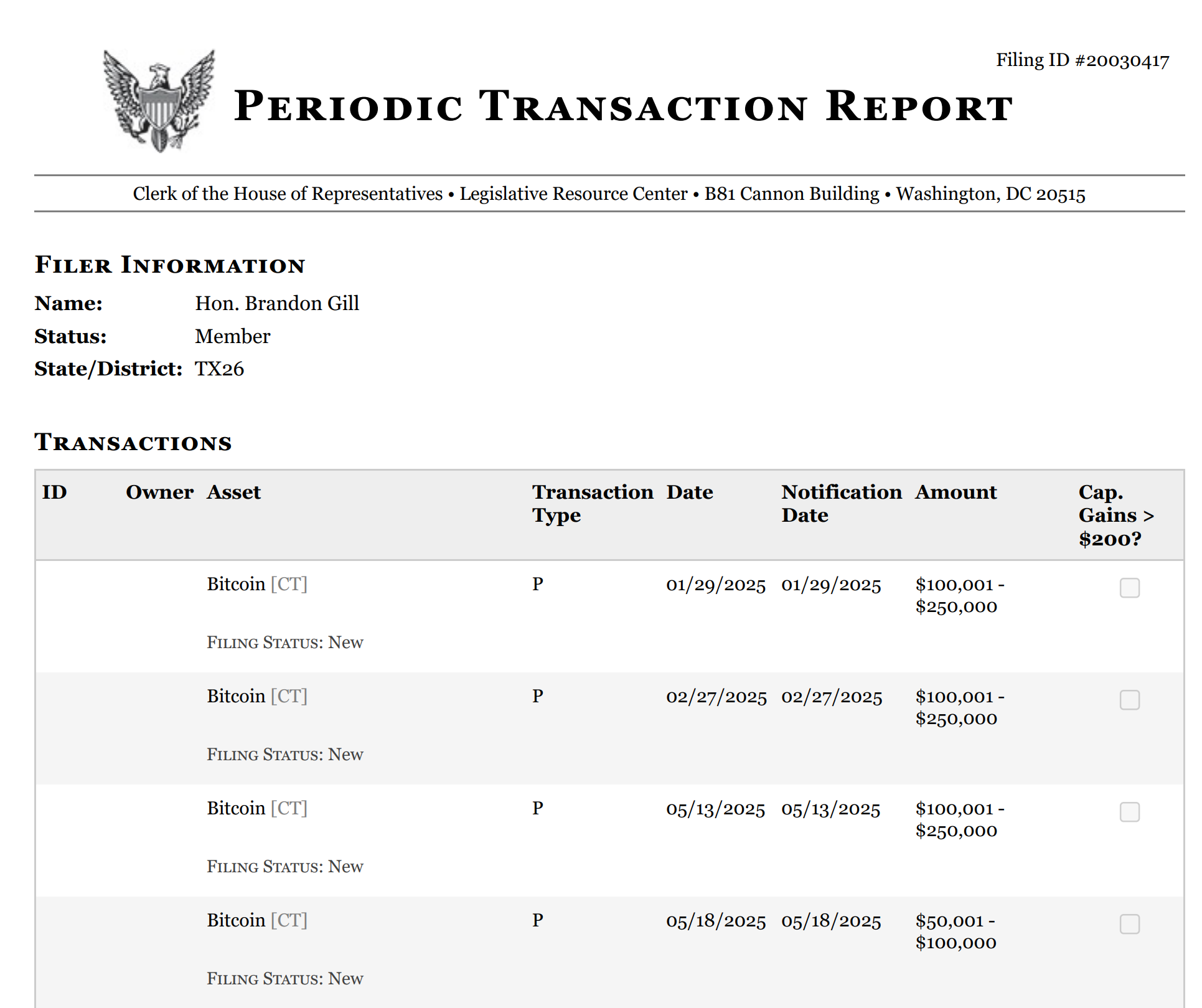

Texas Rep. Brandon Gill’s $500K Bitcoin buys spark STOCK Act scrutiny

Texas Republican Representative Brandon Gill is facing scrutiny after filing late disclosures for up to $500,000 in Bitcoin purchases, potentially violating federal law. Gill, a first-term House member known for his bill proposing President Donald Trump’s face on the $100 bill, has reported two Bitcoin (BTC) purchases, each valued between $100,001 and $250,000, made on Jan. 29 and Feb. 27. However, both trades were disclosed weeks past the 45-day deadline required by the Stop Trading on Congressional Knowledge (STOCK) Act, a law aimed at curbing insider trading and financial conflicts…

Norwegian Block Exchange stock rises 138% on Bitcoin buy

The Norway-based crypto exchange Norwegian Block Exchange has seen its stock price jumped over 138% in a single day after it said it was starting to buy and hold Bitcoin. The company said on June 2 it purchased 6 Bitcoin (BTC), worth $633,700 at current prices, with plans to expand its holdings to 10 BTC by the end of the month. It added that it’s continuing discussions to raise further capital for more Bitcoin buys. Shares in Norwegian Block Exchange (NBX) stock rose over 138.5% over the June 2 trading…

21Shares courts retail with 3-for-1 Bitcoin ETF stock split

The ARK 21Shares Bitcoin ETF (ARKB) will undergo a 3-for-1 share split later this month as the fund’s issuer, 21Shares, says it is looking to boost its appeal to retail investors. The stock split is slated for June 16 and is designed to “make shares more accessible to a broader base of investors and enhance trading efficiency,” 21Shares said on June 2. The exchange-traded fund’s (ETF) investment strategy aiming to track the price of Bitcoin (BTC) won’t change, and its Bitcoin holdings will remain identical, 21Shares said. It added that…

Strategy offers $250M preferred stock to stack more Bitcoin

Strategy, formerly MicroStrategy, plans to raise $250 million through an initial public offering of a new class of perpetual preferred stock so it can fund more Bitcoin purchases. Strategy intends to issue 2.5 million shares of its 10% Series A Perpetual Stride Preferred Stock, with the ticker STRD, at $100 a share, the Bitcoin-stacking firm said in a June 2 statement. Proceeds from the offering will be used to acquire additional Bitcoin (BTC) and provide working capital, it added. Perpetual preferred stocks often pay fixed dividends indefinitely, with no maturity…

Michael Saylor – “This Unexpected Twist Could Drive Bitcoin’s 100x Rise”

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Join this channel to get access to perks: 💰 Win Up To 93% Of Trades With The #1 Most Profitable Trading Indicators 👉 Tired of spending hours crafting engaging video scripts? Wish creating quality content was quicker and easier? 👉 This 7-Second Tesla Ritual Attracts Money To You Whistleblowing Neuroscientists have discovered a new way to make more money start appearing in your life as soon as today… 💰 Make Money Buying and Selling Social Media Accounts For Safe Transactions, visit: 🐦…

Strategy Unveils Stock IPO Plan to Fuel Relentless Bitcoin Expansion

Strategy accelerates its unstoppable bitcoin dominance with a bold IPO move, leveraging high-yield STRD stock to fuel record-breaking BTC acquisitions and expand market supremacy. Strategy Pushes Forward With Relentless Bitcoin Growth via STRD IPO Software intelligence firm Microstrategy (Nasdaq: MSTR), which has rebranded as Strategy, announced on June 2 its intention to initiate an initial […] Original