Blackrock’s digital asset chief sees bitcoin as a “risk-off” asset even though it has shown a pattern aligned with U.S. stocks. He drew parallels between bitcoin and gold, pointing to its decentralized structure and limited supply as crucial factors setting it apart. Blackrock’s increasing engagement with bitcoin is also reflected in the strong performance of […] Original

Tag: Stock

Bitcoin Exchange On The Horizon For Europe’s 3rd Biggest Stock Exchange

Este artículo también está disponible en español. According to the Financial Times, the Swiss stock exchange SIX, the third largest in Europe, is exploring the possibility of launching a new Bitcoin and crypto exchange in the country, aiming to position itself to compete with exchanges like Binance, OKX and Coinbase. SIX Group Plans New Bitcoin Trading Venue Bjørn Sibbern, Global Head of Exchanges at SIX Group, highlighted the potential for creating a platform to facilitate trading in spot cryptocurrencies and derivatives, noting that crypto has become a globally recognized asset…

Bitcoin Jumps Over $58K Amid Tech Stock Rally, SUI Outperforms

SUI beat BTC and ETH in the early hours of East Asia trading. Original

Analyst Forecasts Gold Prices to Reach $2,950 as American Investors Escape From AI and Stock Market Bubbles

Adam Hamilton, the founder of Zeal Intelligence, a financial consulting company, predicts that gold prices will rise as American investors turn to gold, fleeing from traditional stocks and the burst of the artificial intelligence (AI) bubble. Hamilton explained that gold experienced this price upswing without this main demand factor, stressing that it was a very […] Source CryptoX Portal

Virtu Financial Partners with Tokyo Stock Exchange to Enhance ETF Liquidity and Efficiency

Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 Understanding APAC Markets: Partnerships, Culture, Retention | FMPS:24 In financial services, achieving global success requires a deep understanding of local markets. In this hands-on, country-specific session, top experts from the Asian Pacific region will explore what drives traders in this diverse market. The discussion will cover strategies for retaining local…

Mark Cuban Warns Kamala Harris’ Unrealized Gains Tax Will Kill Stock Market

Billionaire Mark Cuban warned that taxing unrealized gains would “kill” the stock market but believes Vice President Kamala Harris would not prioritize this policy. While Harris supports parts of President Biden’s tax plan, Cuban emphasized it is not her final stance. He also raised concerns about the policy’s impact on early-stage companies struggling with cash […] Source CryptoX Portal

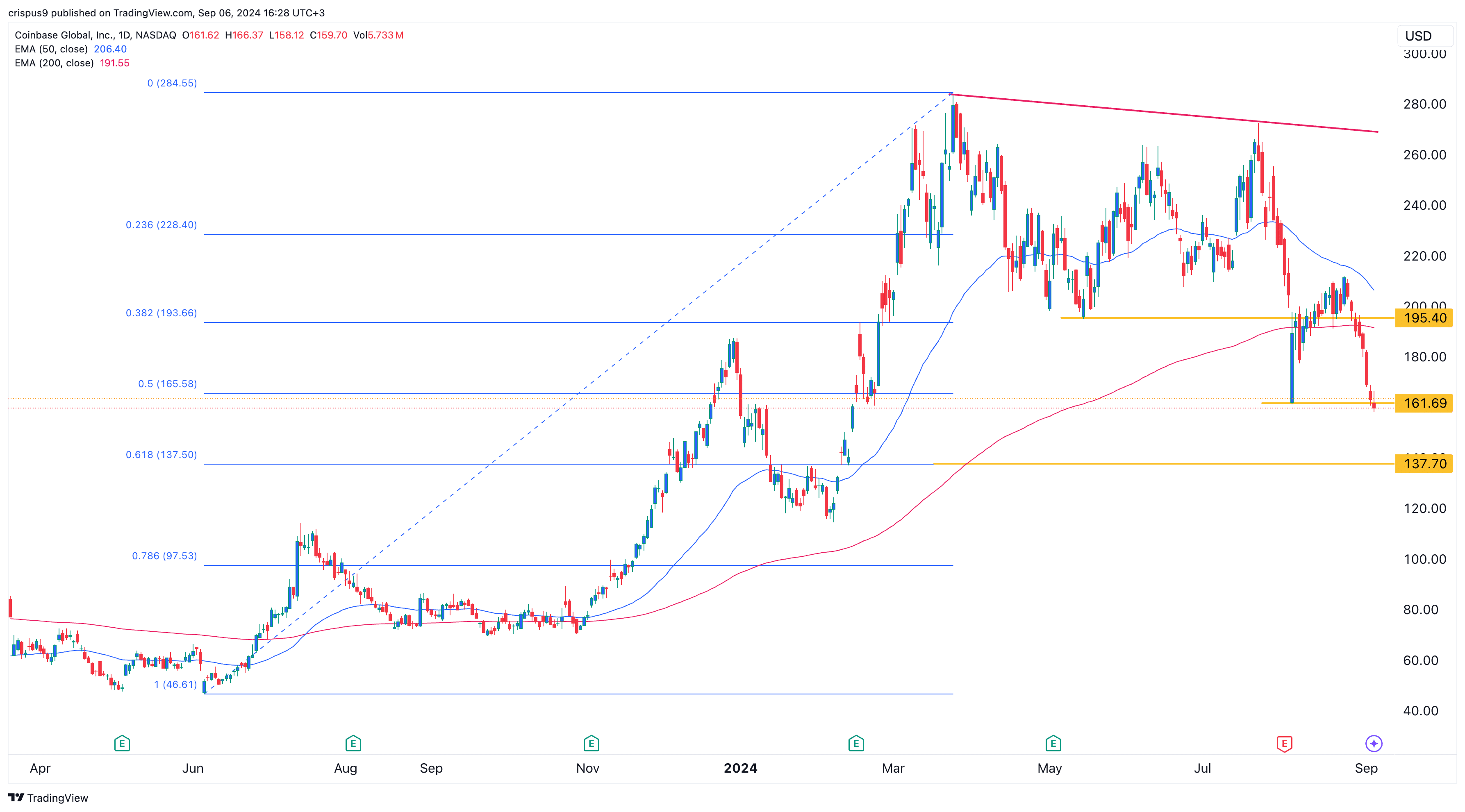

Coinbase stock forms risky patterns as crypto outlook darkens

Coinbase stock slipped for eight straight days, the longest losing streak since July, as cryptocurrencies continued falling. Coinbase is facing major headwinds Decentralized and centralized exchanges have come under pressure as cryptocurrency volume has dropped in the past few months. Data from DeFi Llama shows that the volume traded in DEXs peaked at $260 billion in March and then retreated to $175 billion in August. More data shows that the volume traded on CEX platforms stood at $1.2 trillion in August, down from $2.48 trillion in March. This volume has…

Bitcoin Dives Under $56K Amid Global Stock Market Rout

BTC briefly fell to $55,500, its lowest since August 8, to reverse nearly all gains in the past month. The broader market tracked by CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market capitalization, fell nearly 6%. Major tokens solana’s SOL and ether (ETH) dropped over 7%, leading losses. Source

First Solana Spot ETF Raises $2.75 Million on Brazilian Stock Exchange

On Thursday, the first Solana spot exchange-traded fund (ETF) product raised over $2.75 million during its public offering on B3, the Brazilian stock exchange. The product, previously approved for trading by the Brazilian securities regulator (CVM), is offered by QR Asset, which also has a bitcoin-based ETF product. The offering managed to raise only 15% […] Source

Signs Of A New Crypto Winter? Warren Buffett’s $1 Billion Stock Sales Spark Market Crash Fears

Amid growing global economic uncertainties looming over financial markets, including crypto, Warren Buffett has made a significant move by selling an additional $982 million worth of Bank of America stock. Buffett’s Sale Of Bank Of America Shares According to Bloomberg, this sale marks the continuation of his conglomerate’s reduction of investments in the second-largest US bank. Berkshire Hathaway has trimmed its stake by nearly 13% through sales since mid-July, generating $5.4 billion in proceeds. These sales mark Buffett’s most substantial retreat from an investment that has historically signaled an endorsement…