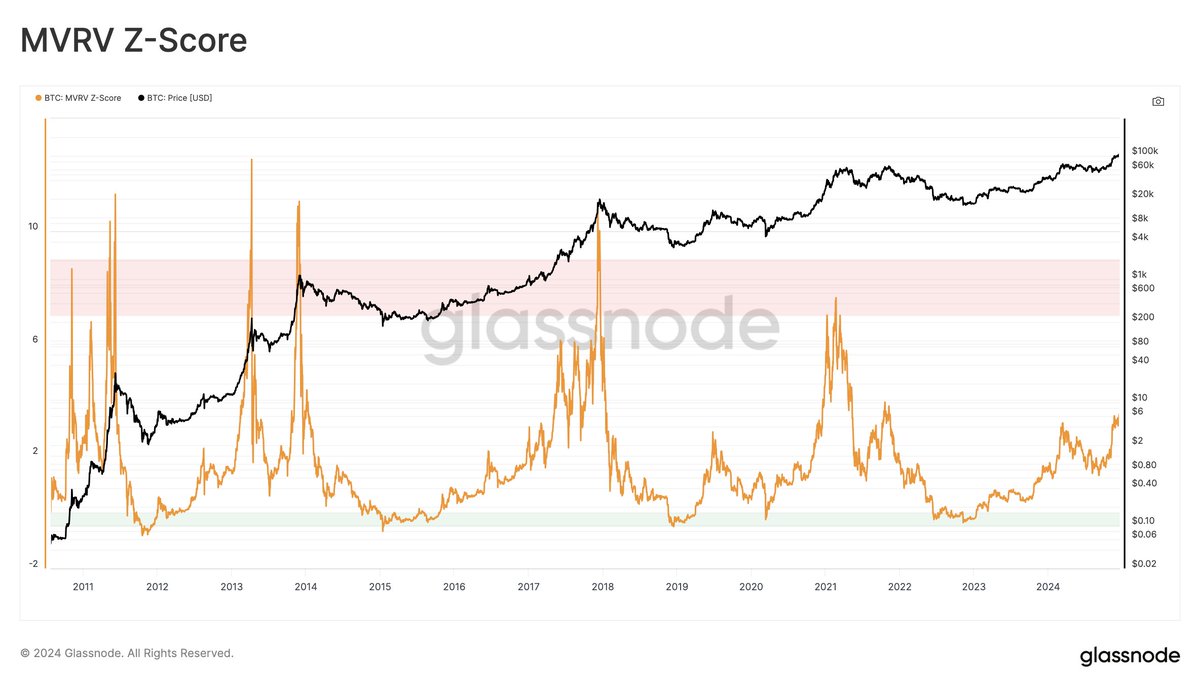

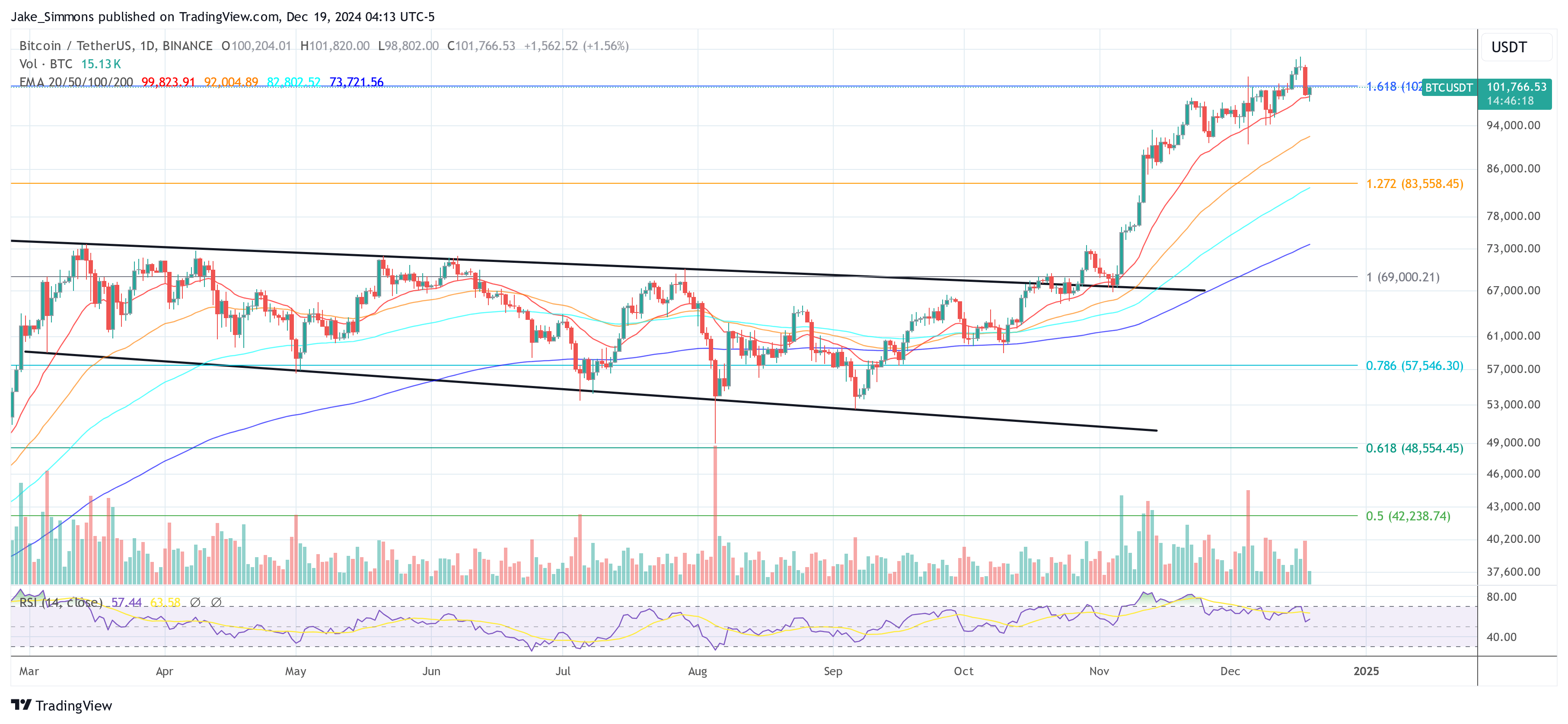

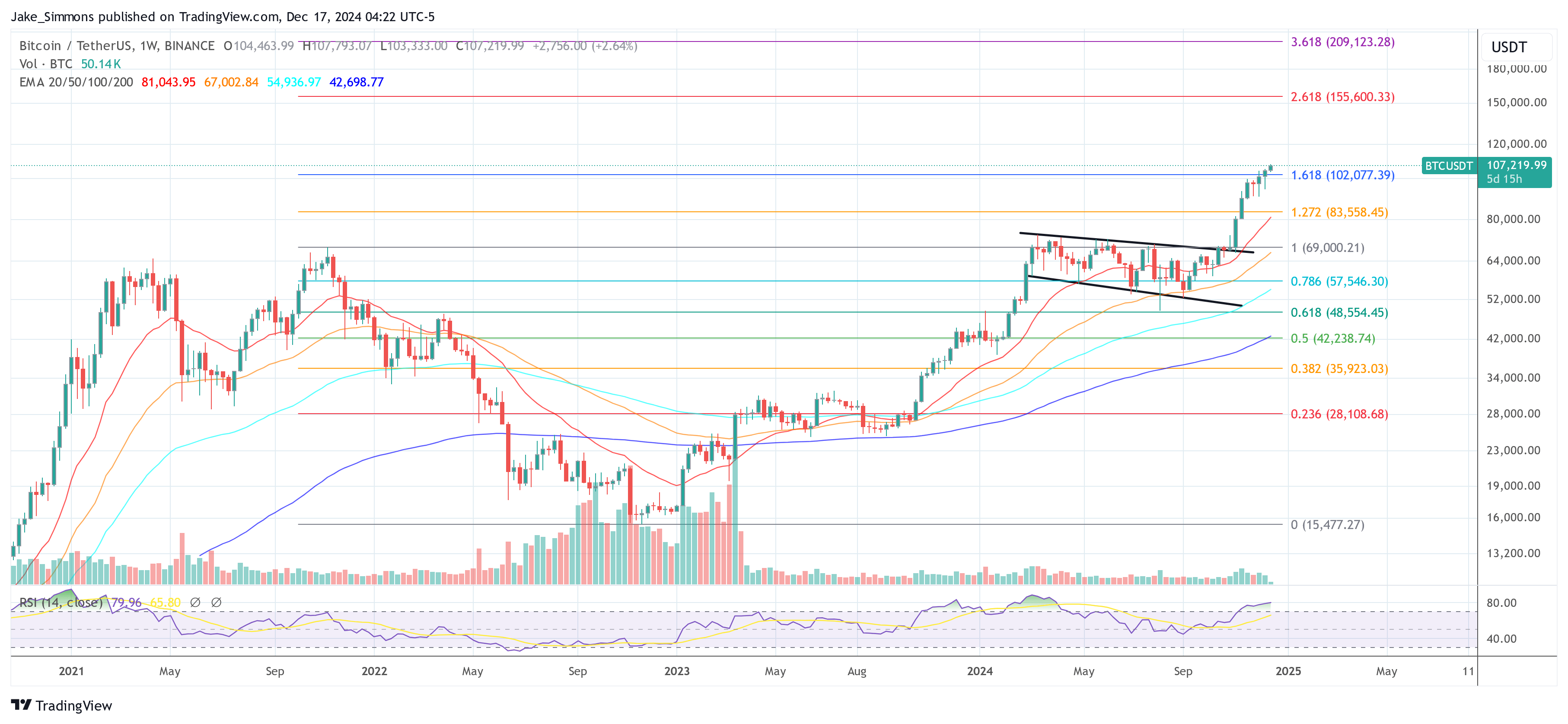

Este artículo también está disponible en español. Bitcoin’s price retracement from its new all-time high of $108,353 on Tuesday to around $96,000 (a -11.5% pullback) has ignited intense speculation about whether the current bull cycle is nearing its peak. To address growing uncertainty, Rafael Schultze-Kraft, co-founder of on-chain analytics provider Glassnode, released a thread on X detailing 18 on-chain metrics and models. “Where is the Bitcoin TOP?” Schultze-Kraft asked, before laying out his detailed analysis. Has Bitcoin Reached Its Cycle Top? 1/ MVRV Ratio: A longstanding measure of unrealized profitability,…

Tag: Top

Top Football Prospect to Be Paid in Bitcoin After Cinching College Contract

The 2025 Polynesian Bowl All-Star signed with the University of Southern California and will use payments app Strike to receive a portion of his compensation in bitcoin (BTC). Newly Signed USC Linebacker Opts for Bitcoin Matai Tagoa’i one of the top college football prospects in the country recently signed a “name, image, and likeness” (NIL) […] Original

Is The Crypto Bull Run Over? Top Exec Discusses The Crash

Este artículo también está disponible en español. The broader crypto market experienced a pronounced downturn following yesterday’s Federal Open Market Committee (FOMC) meeting, held on December 18. After the US Federal Reserve delivered a 25-basis-point rate cut as anticipated, it also signaled fewer cuts in 2025 than previously expected. In response, the Bitcoin price fell by more than 5%, dropping below the $100,000 mark before showing slight signs of recovery. Altcoins saw across-the-board double-digit percentage declines. The Federal Reserve’s decision—while meeting expectations for a 25-basis-point reduction—came with a notable shift…

Bitwise Exec Reveals His Top 3 Crypto Predictions For 2025

Este artículo también está disponible en español. In a post on X dated December 17, 2024, Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, shared his personal top three predictions for the crypto sector in 2025. His insights come at a time when the crypto market has experienced significant growth, and after Bitwise released its annual top 10 crypto predictions for the next year. #1 Bitcoin Structured Products Surge Park predicts that by 2025, Bitcoin structured products will see an asset influx of at least $5 billion. He…

XRP Consolidation Could End Once It Clears $2.60 – Top Analyst Expects $4 Soon

Este artículo también está disponible en español. XRP has entered a consolidation phase after reaching a multi-year high of $2.90 during the first week of December. The cryptocurrency’s price action has left investors uncertain about its next move, fueling speculation about whether XRP will surpass the critical $3 mark or if the cycle top has already been set. This indecisive environment reflects a broader trend of caution among market participants, as XRP’s future remains unclear. Related Reading Ali Martinez, a prominent crypto analyst, recently shared insights suggesting that XRP has…

Bitcoin To Hit $180,000 If These Top Indicators Are Absent: VanEck

Este artículo también está disponible en español. Bitcoin could soar to $180,000 in 2025 if key cycle top indicators remain muted, according to Matthew Sigel, Head of Digital Assets Research at VanEck. Speaking with podcast host Natalie Brunell, Sigel outlined a clear four-year pattern in Bitcoin’s price action that he believes has persisted through multiple market cycles. Why $180,000 Per Bitcoin Seems Plausible Sigel explained that Bitcoin tends to outperform nearly every other asset class for three years out of each four-year halving cycle, followed by a deep correction in…

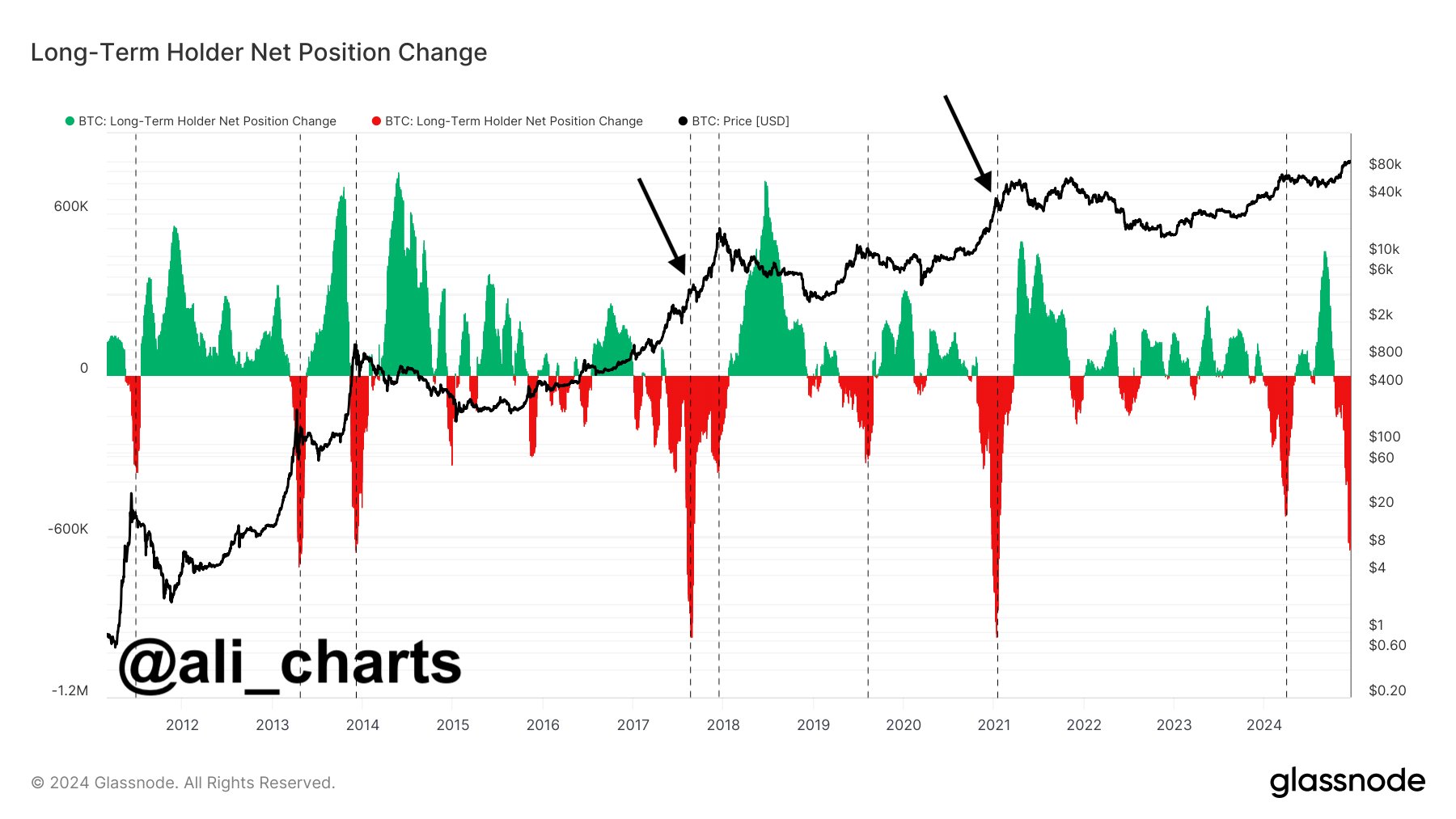

Bitcoin Top Here? What Historical HODLer Selloff Pattern Says

On-chain data shows the Bitcoin long-term holders are selling. Here’s whether the current level of selloff is enough for a price top or not. Bitcoin Long-Term Holders Have Been Selling Big Recently In a new post on X, analyst Ali Martinez has discussed about the historical trend in the holdings of the long-term holders relative to the Bitcoin top. The “long-term holders” (LTHs) refer to the BTC investors who have been holding onto their coins for more than 155 days. The LTHs represent one of the two main divisions of…

Top 5 Coins To Watch This Week

Este artículo también está disponible en español. The crypto ecosystem is on the cusp of yet another significant week, ushered in by several major developments taking place across different networks. This week’s spotlight falls on Bitcoin, Fantom, Avalanche, Stacks, and LayerZero, each of which is facing a pivotal milestone. The broader macro backdrop is also critical, particularly the December 18 Federal Open Market Committee (FOMC) interest-rate decision in the United States. #1 Bitcoin And Crypto Await The FOMC Decision Bitcoin traders and investors are watching the Federal Reserve’s policy meeting…

Top UAE Bank Joins the Crypto Revolution With Investment in Zodia Custody

Emirates NBD, a leading United Arab Emirates (UAE) bank, has invested in Zodia Custody, a digital asset custodian, through its Innovation Fund. A Step Forward for Zodia Custody Emirates NBD, one of the United Arab Emirates’ leading banks, recently disclosed that it had invested in Zodia Custody, a digital asset custodian. The investment was made […] Source CryptoX Portal

Dogecoin Will See New ATH Soon – Top Trader Sets $2 Target

Este artículo también está disponible en español. Dogecoin is testing demand above the $0.40 level following several days of consolidation below its yearly high of $0.484. This period of choppy price action has kept traders on edge, as Dogecoin’s price appears poised for a decisive move. Despite the temporary pause in upward momentum, market sentiment remains optimistic, with many investors anticipating another breakout. Related Reading Top analyst and trader Hardy recently shared a technical analysis highlighting Dogecoin’s potential for a massive price surge. According to Hardy, it’s only a matter…