Stablecoins, cryptocurrencies whose price is meant to be pegged to a real-world asset such as a national currency or gold, are key pieces of plumbing for the crypto market, serving as a bridge between fiat money and digital assets. They are increasingly popular for non-crypto activities in emerging regions like Latin America and Southeast Asia, with uses ranging from saving in dollars, payments and cross-border transactions, a fresh report by venture capital firm Castle Island and hedge fund Brevan Howard Digital said.

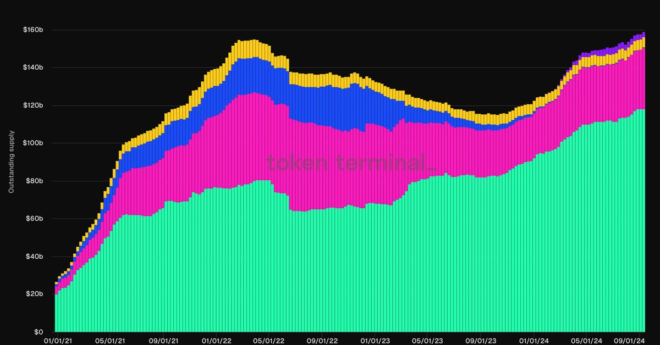

Tether-Issued Stablecoin USDT’s Market Dominance Surges as Market Cap Surpasses $118B