Key Notes

- Scudo eliminates complex decimal fractions in XAUT transactions, making gold practical for daily payments and small purchases.

- Gold reached $4,525 per ounce in December 2025 while Bitcoin dropped from $125K to sub-$85K levels during market volatility.

- Tether’s innovation positions gold-backed tokens as stable value stores amid cryptocurrency market instability and economic uncertainty.

Tether has launched “Scudo,” a new unit of account for Tether Gold

XAUT

$4 479

24h volatility:

1.1%

Market cap:

$2.33 B

Vol. 24h:

$388.43 M

designed to facilitate fractional transactions, making it easier to make and accept payments in gold.

According to a Jan. 6 press release from Tether, one Scudo is equal to one thousandth of a troy ounce of gold or the equivalent amount of XAUT. This allows users to price assets in a manner that avoids what Tether refers to as “complex decimal fractions of XAUT.”

Tether says users can transact in whole or partial Scudo units, making it practical to use gold as a medium of exchange, even for daily use. This added accessibility could appeal to investors and cryptocurrency holders seeking safe haven during economic disruption.

Introducing Scudo.

A new way to measure the value of gold on-chain. Scudo is a simple, intuitive unit that makes Tether Gold ( XAU₮) easier to use, track, and transact.1 Scudo = 1/1000 of an XAU₮ (Gold Ounce), giving you a practical and accessible way to send and receive gold… pic.twitter.com/JLbhuUYTk2

— Tether Gold (@tethergold) January 6, 2026

Gold reaches all-time highs

In October 2025, gold reached a new all-time high of $4,058.98 per ounce. Meanwhile, Bitcoin

BTC

$91 876

24h volatility:

2.3%

Market cap:

$1.83 T

Vol. 24h:

$54.40 B

also claimed a new all-time high in the same month, peaking at $125,556 as 2025 came to a close. Before the year was out, however, Bitcoin would plummet below $85,000 in November. It managed to claw its way back to $90K by year’s end but, as of the time of this article’s publication, a brief pulse to $94K on Jan. 5 has been undone as BTC sits at $92.5K.

Bitcoin price as of Jan. 6 | Source: LSEG

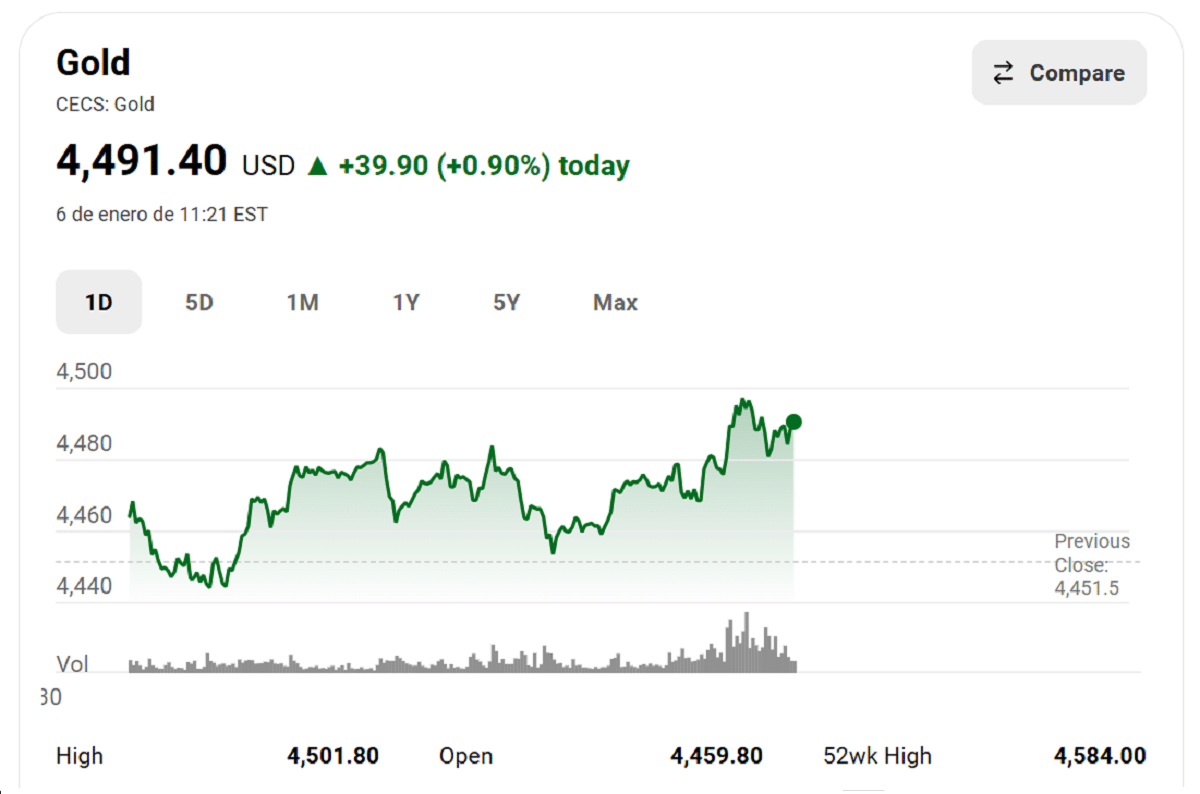

Gold managed to maintain its post-October momentum, reaching a new all-time high price of $4,525.16 per ounce on Dec. 23, 2025 before retreating slightly over the next week. As of Jan. 6, gold has reclaimed $4,491 and is up nearly a percent for the day.

Gold price as of Jan. 6 | Source: LSEG

The economic impact of skyrocketing gold prices and relative instability within the cryptocurrency market, especially among cornerstone tokens such as Bitcoin and Ethereum

ETH

$3 216

24h volatility:

0.6%

Market cap:

$388.19 B

Vol. 24h:

$28.99 B

, has positioned both stablecoins and gold as prime value stores for investors and traders.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Tristan is a technology journalist and editorial leader with 8 years of experience covering science, deep tech, finance, politics, and business. Before joining Coinspeaker, he wrote for Cointelegraph and TNW.