Traditionally, options are used to mitigate risk, although some speculators use them like futures to amplify returns. Bulls typically buy puts to protect against a potential downside, while bears use call options to protect from a sudden upswing in prices. Efficient use of options is contingent on a thorough understanding of key metrics, the so-called Greeks – delta, gamma, theta and rho, that affect the price of an options contract.

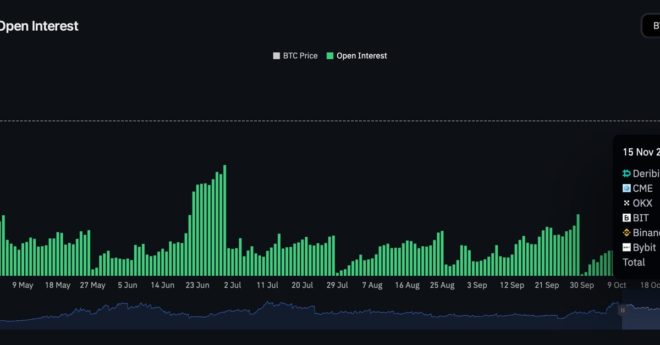

The BTC Options Market Is Bigger Than Its Futures Market