There are few questions in crypto hotter at the moment than whether or not U.S. regulators will finally allow for the creation of ETFs that hold bitcoin (as opposed to the current landscape where the closest thing regulators have allowed are ETFs that hold bitcoin futures contracts). Traditional finance giant BlackRock recently put its enormous muscle behind the push, applying to create one of its own. Given its sway in Washington, D.C., as the world’s largest asset manager, this has generated a massive amount of optimism that a spot bitcoin ETF may not be far from reach. And others like Fidelity, the large mutual-fund manager, have also applied for bitcoin ETFs.

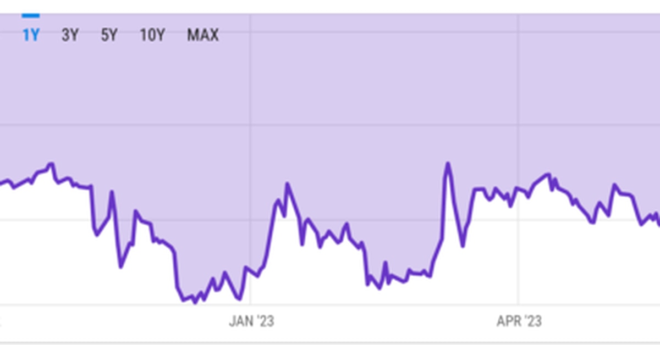

The Grayscale Bitcoin Trust Discount Is Narrowing; Here’s Why It Matters