By Omkar Godbole (All times ET unless indicated otherwise)

The overture to 2025 has a familiar tune. It’s not just the numbers: Bitcoin’s 8% recovery from late December, but the news flow is equally recognizable.

Perhaps the most important note comes from JPMorgan, which says the market forces that drove bitcoin and gold to records last year are still around.

“The debasement trade is here to stay, with both gold and Bitcoin becoming increasingly important components of investors’ portfolios,” the investment bank wrote.

The debasement trade is a strategy where investors buy assets that protect against declines in fiat currencies and government bonds due to inflation and policy shifts.

Last year’s debasement play drove bitcoin above $100,000 — a figure it’s approaching again — and gold over $2,600. The rallies were fueled by increased geopolitical uncertainty, persistent inflation concerns, debt debasement in advanced economies, fears of fiat currency devaluation in emerging markets and a shift away from the U.S. dollar. Coupled with President-elect Donald Trump’s pro-crypto stance, this led to a record $78 billion in net inflows into the digital assets market, according to JPMorgan.

Any discordant tone comes from elevated bond yields and a strong dollar driven by economic optimism and declining Fed rate-cut bets, which could limit upside potential in the short term. This Friday’s nonfarm payrolls report will provide a critical test for the hawkish Fed narrative, with expectations for 154,000 job additions in December.

The shenanigans surrounding BTC-holder MicroStrategy (MSTR) deserve attention, particularly the social-media buzz about brokers reducing their exposure to the company. This reduction comes alongside significant increases in margin requirements, raising concerns about potential volatility.

Meanwhile, crypto economist Ben Lilly suggests that ether’s price has been suppressed by the growing number of coins locked up in the DeFi protocol Ethena, which shorts ETH futures as part of a delta-neutral hedge strategy to maintain the $1 peg of its stablecoin, USDe. ETH has jumped 10% in the first six days of the year but remains well below its record high.

“This suggests a shift in the market toward delta-neutral exposure on ETH instead of seeking upside by holding it as collateral. Thus, the ETH price is likely to be muted on the upside because of Ethena,” Lilly said on X.

Ethena has announced plans to launch iUSDe, a version designed for institutional investors seeking exposure to yield-bearing USDe without direct token interaction. Meanwhile, the leading on-chain perp DEX exchange, Hyperliquid, has listed SOLV, the native token of the Bitcoin staking protocol Solv Protocol, and whispers are circulating about whales looking to buy up the HYPE token. Stay alert.

What to Watch

- Crypto

- Jan. 6: Decentralized exchange Uniswap’s layer-2 blockchain, Unichain, starts its transition to mainnet.

- Jan. 6: Binance is delisting DAR (rebranding).

- Jan. 6: SONIC primary listing.

- Jan. 7: Dusk (DUSK) mainnet launch.

- Jan. 8: Bybit terminates withdrawal and custody services to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) token generation event.

Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s latest release. - Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

Jan. 15: Derive (DRV) token generation event. - Jan. 15: Mintlayer version 1.0.0 release. The mainnet is undergoing an upgrade that introduces Atomic Swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Trading for the Sonic token (S) is set to start on Binance, featuring pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 6, 9:15 a.m.: Fed Governor Lisa D. Cook gives a speech, “Economic Outlook and Financial Stability,” at the Seventh Conference on Law and Macroeconomics, Ann Arbor, Michigan. Livestream link.

- Jan. 6, 9:45 a.m.: S&P Global releases U.S. December 2024 PMI final.

- Composite PMI Est. 56.6 vs. Prev. 54.9.

- Services PMI Est. 58.5 vs. Prev. 56.1.

- Jan. 7, 5:00 a.m.: Eurostat releases November 2024’s eurozone unemployment statistics and December 2024’s eurozone inflation data (flash).

- Core Inflation Rate YoY Est. 2.7% vs. Prev. 2.7%.

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.2%.

- Unemployment Rate Est. 6.4% vs. Prev. 6.3%.

- Jan. 7, 8:55 a.m.: U.S. Redbook YoY for the week ended Jan. 4. Prev. 7.1%.

- Jan. 7, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November 2024’s Job Openings and Labor Turnover Summary (JOLTS) report.

- Job openings Est. 7.65M vs. Prev. 7.744M.

- Job quits Prev. 3.326M.

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Economic Outlook,” at the Lectures of the Governor Event, Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) meeting.

- Jan. 9, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 4. Initial Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment rate Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The University of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Events

- Governance votes & calls

- Cartesi to hold first governance call of 2025 at 8 a.m.

- The injective community passed a proposal in favor of decreasing the INJ supply as part of the INJ 3.0 upgrade.

Conferences:

Token Talk

By Shaurya Malwa

Parody token SPX6900 (SPX) jumped another 17% in the past 24 hours to reach a $1.5 billion market capitalization, keeping a rally from last week going even as the broader market remains fairly steady.

The token started as a satire on the S&P 500 equity index and has since captured a dedicated community that hopes to one day flip the capitalization of the entire U.S. stock market, which was valued at just over $44 trillion as of Monday.

A manifesto on the SPX6900 site speaks to a generation facing economic challenges, positioning the token as a “reset” for the stock market.

The community’s rallying cry, “stop trading and start believing in something,” has fostered a strong, belief-driven following. This slogan encourages long-term holding over short-term trading, fostering a community of “diamond-handed” believers. This culture prioritizes faith in the project’s potential over immediate financial gains.

Derivatives Positioning

- Most large-cap tokens have seen price gains in the past 24 hours.

- The increases are accompanied by muted cumulative volume delta and limited growth in futures open interest, indicating a lack of strong buying pressure and raising concerns about the sustainability of these gains.

- The BTC options market shows renewed buying in calls at strikes $100,000 and $120,000, anticipating a rally to new lifetime highs.

- Dealers are net short gamma at the $100,000 strike, which means a breakout above that level could see them trade in the direction of the market to maintain their net exposure neutral. That could add to the upward momentum.

- Similar negative gamma is seen in ETH between $3,650 and $3,850 strikes.

- Traders have sold upside optionality in SOL.

Market Movements:

- BTC is up 0.78 % from 4 p.m. ET Friday to $99,034.53 (24hrs: +1.41%)

- ETH is up 0.97% at $3,647.09 (24hrs: +3.22%)

- CoinDesk 20 is down 0.29% to 3,659.91 (24hrs: +1.19%)

- Ether staking yield is down 11 bps to 3.05%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.57% at 108.33

- Gold is unchanged at $2,641.26/oz

- Silver is up 1.33% to $30.01/oz

- Nikkei 225 closed -1.47% at 39,307.05

- Hang Seng closed -0.36% at 19,688.29

- FTSE is up 0.12% at 8,233.81

- Euro Stoxx 50 is up 0.89% at 4,914.95

- DJIA closed on Friday +0.8% to 42,732.13

- S&P 500 closed +1.26% at 5,942.47

- Nasdaq closed +1.77% at 19,621.68

- S&P/TSX Composite Index closed +0.7% at 25,073.54

- S&P 40 Latin America closed -1.44% at 2,153.90

- U.S. 10-year Treasury is up 1 bp at 4.61%

- E-mini S&P 500 futures are up 0.51% to 6,020.00

- E-mini Nasdaq-100 futures are up 0.85% to 21,699.25

- E-mini Dow Jones Industrial Average Index futures are up 0.14% at 43,081

Bitcoin Stats:

- BTC Dominance: 57.25%

- Ethereum to bitcoin ratio: 0.0367

- Hashrate (seven-day moving average): 814 EH/s

- Hashprice (spot): $56.5

- Total Fees: 5.9 BTC / $579k

- CME Futures Open Interest: 170,345 BTC

- BTC priced in gold: 37.6 oz

- BTC vs gold market cap: 10.70%

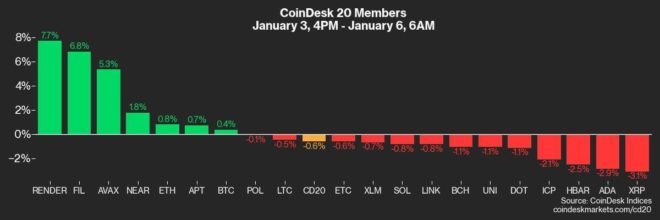

Basket Performance

Technical Analysis

- Watch out for a potential head-and-shoulders topping pattern in bitcoin.

- A breakdown below the horizontal support line would confirm the pattern, opening doors for a deeper price slide.

- Recent price action has shown sellers are looking to reassert themselves.

Crypto Equities

- MicroStrategy (MSTR): closed on Friday at $339.66 (+13.22%), up 2.74% at $348.94 in pre-market.

- Coinbase Global (COIN): closed at $270.65 (+5.23%), up 2.73% at $278.05 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.44 (+13.36%)

- MARA Holdings (MARA): closed at $19.64 (+14.12%), up 2.24% at $20.08 in pre-market.

- Riot Platforms (RIOT): closed at $12.34 (+17.97%), up 2.51% at $12.65 in pre-market.

- Core Scientific (CORZ): closed at $15.38 (+6.22%), up 1.69% at $15.64 in pre-market.

- CleanSpark (CLSK): closed at $10.80 (+14.29%), up 2.87% at $11.11 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.73 (+10.91%).

- Semler Scientific (SMLR): closed at $59.04 (+8.13%).

ETF Flows

Spot BTC ETFs:

- Daily net flow: $908.1 million

- Cumulative net flows: $35.91 billion

- Total BTC holdings ~ 1.124 million.

Spot ETH ETFs

- Daily net flow: $58.9 million

- Cumulative net flows: $2.64 billion

- Total ETH holdings ~ 3.611 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The spread between yields on the U.S. 10-year note and the three-month bill has turned positive in a so-called normalization or de-inversion of the yield curve.

- Previous de-inversions have often signaled sharp economic downturns.

- This time may be different because the movement is led by a faster rise in the 10-year yield, representing economic optimism.

While You Were Sleeping

- High-Stakes $100K Bitcoin Call Signals Expectation for Record Price Jump After Trump’s Inauguration (CoinDesk): Bitcoin traders are anticipating record highs following President-elect Donald Trump’s Jan. 20 inauguration, with notional open interest for $120,000 strike call options on Deribit exceeding $1.52 billion, signaling strong bullish sentiment.

- MicroStrategy, Metaplanet Want Billions More in Bitcoin as BTC Nears $100K (CoinDesk): MicroStrategy plans to raise $2 billion via preferred stock for bitcoin purchases in the first quarter and Metaplanet said it aims to acquire 10,000 BTC by the end of the year.

- Dogecoin Jumps 21% as Whales Accumulate, Galaxy Predicts $1 DOGE (Cointelegraph): Dogecoin jumped 21% last week to $0.38, fueled by whale activity, rising open interest and historical January strength, with forecasts predicting DOGE could hit $1 and reach a $100 billion market cap in 2025.

- Canada PM Trudeau Is Likely to Announce Resignation, Source Says (Reuters): Canadian Prime Minister Justin Trudeau could announce his resignation this week after nine years in office as his Liberal Party faces declining poll numbers ahead of a federal election required by late October.

- Gold Investors Stay Bullish for 2025 on Trump Volatility Fears (Bloomberg): Gold’s 27% rally in 2024, driven by central bank purchases, Federal Reserve easing, and geopolitical tensions, has investors optimistic for 2025 as they look to hedge against economic uncertainty under Trump’s policies.

- China Services Activity Gauge Signals Pickup in Growth (The Wall Street Journal): Recent PMI data shows China’s economy strengthened in December, with services and construction growth offsetting manufacturing weakness.

- South Korea Seeks to Extend Arrest Warrant for Impeached President (Financial Times): South Korea’s anti-corruption agency asked police on Jan. 6 to enforce a Dec. 31 arrest warrant for impeached President Yoon Suk Yeol, accused of treason, after his security service blocked an arrest attempt on Jan. 3.