With being an almost brand new asset class compared to most, cryptocurrencies quickly crept onto HMRC’s radar in need of taxation advice as the total market cap of all cryptocurrencies exceeded one trillion USD.

HMRC did not decide to implement a specific cryptocurrency tax, deciding instead to split cryptocurrency income and cryptocurrency capital gains, which we will review later in the guide.

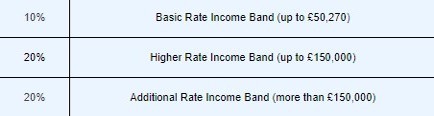

Any asset HMRC deemed a capital asset, will be taxed using capital gain at the date of disposal. Capital gains tax is directly linked to the taxpayer bracket you are in. For example, if you are already a higher rate taxpayer due to regular income, you will pay 20% capital gains tax on any cryptocurrency that you dispose of.

Similar to income, each individual is granted a £12,300 annual capital allowance. This means anyone incurring less than £12,300 in capital gains in a single tax year will pay zero capital gains, great for helping smaller traders and investors in building their portfolios without paying tax.

For any Crypto capital gains or income tax, HMRC requires you to pay by the 31st of January following the tax year. Investors will have to manually submit a self-assessment declaring their income and capital gains. Failing to submit before the 31st of January can lead to penalties and interest being paid on the tax owed.

Remember, tax is only paid on gains*

Is HMRC Tracking Crypto?

In short, Yes, HMRC is tracking users of centralized exchanges (CEX) through their Know Your Customer protocols (KYC).

HMRC has crypto transactions from as far back as 2014 and receives new information whenever a new signup is completed using KYC. With this information, HMRC essentially knows all the crucial dates of what is happening with your trades, when you initially invested in crypto and when you cash out. Although cryptocurrency was first popularized for its decentralized nature, centralized exchanges have made the information public to HMRC.

However, not all transactions are as easy to track. For example, in DeFi, there are many decentralized exchanges (DEX), such as Uniswap or pancake swap, which are trustless and permissionless, not requiring any authentication which keeps the user completely anonymous.

Interacting with DEX or holding your cryptocurrency in a cold wallet offline usually requires private wallets such as a Metamask wallet. Because the blockchain is anonymous, HMRC will find it extremely hard to track all transactions and the movement of funds. However, if you suddenly receive a large amount of funds from a private wallet into a hot wallet on an exchange, it will arouse suspicion.

Remember: The more mainstream cryptocurrency becomes, the more regulation will ultimately follow, so recognizing when and how your crypto can be tracked is extremely important for tax purposes.

Calculating Your Capital Gain

HMRC requires cryptocurrency users to calculate their gain using a Cost Basis. This can be done by adding the total fair market value of the crypto you buy and any purchase fees together.

Using your cost basis, capital gains will occur if you sell above this cost basis or capital losses if you sell below this value. Capital losses can be used to offset future gains.

Example

Mary buys 1 bitcoin for £25,826 in January 2021. She incurs fees of £100, giving her a cost basis of £25,926. Mary is a higher rate taxpayer and will pay 20% on any capital gain, but has not incurred any capital gains in the current 21/22 tax year.

Mary continues to HODL her bitcoin for one year, selling all her remaining bitcoin at the start of January the following year for £34,469.

To calculate her capital gain, we take her selling price, and minus her cost basis to find out her total capital gain.

In Mary’s case, her capital gain is £8543.

As she has not used any of her capital gain allowance, she will pay ZERO capital gains.

£12,300 – £8543 = £3753 Remaining capital allowance balance.

If Mary was to have no capital gain allowance left, she would multiply her gain (£8543), by her capital gain tax rate of 20%, leaving her with a capital gains tax of £1709.

What Classifies as a Disposal?

Remember: capital gains are only triggered when capital assets are disposed of.

A disposal is triggered in several ways:

- Gifting Cryptocurrency: Like any other asset, gifting cryptocurrency to friends or others will count as you disposing of that asset. The fair value of the asset will be taken at the date of the gift as you no longer own it.

- Trading Cryptocurrency: Trading cryptocurrency via crypto for crypto or crypto to fiat triggers a capital gain as you have disposed of your initial asset. It is important to note that HMRC considers stablecoins as simply another cryptocurrency, meaning a disposal has incurred.

- Selling Cryptocurrency: The most obvious trigger of a disposal is simply selling your cryptocurrency for fiat.

- Spending Cryptocurrency: With the rise of crypto debit cards, using your cryptocurrency to pay for goods and services triggers a disposal at the time of the transaction, as you have essentially sold your asset to pay for the good or service.

In good news, not all cryptocurrency transactions are classed as disposals and taxable.

Tax Free Cryptocurrency Transactions

It is important to know as a crypto holder what actions can cause your cryptocurrency to be subject to capital gains tax.

- Buying Cryptocurrency: Although you may pay a small transaction fee when moving fiat currency (GPB) from a bank to a centralized exchange like Kucoin, you will not pay any tax on acquiring cryptocurrency.

- Gifting Cryptocurrency to a spouse: A great way to reduce your capital gains tax liability is to gift some of your cryptos, before disposal, to your spouse. If your spouse has all or part of their capital gains allowance remaining for the current tax year, you can transfer crypto from you to them and fully utilize their £12,300 annual capital gains allowance.

- HODLing: As no asset is sold, HODLing your cryptocurrency is a sure way of not triggering any disposals, avoiding paying any tax.

- Donating Cryptocurrency: Donating any amount of cryptocurrency to a charity organisation will not trigger a disposal and is completely tax-free.

- Moving Cryptocurrency between Wallets: Moving cryptocurrency, without selling it, between wallets you own either on exchanges or private wallets does not count as a disposal and is not taxable. However, it is important to keep track of any transfer fees that you may have incurred while transferring.

Utilizing Cryptocurrency Losses

As the cryptocurrency news market is rife with speculation, it is important to hunt for any small losses that you may have made during the tax year. This action is called ‘Loss Harvesting’ and is a vital process any cryptocurrency investor should take before calculating their gain for the year. Loss Harvesting helps reduce capital gain tax liabilities, greatly reducing your tax bill.

Fortunately, HMRC allows unlimited losses to be used against future gains, but they expire after four years. After four years, the loss is nullified, making it useless.

Remember: When utilizing losses, only claim a loss to the threshold of your capital gains allowance of £12,300 before carrying the losses forward with you into the next tax year.

Example

Andy decided to sell two of his Bitcoin in January 2022, after buying them both at the same price of Mary of £25,926 each, giving him a cost basis of £51,852. Andy found a loss of £8,000 from 2020 that he is able to utilize.

Andy sold all of his bitcoin at the start of January 2022 for £34,469.

After selling both bitcoin he was left with a value of £68,938. After deducting his cost basis and personal allowance, (51,852+12,300), he is left with a taxable gain of £4786.

Now, utilizing his loss brought forward, Andy can avoid paying any capital gains tax by offsetting the £4786 gain with £4786 worth of his previous loss.

This leaves Andy with £0 capital gains tax to pay and £3214 of a loss still remaining.

Stolen or Lost Cryptocurrency

After greater adoption, HMRC posted guidance on how lost or stolen cryptocurrency is taxed in the UK, and how that affects the holder here:

- When your cryptocurrency is Stolen

Whether your cryptocurrencies were to be stolen out of your hot or cold wallet, HMRC does not view this as a disposal. Although you will have lost your cryptocurrency, you will never have to pay tax on your lost crypto. However, the losses that have been incurred will also never be realizable as losses on future gains, as it was not counted as a disposal.

- When your Cryptocurrency is Lost

Similarly to theft, any lost cryptocurrency will not be viewed as a disposal, consequently it will not be taxed or viewed as a loss. It is possible to file a ‘negligible value claim’, in an attempt to claim the cryptocurrency as a capital loss.

Other Sources of Cryptocurrency Capital Gains

Cryptocurrency is often rife with incentives for users to gain free cryptocurrency through airdrops, forks and many other activities such as play-to-earn crypto games.

Airdrops

Although we will take a closer look at income tax payable when receiving airdrops, if you decide to exchange your airdropped tokens for other cryptocurrencies or fiat, you will pay capital gains tax on any gains made.

HMRC counts the cost basis of any airdropped token as the fair market value on the day it was received.

Reminder: Capital gains trigger on the disposal of an asset, meaning you can theoretically sell your airdropped tokens instantly for a stablecoin, or a cryptocurrency of your choice to delay your capital gains payment until you decide to sell your chosen cryptocurrency. This is great advice for users receiving airdropped tokens from projects that they don’t believe in or that they feel won’t improve for a long time.

Example

You receive 1,000 SOS tokens as a free airdrop that have a fair value market of £1 each the day you receive them. After HODLing them for two months, you sell all your SOS tokens at a value of £1.20 each, for a total of £1200.

You have made a gain of £200, as your cost basis was £1000.

You now have to pay capital gains tax, in accordance with your tax rate bracket, on the £200 gain.

Hard Forks

Even though there are two types of forks, hard and soft, you will only pay capital gains tax on crypto you receive from hard forks, as soft forks do not grant any new coins.

The cost basis is not from the day you received the new coins, but from when you bought your initial coins.

How Cryptocurrency Income Is Taxed

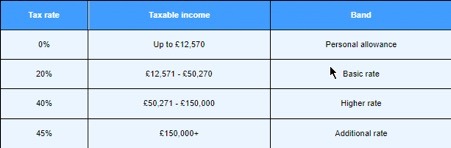

For any income tax, you will pay taxes based on the respective tax bracket you are already in due to existing income or no income at all. Refer to the table below to see which tax bracket you are currently in. Income from cryptocurrency is taxed at the current tax bracket you are in.

Example

If you are currently making £70,000 per year, you will be in the Higher rate tax bracket and pay 40% on any cryptocurrency income.

For most mainstream cryptocurrency users, capital gains tax is the only taxable event they are incurring and most are not thinking about cryptocurrency income. However, there is a separate branch of cryptocurrency activity that creates income taxable events for the users.

A lot of these activities take place in the land of DeFi, or decentralized finance, where there is little to no regulation without rules set in stone. Because of this, the rules around what is taxable or not are still up to debate, but you can be sure HMRC will want to cash in on cryptocurrency mainstream adoption as soon as possible.

Here are some of the main income tax creating events in the cryptocurrency and digital asset space:

Airdrops

Airdrops are a unique type of marketing done by new or up and coming cryptocurrencies either for free or in return for a small labour task, such as following their Coinmarketcap page.

Mainly, HMRC is looking to see if someone has performed a service for the airdrop, even as small as sharing a page, for it to be classed as income. Without providing any service at all, your airdrops will not be considered income, creating ‘free’ value for you.

When calculating how much income you have received from your airdrop, you must calculate the fair market value of all airdropped tokens the day you received them.

Due to the way airdrops are received, most airdropped tokens are taxable both for income and capital gains. They become income as soon as they hit your wallet and become capital gains as soon as they are disposed of.

Staking

Staking allows users to put their cryptocurrency to work in the blockchain, consequently earning them passive income. HMRC recognizes this as regular income and requires it to be taxed at your respective tax band rate.

Staking is a great way to put your cryptocurrency to work and keep your money working smartly. For instance, enthusiasts are able to stake their stablecoins, such as USDT, for up to 12% APY, an extremely high and secure return for doing nothing! However, HMRC will want their fair share of the pie for those gains.

Liquidity Pools

Although similar to staking, liquidity pools often grant you a separate token when providing liquidity, which may be seen as trading crypto-for-crypto by the HMRC. There is extremely small guidance on Liquidity Pools and other DeFi protocols at the moment.

We are most likely to see more attempts at regulating the DeFi space, especially for staking and providing liquidity, as users can see great returns, but the HMRC will struggle to properly track and fairly tax users.

Mining

Mining cryptocurrency as a hobby incurs the same problem as airdrops, hobby miners will be taxed twice. They will be required to pay income tax when they receive their mined tokens, and consequently, pay capital gains tax on any gain after the disposal.

However, miners should use any allowable expenses they incur to offset their profits. Allowable expenses can include costs for electricity and the initial investment of the kits. Guidance on mining, as it is still very new, is constantly changing, so it is important to keep on top of new HMRC guidance.

Play-to-Earn Crypto Games

With the massive increase in crypto gaming, recognizing what taxable events are occurring when you are playing is important. For most, any income received that has real value will be taxed as regular income but is often required to be put under the ‘miscellaneous income tax’ section.

Good news, everyone receives a £1000 miscellaneous income tax allowance per year, so unless you are playing non-stop, it is not likely you will need to pay any tax.

How Is DeFi Taxed?

With such a new and ever-evolving space such as DeFi, HMRC is still yet to issue clear guidance on exactly what is taxable. During this time of uncertainty, it is best to follow two simple rules:

- If you are earning cryptocurrency, you will pay income tax.

- If you are disposing of, spending or swapping your cryptocurrency, you will pay capital gains tax on any gain.

For example:

- Earning any interest from DeFi protocols will be taxed as income.

- Selling or swapping NFTs will be capital gains tax.

- Buying NFTs is not taxable, similar to initially buying cryptocurrency.

We will have to wait to see if DeFi will ever receive strict guidance and regulation due to its decentralized nature and the mindset of the users. Ultimately, DeFi, without complete regulation, will force each user to choose whether or not they disclose the completely anonymous transaction as theirs and pay tax on them.

What Records Does HMRC Want?

Now that you know how your cryptocurrency is going to be taxed, it’s important to know what records HMRC wants and needs to confirm those transactions. Most exchanges only keep records of each user’s transactions for up to six months, meaning it is vital that you manually keep transactions stored, or download all transactions every three months to stay up to date.

HMRC knows how the exchanges operate and rests the liability of collecting the transactions on the taxpayer.

Users should be looking out for:

- Dates of transactions

- The type of cryptocurrency

- The fair value of the transaction

Manually keeping track of all this information can be extremely tedious for most, so it is advised you connect your exchange account to a service such as Koinly or Recap to store transactions for you. Services like Koinly or Recap can connect to an API created on the exchange and automatically sync old and new transactions.

Such software reduces the overall friction of investing in cryptocurrency and helps reduce your tax liability by focusing on loss harvesting.

The UK Cost Basis Method

HMRC requires investors to use their cost basis method when calculating any gains. They have put in place precise methods for each time period of trading to stop the manipulation of loss harvesting through smart practices.

There are three cost basis methods which an investor needs to look at and decide which fits their current situation.

- Same day: The same day rule states that when buying and selling coins on the same day, the cost basis must be taken from the same day. Any investors selling more coins or tokens than what was brought should move on to rule 2.

- Bed and Breakfasting Rule: The B&B rule applies to investors buying and selling the same cryptocurrency within a thirty-day time period. The cost basis is taken from all the coins that were bought in this thirty day period. As with rule 1, anyone selling more coins than what was bought in the thirty day period should move on to rule 3.

- 104 Rule: If neither of rules 1 or 2 applies to you, using the 104 rule is the next step forward. The 104 rule uses an average cost basis. Divide the total amount spent acquiring your coins or tokens and divide by the amount of tokens you own.

Calculating Cryptocurrency Taxes

To fully calculate your cryptocurrency taxes, you should apply these three rules to all major transactions to eventually find your total gain or total income received.

As mentioned before, it is extremely beneficial to use a service that completes these processes automatically, using the UK’s specific cost basis method, to ensure all gains and losses have been accounted for.

Remember: You SHOULD be claiming any losses available to reduce your crypto tax liability by as much as possible.

What You Can Do to Reduce Your Cryptocurrency Taxes

- HODL: The most bulletproof plan to ensure you pay no capital gains taxes on your crypto is to simply HODL. Finding a project which you can hold for the long term will remove any taxable events and help defer your taxes until much further down the line.

- Use Your Allowances: Making use of any personal or capital gains allowances that you or your partner may still have is vital to reducing your tax liability to as little as possible. Each person is granted a personal and capital gains allowance annually.

- Make a Donation: Donating your crypto to charity is completely tax-free.

- Utilizing Low Income Years: If you know you will have a year of low income from other sources such as employment or other investments, you can choose to sell your crypto in this tax year to reap as many benefits from allowance as you can.

- Leverage allowable costs: Making sure you keep track of transaction fees or exchange fees that you incur throughout the year can help reduce your tax liability. Every little helps.

Conclusion

Ultimately, no one enjoys paying their taxes, especially on potentially lucrative investments such as cryptocurrency. However, as cryptocurrency becomes more heavily adopted into the mainstream, understanding how and when your cryptocurrency and other digital assets will be taxed is vital to your financial literacy. In the long term, we may expect more guidance on the DeFi space, and more set in stone guidance from HMRC to follow.

With being an almost brand new asset class compared to most, cryptocurrencies quickly crept onto HMRC’s radar in need of taxation advice as the total market cap of all cryptocurrencies exceeded one trillion USD.

HMRC did not decide to implement a specific cryptocurrency tax, deciding instead to split cryptocurrency income and cryptocurrency capital gains, which we will review later in the guide.

Any asset HMRC deemed a capital asset, will be taxed using capital gain at the date of disposal. Capital gains tax is directly linked to the taxpayer bracket you are in. For example, if you are already a higher rate taxpayer due to regular income, you will pay 20% capital gains tax on any cryptocurrency that you dispose of.

Similar to income, each individual is granted a £12,300 annual capital allowance. This means anyone incurring less than £12,300 in capital gains in a single tax year will pay zero capital gains, great for helping smaller traders and investors in building their portfolios without paying tax.

For any Crypto capital gains or income tax, HMRC requires you to pay by the 31st of January following the tax year. Investors will have to manually submit a self-assessment declaring their income and capital gains. Failing to submit before the 31st of January can lead to penalties and interest being paid on the tax owed.

Remember, tax is only paid on gains*

Is HMRC Tracking Crypto?

In short, Yes, HMRC is tracking users of centralized exchanges (CEX) through their Know Your Customer protocols (KYC).

HMRC has crypto transactions from as far back as 2014 and receives new information whenever a new signup is completed using KYC. With this information, HMRC essentially knows all the crucial dates of what is happening with your trades, when you initially invested in crypto and when you cash out. Although cryptocurrency was first popularized for its decentralized nature, centralized exchanges have made the information public to HMRC.

However, not all transactions are as easy to track. For example, in DeFi, there are many decentralized exchanges (DEX), such as Uniswap or pancake swap, which are trustless and permissionless, not requiring any authentication which keeps the user completely anonymous.

Interacting with DEX or holding your cryptocurrency in a cold wallet offline usually requires private wallets such as a Metamask wallet. Because the blockchain is anonymous, HMRC will find it extremely hard to track all transactions and the movement of funds. However, if you suddenly receive a large amount of funds from a private wallet into a hot wallet on an exchange, it will arouse suspicion.

Remember: The more mainstream cryptocurrency becomes, the more regulation will ultimately follow, so recognizing when and how your crypto can be tracked is extremely important for tax purposes.

Calculating Your Capital Gain

HMRC requires cryptocurrency users to calculate their gain using a Cost Basis. This can be done by adding the total fair market value of the crypto you buy and any purchase fees together.

Using your cost basis, capital gains will occur if you sell above this cost basis or capital losses if you sell below this value. Capital losses can be used to offset future gains.

Example

Mary buys 1 bitcoin for £25,826 in January 2021. She incurs fees of £100, giving her a cost basis of £25,926. Mary is a higher rate taxpayer and will pay 20% on any capital gain, but has not incurred any capital gains in the current 21/22 tax year.

Mary continues to HODL her bitcoin for one year, selling all her remaining bitcoin at the start of January the following year for £34,469.

To calculate her capital gain, we take her selling price, and minus her cost basis to find out her total capital gain.

In Mary’s case, her capital gain is £8543.

As she has not used any of her capital gain allowance, she will pay ZERO capital gains.

£12,300 – £8543 = £3753 Remaining capital allowance balance.

If Mary was to have no capital gain allowance left, she would multiply her gain (£8543), by her capital gain tax rate of 20%, leaving her with a capital gains tax of £1709.

What Classifies as a Disposal?

Remember: capital gains are only triggered when capital assets are disposed of.

A disposal is triggered in several ways:

- Gifting Cryptocurrency: Like any other asset, gifting cryptocurrency to friends or others will count as you disposing of that asset. The fair value of the asset will be taken at the date of the gift as you no longer own it.

- Trading Cryptocurrency: Trading cryptocurrency via crypto for crypto or crypto to fiat triggers a capital gain as you have disposed of your initial asset. It is important to note that HMRC considers stablecoins as simply another cryptocurrency, meaning a disposal has incurred.

- Selling Cryptocurrency: The most obvious trigger of a disposal is simply selling your cryptocurrency for fiat.

- Spending Cryptocurrency: With the rise of crypto debit cards, using your cryptocurrency to pay for goods and services triggers a disposal at the time of the transaction, as you have essentially sold your asset to pay for the good or service.

In good news, not all cryptocurrency transactions are classed as disposals and taxable.

Tax Free Cryptocurrency Transactions

It is important to know as a crypto holder what actions can cause your cryptocurrency to be subject to capital gains tax.

- Buying Cryptocurrency: Although you may pay a small transaction fee when moving fiat currency (GPB) from a bank to a centralized exchange like Kucoin, you will not pay any tax on acquiring cryptocurrency.

- Gifting Cryptocurrency to a spouse: A great way to reduce your capital gains tax liability is to gift some of your cryptos, before disposal, to your spouse. If your spouse has all or part of their capital gains allowance remaining for the current tax year, you can transfer crypto from you to them and fully utilize their £12,300 annual capital gains allowance.

- HODLing: As no asset is sold, HODLing your cryptocurrency is a sure way of not triggering any disposals, avoiding paying any tax.

- Donating Cryptocurrency: Donating any amount of cryptocurrency to a charity organisation will not trigger a disposal and is completely tax-free.

- Moving Cryptocurrency between Wallets: Moving cryptocurrency, without selling it, between wallets you own either on exchanges or private wallets does not count as a disposal and is not taxable. However, it is important to keep track of any transfer fees that you may have incurred while transferring.

Utilizing Cryptocurrency Losses

As the cryptocurrency news market is rife with speculation, it is important to hunt for any small losses that you may have made during the tax year. This action is called ‘Loss Harvesting’ and is a vital process any cryptocurrency investor should take before calculating their gain for the year. Loss Harvesting helps reduce capital gain tax liabilities, greatly reducing your tax bill.

Fortunately, HMRC allows unlimited losses to be used against future gains, but they expire after four years. After four years, the loss is nullified, making it useless.

Remember: When utilizing losses, only claim a loss to the threshold of your capital gains allowance of £12,300 before carrying the losses forward with you into the next tax year.

Example

Andy decided to sell two of his Bitcoin in January 2022, after buying them both at the same price of Mary of £25,926 each, giving him a cost basis of £51,852. Andy found a loss of £8,000 from 2020 that he is able to utilize.

Andy sold all of his bitcoin at the start of January 2022 for £34,469.

After selling both bitcoin he was left with a value of £68,938. After deducting his cost basis and personal allowance, (51,852+12,300), he is left with a taxable gain of £4786.

Now, utilizing his loss brought forward, Andy can avoid paying any capital gains tax by offsetting the £4786 gain with £4786 worth of his previous loss.

This leaves Andy with £0 capital gains tax to pay and £3214 of a loss still remaining.

Stolen or Lost Cryptocurrency

After greater adoption, HMRC posted guidance on how lost or stolen cryptocurrency is taxed in the UK, and how that affects the holder here:

- When your cryptocurrency is Stolen

Whether your cryptocurrencies were to be stolen out of your hot or cold wallet, HMRC does not view this as a disposal. Although you will have lost your cryptocurrency, you will never have to pay tax on your lost crypto. However, the losses that have been incurred will also never be realizable as losses on future gains, as it was not counted as a disposal.

- When your Cryptocurrency is Lost

Similarly to theft, any lost cryptocurrency will not be viewed as a disposal, consequently it will not be taxed or viewed as a loss. It is possible to file a ‘negligible value claim’, in an attempt to claim the cryptocurrency as a capital loss.

Other Sources of Cryptocurrency Capital Gains

Cryptocurrency is often rife with incentives for users to gain free cryptocurrency through airdrops, forks and many other activities such as play-to-earn crypto games.

Airdrops

Although we will take a closer look at income tax payable when receiving airdrops, if you decide to exchange your airdropped tokens for other cryptocurrencies or fiat, you will pay capital gains tax on any gains made.

HMRC counts the cost basis of any airdropped token as the fair market value on the day it was received.

Reminder: Capital gains trigger on the disposal of an asset, meaning you can theoretically sell your airdropped tokens instantly for a stablecoin, or a cryptocurrency of your choice to delay your capital gains payment until you decide to sell your chosen cryptocurrency. This is great advice for users receiving airdropped tokens from projects that they don’t believe in or that they feel won’t improve for a long time.

Example

You receive 1,000 SOS tokens as a free airdrop that have a fair value market of £1 each the day you receive them. After HODLing them for two months, you sell all your SOS tokens at a value of £1.20 each, for a total of £1200.

You have made a gain of £200, as your cost basis was £1000.

You now have to pay capital gains tax, in accordance with your tax rate bracket, on the £200 gain.

Hard Forks

Even though there are two types of forks, hard and soft, you will only pay capital gains tax on crypto you receive from hard forks, as soft forks do not grant any new coins.

The cost basis is not from the day you received the new coins, but from when you bought your initial coins.

How Cryptocurrency Income Is Taxed

For any income tax, you will pay taxes based on the respective tax bracket you are already in due to existing income or no income at all. Refer to the table below to see which tax bracket you are currently in. Income from cryptocurrency is taxed at the current tax bracket you are in.

Example

If you are currently making £70,000 per year, you will be in the Higher rate tax bracket and pay 40% on any cryptocurrency income.

For most mainstream cryptocurrency users, capital gains tax is the only taxable event they are incurring and most are not thinking about cryptocurrency income. However, there is a separate branch of cryptocurrency activity that creates income taxable events for the users.

A lot of these activities take place in the land of DeFi, or decentralized finance, where there is little to no regulation without rules set in stone. Because of this, the rules around what is taxable or not are still up to debate, but you can be sure HMRC will want to cash in on cryptocurrency mainstream adoption as soon as possible.

Here are some of the main income tax creating events in the cryptocurrency and digital asset space:

Airdrops

Airdrops are a unique type of marketing done by new or up and coming cryptocurrencies either for free or in return for a small labour task, such as following their Coinmarketcap page.

Mainly, HMRC is looking to see if someone has performed a service for the airdrop, even as small as sharing a page, for it to be classed as income. Without providing any service at all, your airdrops will not be considered income, creating ‘free’ value for you.

When calculating how much income you have received from your airdrop, you must calculate the fair market value of all airdropped tokens the day you received them.

Due to the way airdrops are received, most airdropped tokens are taxable both for income and capital gains. They become income as soon as they hit your wallet and become capital gains as soon as they are disposed of.

Staking

Staking allows users to put their cryptocurrency to work in the blockchain, consequently earning them passive income. HMRC recognizes this as regular income and requires it to be taxed at your respective tax band rate.

Staking is a great way to put your cryptocurrency to work and keep your money working smartly. For instance, enthusiasts are able to stake their stablecoins, such as USDT, for up to 12% APY, an extremely high and secure return for doing nothing! However, HMRC will want their fair share of the pie for those gains.

Liquidity Pools

Although similar to staking, liquidity pools often grant you a separate token when providing liquidity, which may be seen as trading crypto-for-crypto by the HMRC. There is extremely small guidance on Liquidity Pools and other DeFi protocols at the moment.

We are most likely to see more attempts at regulating the DeFi space, especially for staking and providing liquidity, as users can see great returns, but the HMRC will struggle to properly track and fairly tax users.

Mining

Mining cryptocurrency as a hobby incurs the same problem as airdrops, hobby miners will be taxed twice. They will be required to pay income tax when they receive their mined tokens, and consequently, pay capital gains tax on any gain after the disposal.

However, miners should use any allowable expenses they incur to offset their profits. Allowable expenses can include costs for electricity and the initial investment of the kits. Guidance on mining, as it is still very new, is constantly changing, so it is important to keep on top of new HMRC guidance.

Play-to-Earn Crypto Games

With the massive increase in crypto gaming, recognizing what taxable events are occurring when you are playing is important. For most, any income received that has real value will be taxed as regular income but is often required to be put under the ‘miscellaneous income tax’ section.

Good news, everyone receives a £1000 miscellaneous income tax allowance per year, so unless you are playing non-stop, it is not likely you will need to pay any tax.

How Is DeFi Taxed?

With such a new and ever-evolving space such as DeFi, HMRC is still yet to issue clear guidance on exactly what is taxable. During this time of uncertainty, it is best to follow two simple rules:

- If you are earning cryptocurrency, you will pay income tax.

- If you are disposing of, spending or swapping your cryptocurrency, you will pay capital gains tax on any gain.

For example:

- Earning any interest from DeFi protocols will be taxed as income.

- Selling or swapping NFTs will be capital gains tax.

- Buying NFTs is not taxable, similar to initially buying cryptocurrency.

We will have to wait to see if DeFi will ever receive strict guidance and regulation due to its decentralized nature and the mindset of the users. Ultimately, DeFi, without complete regulation, will force each user to choose whether or not they disclose the completely anonymous transaction as theirs and pay tax on them.

What Records Does HMRC Want?

Now that you know how your cryptocurrency is going to be taxed, it’s important to know what records HMRC wants and needs to confirm those transactions. Most exchanges only keep records of each user’s transactions for up to six months, meaning it is vital that you manually keep transactions stored, or download all transactions every three months to stay up to date.

HMRC knows how the exchanges operate and rests the liability of collecting the transactions on the taxpayer.

Users should be looking out for:

- Dates of transactions

- The type of cryptocurrency

- The fair value of the transaction

Manually keeping track of all this information can be extremely tedious for most, so it is advised you connect your exchange account to a service such as Koinly or Recap to store transactions for you. Services like Koinly or Recap can connect to an API created on the exchange and automatically sync old and new transactions.

Such software reduces the overall friction of investing in cryptocurrency and helps reduce your tax liability by focusing on loss harvesting.

The UK Cost Basis Method

HMRC requires investors to use their cost basis method when calculating any gains. They have put in place precise methods for each time period of trading to stop the manipulation of loss harvesting through smart practices.

There are three cost basis methods which an investor needs to look at and decide which fits their current situation.

- Same day: The same day rule states that when buying and selling coins on the same day, the cost basis must be taken from the same day. Any investors selling more coins or tokens than what was brought should move on to rule 2.

- Bed and Breakfasting Rule: The B&B rule applies to investors buying and selling the same cryptocurrency within a thirty-day time period. The cost basis is taken from all the coins that were bought in this thirty day period. As with rule 1, anyone selling more coins than what was bought in the thirty day period should move on to rule 3.

- 104 Rule: If neither of rules 1 or 2 applies to you, using the 104 rule is the next step forward. The 104 rule uses an average cost basis. Divide the total amount spent acquiring your coins or tokens and divide by the amount of tokens you own.

Calculating Cryptocurrency Taxes

To fully calculate your cryptocurrency taxes, you should apply these three rules to all major transactions to eventually find your total gain or total income received.

As mentioned before, it is extremely beneficial to use a service that completes these processes automatically, using the UK’s specific cost basis method, to ensure all gains and losses have been accounted for.

Remember: You SHOULD be claiming any losses available to reduce your crypto tax liability by as much as possible.

What You Can Do to Reduce Your Cryptocurrency Taxes

- HODL: The most bulletproof plan to ensure you pay no capital gains taxes on your crypto is to simply HODL. Finding a project which you can hold for the long term will remove any taxable events and help defer your taxes until much further down the line.

- Use Your Allowances: Making use of any personal or capital gains allowances that you or your partner may still have is vital to reducing your tax liability to as little as possible. Each person is granted a personal and capital gains allowance annually.

- Make a Donation: Donating your crypto to charity is completely tax-free.

- Utilizing Low Income Years: If you know you will have a year of low income from other sources such as employment or other investments, you can choose to sell your crypto in this tax year to reap as many benefits from allowance as you can.

- Leverage allowable costs: Making sure you keep track of transaction fees or exchange fees that you incur throughout the year can help reduce your tax liability. Every little helps.

Conclusion

Ultimately, no one enjoys paying their taxes, especially on potentially lucrative investments such as cryptocurrency. However, as cryptocurrency becomes more heavily adopted into the mainstream, understanding how and when your cryptocurrency and other digital assets will be taxed is vital to your financial literacy. In the long term, we may expect more guidance on the DeFi space, and more set in stone guidance from HMRC to follow.