Crypto markets got more institutional and more regulated in 2025, but the familiar “altcoin season” many traders expected never fully arrived.

Bitcoin (BTC) hit fresh highs earlier in the cycle, yet much of the rest of the market lagged. Bitcoin was down approximately 7% year-to-date after an early-October sell-off, while the total market capitalization of altcoins declined by more than 46% in 2025, according to TradingView data.

Even so, a handful of tokens managed to outperform during a year defined by selective risk taking and heavy scrutiny. XRP (XRP) drew fresh momentum from regulatory developments, Zcash (ZEC) rallied as interest returned to financial privacy, and Algorand (ALGO) got a boost from real-world tokenization efforts.

XRP gains as regulatory overhang eases

XRP was among the winners of the 2025 crypto market, outperforming most cryptocurrencies despite the absence of an altcoin season.

XRP surged over 35% in July, topping at a yearly high of $3.60 on July 23, recording an eight-fold price increase from the previous year’s low of $0.43 recorded on Aug. 5, 2024, TradingView data shows.

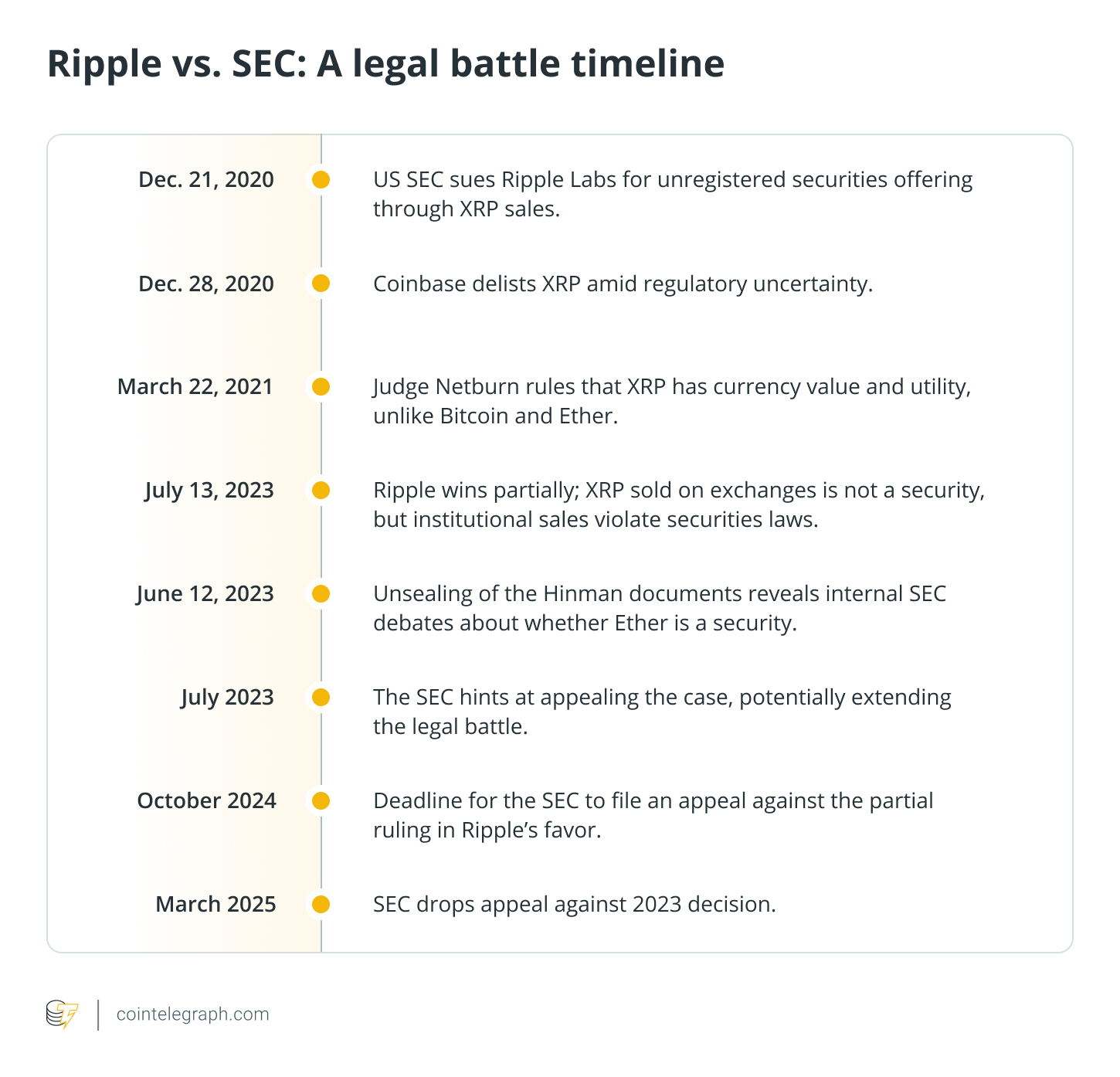

The token received significant tailwinds from growing regulatory clarity, including the initial reports about the end of the US Securities and Exchange Commission’s (SEC) long-standing lawsuit against Ripple Labs.

Ripple and the SEC ended their long-running dispute on Aug. 8, according to the company’s court filing, after submitting a joint letter asking the court to dismiss the SEC’s appeal and Ripple’s cross-appeal, with each side bearing its own costs and fees.

“The market is clearly rotating toward assets that regulators can classify, institutions can model, and compliance teams can sign off on. XRP fit that profile better than most altcoins this year,” Alex Davis, Founder and CEO at blockchain ecosystem Mavryk Dynamics, told Cointelegraph.

He said the lifting of a multi-year regulatory cloud helped reopen the door to institutional participation.

The SEC sued Ripple in December 2020, alleging the company raised $1.3 billion through unregistered XRP sales.

The debut of the Canary Capital XRP exchange-traded fund (ETF) on Nov. 13 sent another strong signal for institutional investors looking for altcoin exposure, according to Isaac Joshua, CEO of crypto startup platform Gems Launchpad.

XRP outshined most other altcoins due to three main reasons, including “regulatory clarity, new institutional inflows, and a growing perception of real-world usage,” he told Cointelegraph, adding:

“Looking into next year, if ETF demand remains strong and payment volumes keep rising, XRP may continue shifting from a speculative altcoin into a more established piece of global payment infrastructure.”

XRP ETFs generated $756 million in net positive inflows in their first 11 trading days.

Zcash rallies as privacy trade returns

Zcash also stood out in 2025, helped by renewed interest in privacy-focused crypto as regulators tighten oversight of transactions and identity.

Zcash went from a low-profile cryptocurrency to the most-searched by mid-November on cryptocurrency exchange Coinbase, surpassing both Bitcoin and XRP in terms of investor interest.

Zcash clocked an over 12-fold rally, rising from a yearly low of $48 to a high of $744 on Nov. 7, a month after the record $19 billion market crash at the beginning of October, TradingView data shows.

While Zcash managed to rise to a new yearly high in 2025, it failed to blitz its all-time high of $5,941 recorded nine years ago on Oct. 29, 2016.

Privacy-focused assets like Zcash outperformed the broader market due to a growing demand for “financial confidentiality” amid rising “surveillance” in the digital economy, according to Narek Gevorgyan, the founder and CEO of crypto portfolio management platform CoinStats.

“The recent momentum is driven more by structural factors—tightening KYC/AML rules on exchanges, increasing government scrutiny of crypto transactions, and renewed interest from institutions and developers in zero-knowledge technologies,” he said.

Launched in 2016, Zcash combines a proof-of-work (PoW) consensus model with zero-knowledge proof technology, enabling users to send either transparent transactions or fully shielded transactions where amounts and addresses are hidden.

In a sign of growing demand, the amount of ZEC tokens held in shielded addresses climbed to about 4.5 million coins from 1.7 million in 2025 as of Nov. 25, with 1 million tokens transferred in a three-week period.

Other demand drivers included the latest Zcash halving on Nov. 23, 2024, which cut the block reward to 1.5625 ZEC from 3.125 ZEC, reducing daily new issuance to about 1,800 tokens from 3,600.

Related: Hard money vs. privacy? Saifedean Ammous questions crypto’s privacy push

Algorand jumps on tokenization push

Algorand drew attention early in the year on signs of expanding real-world deployment.

ALGO rose by about 48% in three weeks, from $0.33 at the end of December 2024 to surpass a $0.49 yearly high on Jan. 17, according to TradingView data.

On Jan. 21, Algorand partnered with Enel Group, one of Europe’s largest electricity providers by number of customers, to enable Italian residents to purchase fractional shares of Enel’s solar farms and wind installations via tokenized Energy Utility Tokens.

Algorand’s real-world integrations “position the chain well for long-term relevance,” according to Lacie Zhang, market analyst at Bitget Wallet.

“These developments reinforce Algorand’s underlying technical strengths and its focus on enterprise-grade, environmentally aligned use cases,” she said.

“However, its poor yearly performance reflects a much broader structural trend rather than project-specific weakness,” said Zhang, attributing the wider altcoin sector’s underperformance to macro headwinds, including higher interest rates and Bitcoin’s “prolonged” dominance attracting most crypto liquidity.

“In this environment, strong technical progress has not translated into price performance,” she said, adding that Algorand and projects with real-world integrations will eventually recover, as investors shift from “speculation to utility-driven adoption.”

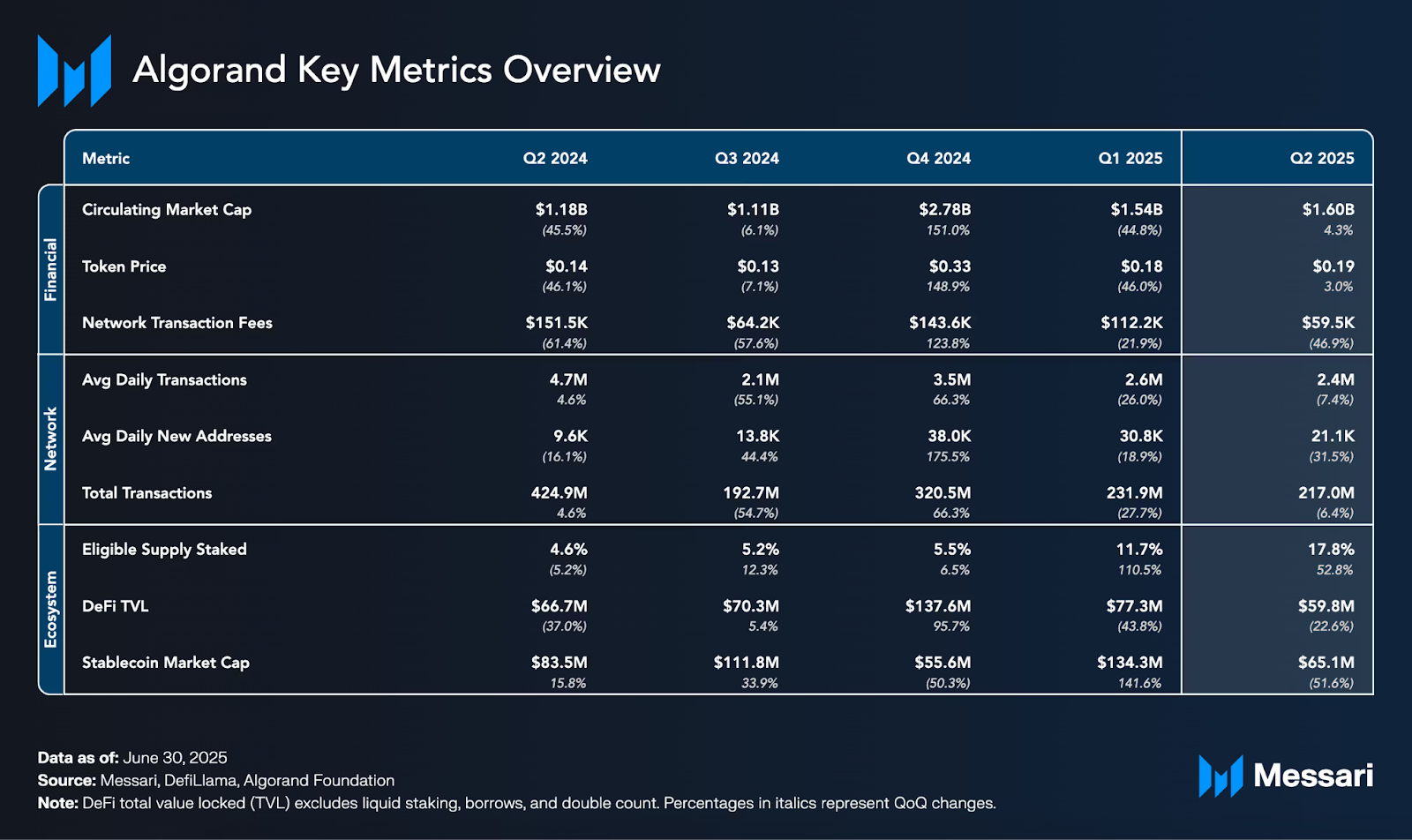

Despite the token’s poor performance after January, Algorand continued to see growing blockchain activity, as the amount of staked ALGO grew 28% quarter-over-quarter, to surpass 1.95 billion ALGO tokens in the second quarter of 2025, according to a Messari research report.

In March, Algorand launched AlgoKit 3.0, an improved developer tool kit seeking to offer enhanced tools for building on the network.

The network continues to work on developer tools, including the launch of AlgoKit 4.0, slated for early 2026. The new tool kit will introduce composable smart contract libraries and support for Rust, Swift and Kotlin.

A selective market heads into 2026

The gap between Bitcoin and the broader market left 2025 looking less like past cycle playbooks and more like a selective, fundamentals-driven market.

While some crypto enthusiasts may still expect an altcoin season due to previous historic market cycles, the current market structure suggests a maturing crypto landscape, where projects require fundamental underlying utility to gain more traction.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more