Bitcoin new address momentum is approaching a retest that could change the course of the crypto’s price, if history is anything to go by.

Monthly MA Of Bitcoin New Addresses Is Currently Retesting The Yearly MA

According to the latest weekly report from Glassnode, new address momentum is currently on the verge of a push higher.

The “new addresses” is an indicator that measures the total number of new addresses coming active on the Bitcoin blockchain.

To know whether the crypto is seeing a sufficient amount of push in new users coming to the network or not, the “new address momentum” metric is used.

This momentum indicator is based on the 30-day and 365-day moving averages of the new addresses. By comparing the trend of these MAs against each other, we can learn how the monthly average new users stack up against the mean for the year.

Now, here is a chart that shows the trend in the Bitcoin new address momentum over the last few years:

Looks like the two MAs have been approaching a test in recent days | Source: Glassnode's The Week Onchain - Week 43, 2022

As you can see in the above graph, the relevant points of trend for the Bitcoin new address momentum are highlighted.

It seems like whenever the 30-day MA has failed to cross above the 365-day MA, the price of the crypto has observed a bearish trend.

This happened back in November 2018, where when shortly after the crossover didn’t happen, the coin crashed from $6k to $3.2k November 2021 and May 2022 also saw a similar pattern.

On the other hand, during times when the monthly MA successfully passed above the yearly and sustained there, Bitcoin felt a constructive effect on its value.

In recent months, the 30-day MA has been below the 365-day as there hasn’t been much demand for BTC. Most recently, however, the metric has seen some upwards push, and is now approaching another retest of the yearly line.

Currently, it’s unclear how this crossover attempt will go, but the report notes that so far the market hasn’t shown the same convincing burst of strength as in 2019.

BTC Price

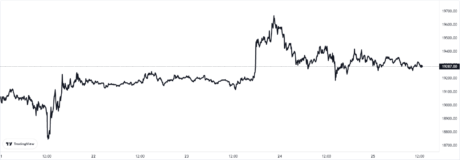

At the time of writing, Bitcoin’s price floats around $19.2k, down 1% in the last week. Over the past month, the crypto has gained 2% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have continued its boring sideways movement around $19k recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com