On-chain data shows that a bullish combination has just formed for Bitcoin, which may signal that a rally could be ahead for the asset.

Sharks & Whales Are Accumulating Both Bitcoin, Tether Right Now

According to data from the on-chain analytics firm Santiment, both the sharks and whales of BTC and USDT have been accumulating recently. The metric of interest here is the “Supply Distribution,” which keeps track of the total amount of a given asset that the different holder groups carry.

In the current topic, sharks and whales are the entities of interest. For Bitcoin, the combined supply of these assets may be defined as the 10 to 10,000 BTC range, while for Tether, it’s generally 100,000 to 10 million USDT.

The sharks and whales are influential entities in the sector due to their holdings, but their role differs between whether they are holding the volatile BTC or the stablecoin USDT.

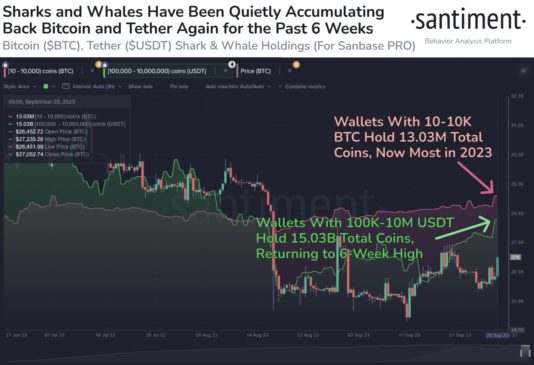

The chart below shows how the supplies of the sharks and whales of the two cryptocurrencies have changed over the last few months:

Both of these metrics appear to have registered an increase during the past few days | Source: Santiment on X

The graph shows that the Bitcoin sharks and whales have participated in some accumulation recently, which has taken their supply to 13.03 million BTC, a new high for the year.

Interestingly, while this accumulation has occurred, the sharks and whales of Tether have also expanded their holdings. The metric’s value, in this case, has reached a six-week high of 15.03 billion USDT.

The significance of the trend in the supply of the BTC sharks and whales may seem straightforward: these humongous entities are buying right now, so that should be bullish for the price. But what about the pattern being shown by the USDT cohort?

Generally, an investor may buy into a stablecoin like USDT to avoid the volatility of assets like Bitcoin. Once these holders feel that the prices are right to jump back into the volatile side of the sector, they exchange their fiat-tied tokens for their desired coin.

This shift can naturally provide buying pressure on whatever cryptocurrency they are swapping into. Because of this reason, one way to look at the supply of a stablecoin is as a measure of the available potential buying power for Bitcoin and other assets in the market.

Thus, the latest Tether accumulation would suggest that the sharks and whales have increased their buying capacity. Sometimes, spikes in this indicator come at the expense of the corresponding BTC metric, as these holders convert their reserves. While the buying power goes up for the future in such a scenario, it has only come at the expense of a BTC selloff.

In the current case, though, both of these indicators have trended up at the same time, which means that not only have the sharks and whales participated in some Bitcoin shopping, but the capital reserves that these large holders may deploy into the asset in the form of Tether have also gone up. “This is generally a bullish combination,” explains Santiment.

BTC Price

Bitcoin had earlier risen above the $27,000 level, but the asset has retreated in the past few hours as it is now trading around the $26,700 mark.

BTC has already retraced some of its recovery | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net