The global cryptocurrency market recorded mixed sentiments last week, witnessing major upswings and declines. The total market cap remained flat at $1.66 trillion. Amid the rollercoaster ride, crypto assets Bitcoin (BTC), Near Protocol (NEAR) and Bonk (BONK) made noteworthy moves.

Bitcoin retests $45,000

The week began on favorable grounds for Bitcoin and the rest of the crypto market amid sustained discussions about the upcoming spot BTC ETFs. Bitcoin began the week at $42,146, slipping into the new year with an uptrend that saw it finally clinch the $45,000 mark.

The asset failed to reach this price mark despite its massive surges from October to December 2023. The renewed optimism brought by the new year triggered a rally to a 21-month high of $45,894 on Jan. 2, as industry commentators stressed an imminent approval of the multiple ETF applications.

However, the optimism withered when a Matrixport report presented the possibility of a denial of all ETF applications this month. Amid the report, a wave of selloffs ensued, leading to a severe market collapse. BTC dropped to a low of $40,879 on Jan. 3, with liquidations approaching $700 million in the market.

Despite engineering a recovery, the premier crypto recorded a 4.69% intraday slump that day, its highest intraday decline since Dec. 11, 2023. Nonetheless, the asset has recovered most of the Jan. 3 losses, currently trading for $44,007 amid a battle to hold up the $44,000 price threshold.

Bitcoin ended the week with an impressive 4.41% increase despite the Jan. 3 collapse. At its current price, the crypto asset’s next pivotal resistance below the $45,000 mark, sits at $44,857 currently at Fibonacci 0.786.

NEAR slumps below $3

Near Protocol had fervently defended the $3 price territory since reclaiming it on Dec. 21, 2023. Before the December 2023 upsurge, the last time NEAR traded at the $3 mark was in October 2022. Upon hitting a high of $3.625 on Dec. 21, the token held above the $3.5 level for several days, eventually hitting $4.62 on Dec. 26, 2023.

However, the asset began this week on a bearish note, caught in a consolidation preceded by a drop to $3.520. The asset struggled to defend the $3.5. A measured move toward reclaiming the $4 level materialized on Jan. 2, but the bears mounted stern opposition at the $4.33 resistance point.

Amid the market slump on Jan. 3, NEAR dropped below the $3 mark for the first time since Dec. 21, 2023, collapsing to the support level of $2.905. Near Protocol recovered the $4 zone in a recovery move the next day, but this campaign was short-lived.

The asset has shed off more gains since then, recording two consecutive daily losing candles at the end of the week. NEAR ended the week with a 7.7% decline, relinquishing the $3.6 and $3.5 pivotal price thresholds.

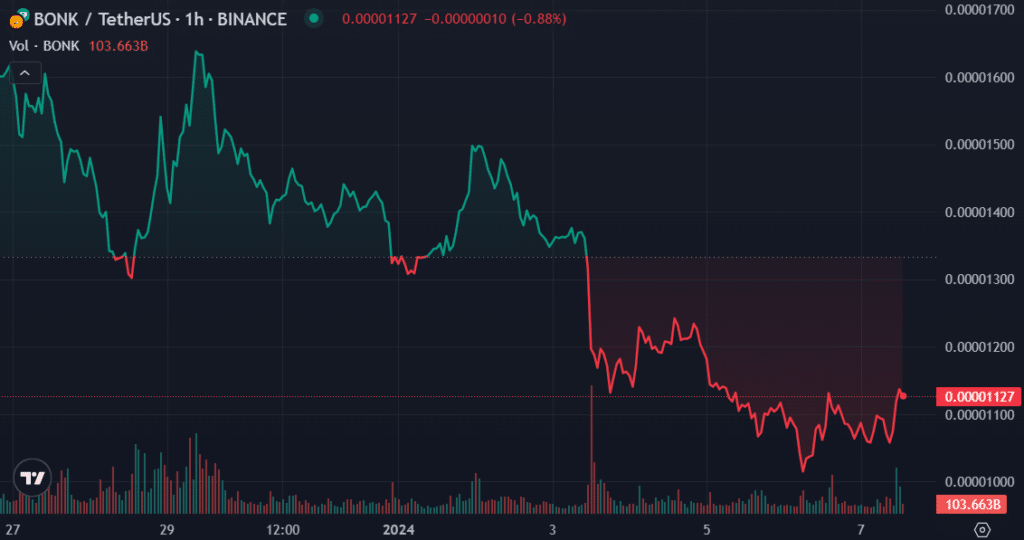

Bonk drops to 4-week low

BONK has been on a free fall since it hit an all-time high of $0.00003498 on Dec. 15, 2023, and this continuous slump spilled into this week.

Since claiming the all-time high, the meme coin has registered lower and lower highs, now 67% down from the peak value.

The downward spiral has resulted in the formation of a downtrend, further exacerbated by the latest market-wide turbulence.

BONK was one of the most impacted by the drop, losing 13.68% of its value on Jan. 3. The asset only gained 2% the next day in a weak recovery attempt.

Subsequent days dealt further blows to the meme coin, with a 6.33% slump on Jan. 5 and a 3.83% drop on Jan. 6. Amid the sustained drop, BONK ended the week at $0.00001075, marking its lowest price in four weeks. The token closed the week with a discouraging 23.4% decline. However, with a CCI of -103, BONK could be on the verge of a trend reversal.