An unknown trader made nearly half a million worth of profit on a recently launched memecoin just before the token lost half of its value, sparking insider trading allegations after the recent wave of memecoin meltdowns.

A savvy trader made an over 1,500-fold return on his initial investment, turning it into over $482,000 in less than 24 hours on the Bubb (BUBB) memecoin.

Source: Lookonchain

“Turned $304 into $482K on $BUBB—a 1,586x return! This trader spent only $304 to buy 43.94M $BUBB and sold 28.9M $BUBB for $122K, leaving 15.64M $BUBB($360K),” wrote Lookonchain in a March 21 X post.

The profitable trade occurred shortly before the token lost over 50% of its value, from a peak that rose to a peak $43.7 million market capitalization on March 21 at 10:00 p.m. UTC, to the current $22.6 million, Dexscreener data shows.

BUBB/WBNB, all-time chart. Source: Dexscreener

The Bubb token started receiving significant investor attention on March 20, after Binance co-founder and chief customer service officer, Yi He, commented on one of the token’s posts — a move that was interpreted by traders as a sign of a potential token listing on the world’s largest exchange.

Source: Bubbnb

The unknown trader’s over 1,500-fold return sparked insider trading allegations among market participants.

“Can you tag these kinds of posts with “insider” so I can mute all of those, i rather be naive about it,” replied pseudonymous crypto investors fhools, to Lookonchain’s X post.

The profitable trade comes a week after Hayden Davies’ Wolf of Wall Street-inspired memecoin crashed 99%, showing signs of significant insider activity ahead of the token’s collapse.

Source: Bubblemaps

Davis launched the Wolf (WOLF) memecoin on March 8, banking on rumors of Jordan Belfort, known as the Wolf of Wall Street, launching his own token.

The token reached a peak $42 million market cap. However, 82% of the WOLF token’s supply was bundled under the same entity, according to a March 15 X post by Bubblemaps,

Related: Crypto debanking is not over until Jan 2026: Caitlin Long

Davies’ latest token launch comes weeks after the Libra token’s collapse, where eight insider wallets cashed out $107 million in liquidity, leading to a $4 billion market cap wipeout within hours.

The Libra token turned into a political issue, with Argentine President Javier Milei risking impeachment after his endorsement of the Libra coin.

Related: Milei-endorsed Libra token was ‘open secret’ in memecoin circles — Jupiter

Politically-backed memecoins need stronger investor protection guardrails

To avoid another meltdown similar to Libra’s, tokens with presidential endorsements will need more robust safety and economic mechanisms, such as liquidity locking or making the tokens in the liquidity pool non-sellable for a predetermined period, DWF Labs wrote in a report shared with Cointelegraph.

The report stated that tokens from high-profile leaders would also need launch restrictions to limit participation from crypto-sniping bots and large holders or whales.

“Limiting bot and whale activity is essential in limiting the impact of individuals acting on insider information to corner a large percentage of the token supply,” according to Andrei Grachev, managing partner at DWF Labs:

“Projects must strive to deliver as fair a launch as possible so that all participants have an equal opportunity to secure an allocation and aren’t disadvantaged by a handful of well-funded or well-informed players claiming the lion’s share of the supply.”

Source: DWF Labs

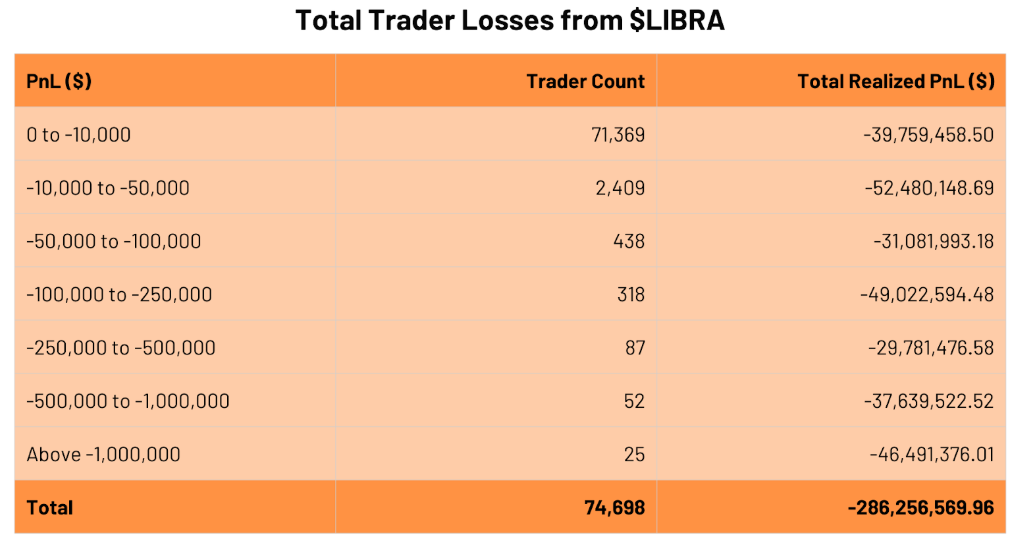

The Libra scandal resulted in 74,698 traders losing a cumulative $286 million worth of capital, according to DWF Labs’ report.

Milei faces impeachment calls from his political opponents after endorsing the cryptocurrency that turned into a $100 million rug pull.

Magazine: Caitlyn Jenner memecoin ‘mastermind’s’ celebrity price list leaked