A crypto whale that placed hundreds of 50x leverage long position bets on Bitcoin and Ether before US President Donald Trump announced a Crypto Strategic Reserve has profited nearly $7 million from the trades.

The whale deposited $5.9 million in USD Coin (USDC) on decentralized derivatives exchange Hyperliquid on March 1 to place the long positions, according to crypto analytics platform HyperDash.

The whale placed their first Ether (ETH) long position on March 2 at 2:49 pm UTC. Thirty-five minutes later, Trump announced the Crypto Strategic Reserve — nearly immediately causing an explosion in market prices.

Around $4 million was used to create $200 million worth of positions with the 50x leverage. The whale’s Ether positions from Ethereum wallet address ”0xe4d…02c62” started closing 16 minutes after Trump’s announcement, with some speculating whether insider trading was involved.

The whale started closing several Ether long positions shortly after Trump’s announcement. Source: Source: HyperDash

The first Bitcoin (BTC) long position, however, was placed on March 1 at 10:44pm UTC, when Bitcoin was trading around $86,033. Many positions were then closed between $87,512 and $91,399.

Some of those Bitcoin exit positions came before Trump’s announcement.

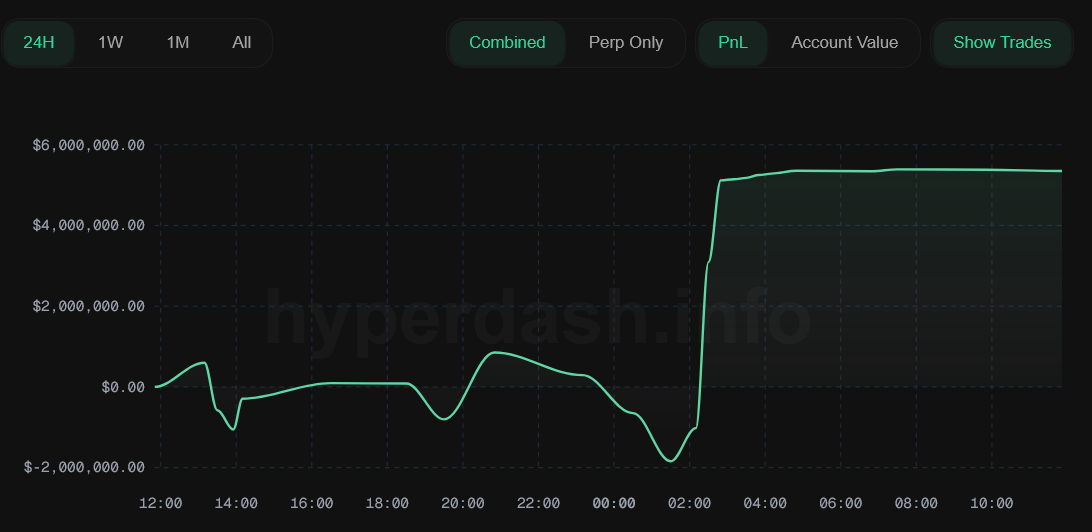

Most of the whale’s positions have now been closed for a profit above $6.8 million, according to HyperDash.

Profit and loss position for crypto whale behind the”0xe4d…02c62” wallet address profit over the last 24 hours. Source: HyperDash

It should, however, be noted that Trump’s first post about the Crypto Strategic Reserve only confirmed XRP (XRP), Solana (SOL) and Cardano’s (ADA) inclusion.

Nearly two hours later, Trump confirmed that Bitcoin and Ether were not only included but would be at the “heart of the reserve.”

Between those two posts, Bitcoin and Ether’s prices were rising, but not to the same extent as the other tokens initially mentioned.

Insider trading? Pundits speculate

The 50x leverage meant that a 2% price fall in Bitcoin or Ether would have triggered liquidation, leading industry pundits to speculate whether insider trading was involved.

The founder and host of The Moon Show, Carl Moon, said: “This $200 million long on Bitcoin and Ethereum before the Bitcoin strategic reserve announcement, could be the biggest INSIDER TRADE I’ve ever seen.”

“Smells illegal.”

One X user suggested that the trader would have longed other tokens had they known about Trump’s incoming announcement, to which crypto researcher “FatMan” responded:

“I don’t know if it was an insider or not, but it’s also possible for an insider to know the tweet is coming but not know the exact contents of the tweet.”

Related: Bitcoin price metric hits ‘optimal DCA’ zone not seen since BTC traded in $50K to $70K range

The Crypto Strategic Reserve follows weeks of evaluation from the President’s newly formed Working Group on Digital Assets, led by executive director Bo Hines and David Sacks, the White House’s AI and crypto czar.

Trump is set to host the first White House Crypto Summit on March 7, inviting industry leaders to meet the Working Group’s Bo Hines and Trump’s AI and crypto czar David Sacks to discuss regulatory policies and stablecoin oversight, among other things.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle