Global and macroeconomic concerns ranging from rising inflation rates in the United States to the prospect of Russia invading Ukraine continue to spark volatility in financial markets.

To the surprise of many analysts, the mood in the cryptocurrency market shifted in a positive direction on Feb. 15 after Bitcoin (BTC) climbed to $44,500 and Ether (ETH) regained support at $3,100.

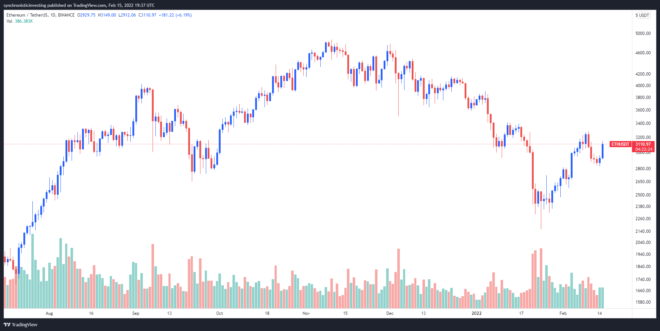

Data from Cryptox Markets Pro and TradingView shows that after bouncing off a low of $2,826 in the early trading hours on Feb. 15, the price of Ether rallied 11.4% to a daily high of $3,148.

Here’s a look at what several traders in the market are saying about the recent price action for Ether and what to be on the lookout for in the weeks ahead.

Ether is in a heavy resistance zone

The stiff resistance facing Ether was addressed in a tweet by independent market analyst Michaël van de Poppe, who posted the following chart outlining the major support and resistance zones for the top altcoin.

van de Poppe said,

“Ethereum, just like Bitcoin, was rejected at weekly order block and heavy resistance zone, ending up in a red candle for the week. With the uncertainty arising for the coming week, I’m not expecting this to break and expecting lower tests.

Bulls could exploit the inverse head and shoulders pattern

A more positive take on the path ahead was offered by crypto trader and pseudonymous Twitter user ‘Phoneix’, who posted the following chart providing one possible trajectory for the price of Ether.

Phoenix said,

“We’re going to play Ether this way, right?”

Related: Bitcoin spikes to $44.5K amid fresh warning over ‘exceptionally high’ stocks correlation

Bitcoin and Ether have similar daily charts

A final bit of insight into the long-term price structure for Ether was addressed by trader Glen Goodman, the author of The Crypto Trader. Goodman posted the following charts comparing the formation of an inverse head and shoulders formation on the BTC and Ether charts, noting that the “head & shoulders patterns are nearing completion.”

Goodman said,

“A couple of worries – the patterns are a bit sloping and irregular…..and also there’s the small matter of Ukraine. Wars have a tendency to mess up nice chart patterns.”

The overall cryptocurrency market cap now stands at $1.978 trillion and Bitcoin’s dominance rate is 42.2%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.