Hong Kong-based investment firm Trend Research has continued accumulating Ether even as one of the biggest corporate ETH holders expects a sharp drawdown during the first quarter of 2026.

Trend Research acquired $35 million in Ether (ETH), pushing its holdings above 601,000 ETH worth about $1.83 billion, according to blockchain data platform Lookonchain.

The company has borrowed a total of $958 million in stablecoins from decentralized lending protocol Aave, with an average purchase price of about $3,265 per ETH, wrote Lookonchain in a Monday X post.

Trend’s founder, Jack Yi, said he was “bullish” on crypto for the first half of 2026 and pledged to continue buying Ether “until the bull market arrives,” with “maximum position in ETH” and a “heavy” position in the Trump family-linked World Liberty Financial (WLFI) token.

He added that “2026 will also be an environment with comprehensive positives like financial on-chain, stablecoins, rate cut cycles, crypto policies.”

Related: Bitcoin crawls to $88K as Aave faces governance drama: Finance Redefined

While BitMine Immersion Technologies, the largest corporate Ether holder, relies on dollar-cost averaging, Trend Research pledged to continue acquiring Ether regardless of “fluctuations of a few hundred dollars.”

Trend Research is the third-largest Ether holder following Bitmine and SharpLink Gaming, but as an unlisted company, it doesn’t appear on most tracking websites, including the StrategicEthReserve.

Related: Crypto speculation at 2024 lows as TradFi leveraged ETFs hit record $239B

FundStrat calls $1.8K ETH bottom, while smart money short ETH price

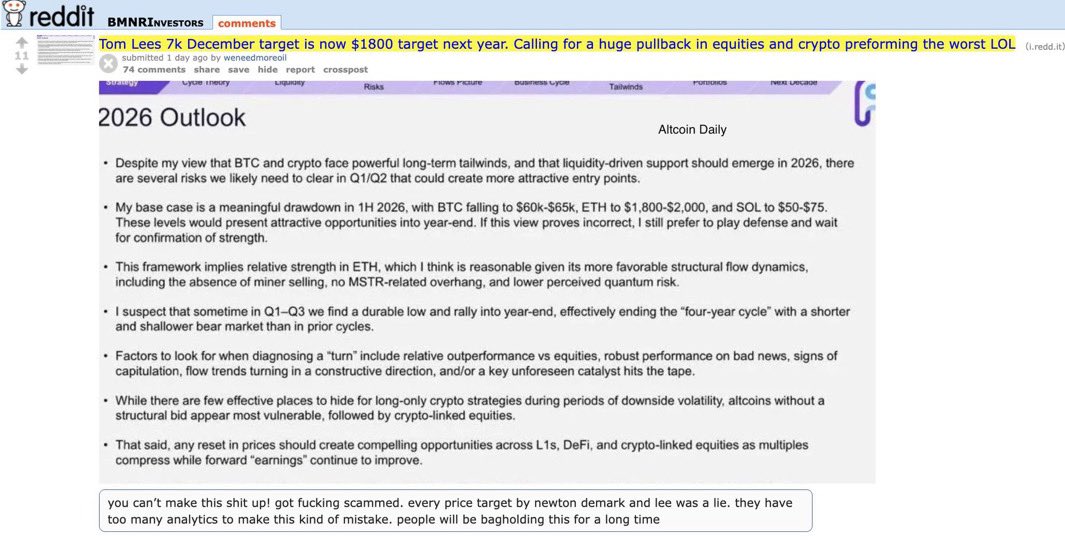

Yi’s optimistic outlook contrasts with the insights shared by Fundstrat Global Advisors, who predicted that Ether will sink to a local bottom of around $1,800 in the first quarter of 2026.

On Dec. 21, screenshots emerged of an internal research note from Fundstrat’s co-founder and managing partner, Tom Lee, who predicted a “meaningful drawdown” for the first half of the next year:

“MY base case is a meaningful drawdown in 1H 2026, with BTC falling to $60k – $65K, ETH to $1,800 – $2,000, and SOL to $50-$75. These levels would present attractive opportunities into year-end.”

The same note suggested the market could form a “durable low” in the first or third quarter before rallying into year-end, resulting in a shallower bear market than prior cycles.

The bearish prediction came as a surprise to investors, considering Lee is also the chairman of Bitmine, the largest corporate Ether holder with around $12.3 billion in ETH holdings.

Meanwhile, the industry’s most successful traders by returns, who are tracked as “smart money” traders on Nansen’s blockchain intelligence platform, also continued to bet on Ether’s short-term price decline.

Smart money was net short on Ether for a cumulative $117 million, but added $15 million worth of long positions during the past 24 hours, signaling a minor recovery in risk appetite from this key cohort, Nansen data shows.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling — Joseph Chalom