Coinspeaker

Truflation Unveils Hedge Index to Protect Investments against Inflation with Real-World Asset Tracking

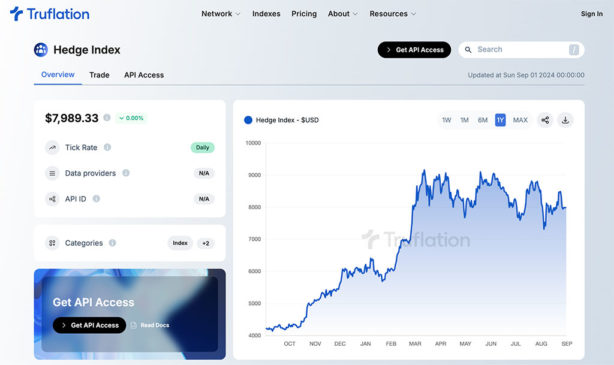

Truflation, a leading real-time financial data provider, has introduced a Hedge Index aimed at helping investors protect their portfolios against inflation. This cutting-edge index monitors Real World Assets (RWAs) and serves as a performance benchmark, offering a diversified strategy to reduce the effects of inflation on investments.

The Truflation Hedge Index comprises five key asset classes: Gold (25%), Silver (20%), WTI Crude Oil (20%), the S&P 500 (25%), and Bitcoin (10%). These assets are carefully weighted to create a balanced hedge against inflation. The index’s value is continuously updated throughout the day, reflecting the price movements of these components, which helps investors manage the risks associated with inflation.

A Tool for Traditional and Decentralized Finance

The Hedge Index is crafted to serve both traditional finance (TradFi) and decentralized finance (DeFi) sectors. For traditional investors, it provides a dependable way to hedge against inflation by spreading investments across various asset classes. This diversification helps mitigate potential losses from other investments during times of inflation.

In the decentralized finance sector, the index is particularly valuable for protocols that focus on the tokenization of RWAs. Projects like Nuon Finance, Frax Finance, and Overlay Protocol can use this index to gauge the effectiveness of RWAs as a hedge against inflation. By tracking the value of these assets, the Truflation Hedge Index provides accurate, real-time data that is crucial for making informed decisions in an ever-changing economic landscape.

Stefan Rust, CEO of Truflation, stated:

“The Truflation Hedge Index is a game-changer for investors seeking to protect their portfolios against inflation. By leveraging real-time data and diversifying across core asset classes, we provide a powerful tool that mitigates the impact of inflation on investments.”

Truflation’s decentralized data feeds, indexes, and oracles are essential tools for DeFi applications. With data sourced from over 65 partners and tracking more than 18 million items, these tools provide a dependable foundation for both traditional and decentralized finance.

Beyond Inflation Tracking

Truflation’s offerings extend beyond the Hedge Index. The company also provides dedicated dashboards for tracking inflation in various countries, including the US, UK, and Argentina. These dashboards are part of Truflation’s mission to bring accurate economic data on-chain, offering alternative metrics that address the limitations of traditional indices like the Consumer Price Index (CPI).

These innovations aim to improve decision-making for individuals, businesses, and policymakers, contributing to a more informed and resilient economy.

About Truflation

Established in 2021, Truflation benefits from the backing of major partners like Coinbase and Chainlink. The company runs the Truflation Stream Network (TSN), a decentralized real-time data oracle that monitors more than 18 million items. This network, which is resistant to censorship, is vital for decentralized applications (dApps) and supports various financial instruments, including commodity price forecasts and BTC-denominated markets.

Truflation’s solutions mark a significant leap forward in the Web3 sector, enhancing both innovation and transparency in financial markets.