The Business Source License (BSL) for the Uniswap v3 protocol expired on April 1. Developers can now fork it, protocol documentation shows.

The decentralized finance (DeFi) industry has eagerly awaited this expiration as it would allow developers to deploy their decentralized exchanges (DEX) using Uniswap v3 code.

Uniswap v3 license replaced with a GPL

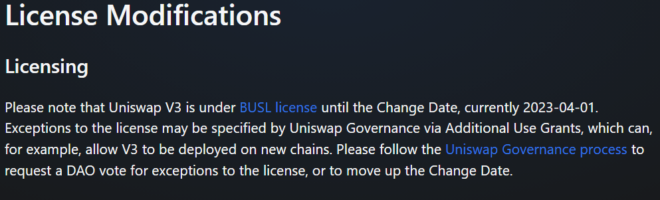

The BSL is a license created to safeguard the author’s ability to profit from their works and lasts typically for a specific amount of time before being fully open source.

BSL is a substitute for open-core or closed-source licensing systems. Under BSL, the source code is always accessible to the public. The code is always free for non-production usage, and the licensor may also issue an additional Use Grant enabling certain production use.

When a business source license expires, it indicates that the license contract that permitted the firm’s use of specific software or technology is no longer in force. This may occur due to several factors, including the termination or non-renewal of a license agreement.

A General Public License (GPL) now applies to the protocol, replacing the two-year license for Uniswap v3 released in 2021 that forbade using its code for commercial purposes.

Developers will require an Extra Use Grant, a production exception created to meet the interests of both open-source and for-profit developers, to fork the code.

Uniswap is a well-known decentralized exchange and one of the biggest automated market maker (AMM) platforms by total value locked (TVL) in the DeFi. It offers a trustless portal for trading tokens, including non-fungible tokens (NFTs). Investors frequently use its governance token, UNI, to vote on proposals.

In November 2018, Uniswap v1 was released as a proof-of-concept for AMMs, a class of exchange that allows anybody to pool assets into common market-making strategies.

Novel features and optimizations were added to Uniswap v2 in May 2020, which paved the way for a rapid increase in the usage of AMM.

Uniswap v3 came with it concentrated liquidity, providing each LP with fine-grained discretion over the price bands to which their capital is allocated.

In Uniswap v3, several fee categories enable LPs to be fairly compensated for assuming varied levels of risk. Individual positions are merged into a single pool, providing one composite curve for users to trade against.

In May 2021, Uniswap v3 surpassed the Bitcoin network daily fees after generating $5.4m compared to the legacy proof-of-work network’s fees which stood at $3.7m.

Uniswap goes live on BSC

Following a vote in favor of an 0x Plasma Labs proposal, Uniswap v3 recently launched on the BNB Smart Chain (BSC), one of the most active smart contracting platforms after Ethereum.

This integration allows Uniswap users to trade and swap tokens within the BNB Chain ecosystem.

PancakeSwap, a decentralized cryptocurrency exchange, is set to release a new version of its app to users in the first week of April on BNB Smart Chain (BSC).

According to a press statement from the company, PancakeSwap v3 is anticipated to include several enhancements to the service, including more aggressive trading costs and greater liquidity provisioning.