Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Sebastian Bea, president of Coinbase Asset Management, believes a technical change to the way Washington accounts for its gold could unlock enough budget-neutral capital for a strategic Bitcoin purchase approaching $100 billion—years ahead of market expectations.

In a 40-minute appearance on The Scoop with Frank Chaparro released Wednesday, Bea framed the idea as hiding in plain sight. “Sometimes the ideas are so big that people either can’t hear them or don’t want to hear them,” he said at the top of the interview. “But they’ve got to listen to this one.”

By statute, the 261.5 million-ounce US gold hoard is still recorded at $42.22 per ounce—a valuation fixed in 1973. At Wednesday’s spot price of roughly $3,303, the gap between book value and market value is almost $900 billion.

“So today, because of law, the US government still values gold that it holds in Fort Knox at $42 and change,” Bea noted. “If they were to just mark that to market, that’s an incremental 900 to … I heard a billion to a trillion dollars.”

From Mark-To-Market To Bitcoin

Bea’s central contention is that Congress could pass a short bill amending 31 U.S.C. § 5117, re-strike higher-denomination gold certificates, and credit the revaluation gain to a sovereign-wealth-style account at Treasury in line with US president Donald Trump’s executive order for a strategic Bitcoin reserve—without adding to headline federal debt.

Related Reading

“When the revaluation occurs, that creates a $900 billion mark-to-market gain, which the Treasury could then take […] in a budget-neutral manner to go and buy a variety of things. We think probably including Bitcoin,” he said.

His arithmetic mirrors Senator Cynthia Lummis’ BITCOIN Act, introduced earlier this year, which directs Treasury to acquire one million BTC (around $100 billion at prevailing prices) over five years while remaining deficit neutral.

Bea argued that a US purchase of that size—about 5.5% of Bitcoin’s $1.8 trillion market capitalization—would almost certainly prompt other states to respond. “It’s hard to see a situation where other governments don’t feel compelled in some way to measure up,” he said, adding that the dynamic could resemble the “competitive situation” in gold, where central banks bought a record 1,037 tonnes last year.

Related Reading

Central bank demand for gold is motivated by “the overall level of debt that they see and the concerns around the global economy,” Bea said. “So does it seem so crazy to maybe save in some Bitcoin at, say, a ninety-to-ten ratio, given the whole world is going online?”

How Soon Is ‘Sooner Than Expected’?

Bea would not commit to a precise timetable but told Chaparro that the legal change “could be this year.” He suggested the trigger could come from legislators seeking an offset for new outlays—or from Treasury itself if political momentum builds behind the Lummis bill.

“As soon as you understand the pipes of how banks and how the government works,” he concluded, “you realize they can revalue gold and buy Bitcoin and still be budget neutral. And once that’s on the table, it’s really just a matter of political will.”

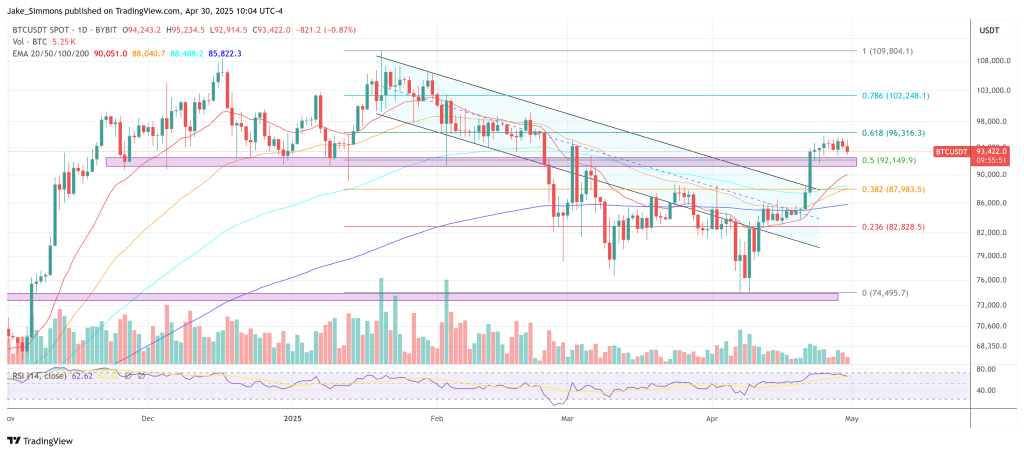

At press time, BTC traded at $93,422.

Featured image created with DALL.E, chart from TradingView.com