Ethena Labs, the firm behind the USDe stablecoin, currently offers an annual yield of 17.2%, a rolling average over the past seven days, to investors that stake USDe or other stablecoins on the platform. The yield is created from a tokenized “cash and carry” trade that involves purchasing an asset whilst simultaneously shorting that asset to rake in funding payments.

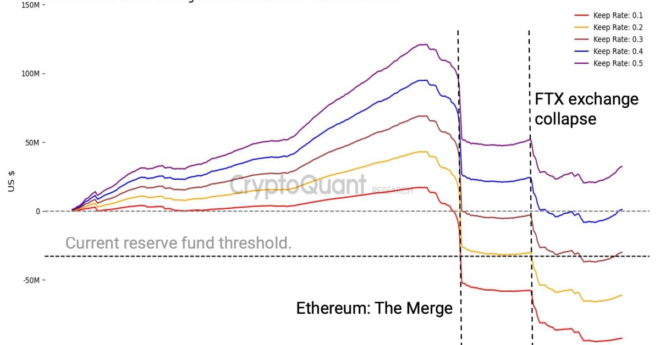

USDe Holders Should Monitor Ethena Labs’ Reserve Fund to Avoid Risk, CryptoQuant Warns