Blockchain analytics firm Chainalysis has published its 2022 cryptocurrency adoption index. Vietnam, the Philippines, India, and China are among the countries with the highest crypto adoption. While the overall adoption slows worldwide in bear markets, it “remains above pre-bull market levels,” the firm said.

Chainalysis’ Latest Cryptocurrency Adoption Index

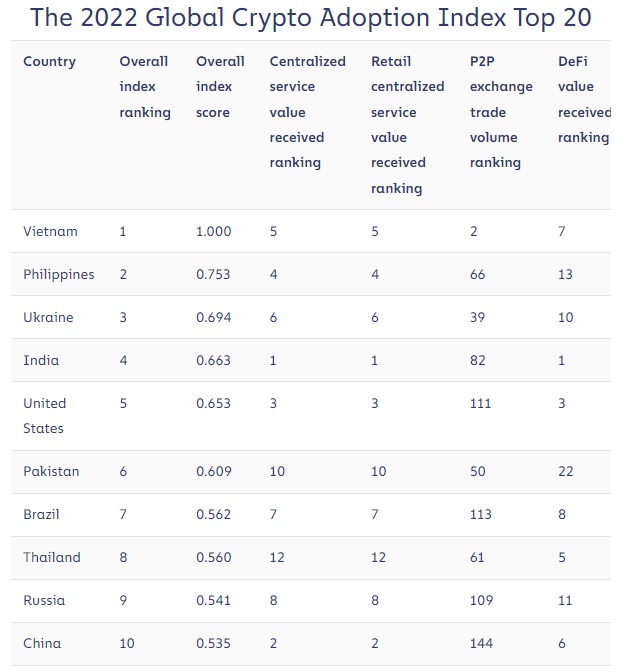

Chainalysis published an excerpt of its upcoming report titled “2022 Geography of Cryptocurrency” Wednesday. It highlights the company’s 2022 Global Crypto Adoption Index, which ranked all countries based on their usage of different types of cryptocurrency services, the blockchain data firm explained.

According to the index, Vietnam tops the list overall, followed by the Philippines, Ukraine, India, the United States, Pakistan, Brazil, Thailand, Russia, and China.

Chainalysis detailed:

Overall adoption slows worldwide in bear market, but remains above pre-bull market levels.

Moreover, the blockchain analytics firm noted that “Emerging markets dominate the global crypto adoption index.”

In addition, the firm explained that China finally reentered the top 10 of its global cryptocurrency adoption index this year after placing 13th last year.

“Our sub-indexes show that China is especially strong in usage of centralized services, placing second overall for purchasing power-adjusted transaction volume at both the overall and retail levels,” Chainalysis described.

“This is especially interesting given the Chinese government’s crackdown on cryptocurrency activity, which includes a ban on all cryptocurrency trading announced in September 2021,” the blockchain analytics firm said, elaborating:

Our data suggests that the ban has either been ineffective or loosely enforced.

What do you think about Chainalysis’ crypto adoption rankings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.