Bitcoin ETFs and exchanges now have up to eight times more of an impact than miners, according to a new report.

Sell-side pressure from miners is diminishing with each and every halving, a new analysis from Glassnode says.

Meanwhile, centralized exchanges and ETF providers now have up to eight times more of an impact — a powerful illustration of how the market is shifting.

This chart helps explain what’s changing. The largest pool of Bitcoin being monitored by Glassnode rests in CEXs.

That comes to three million BTC, or about one in seven of the total supply that’ll ever exist.

It’s also fascinating to see how the 11 firms that have issued exchange-traded funds based on Bitcoin’s spot price have ballooned in popularity since January.

They collectively now hold 887,000 BTC on behalf of investors, meaning they’re creating much more sell-side pressure on days when there are considerable outflows.

Once the vast reserves held by Satoshi Nakamoto are taken out of the equation, miners currently hold about 705,000 BTC.

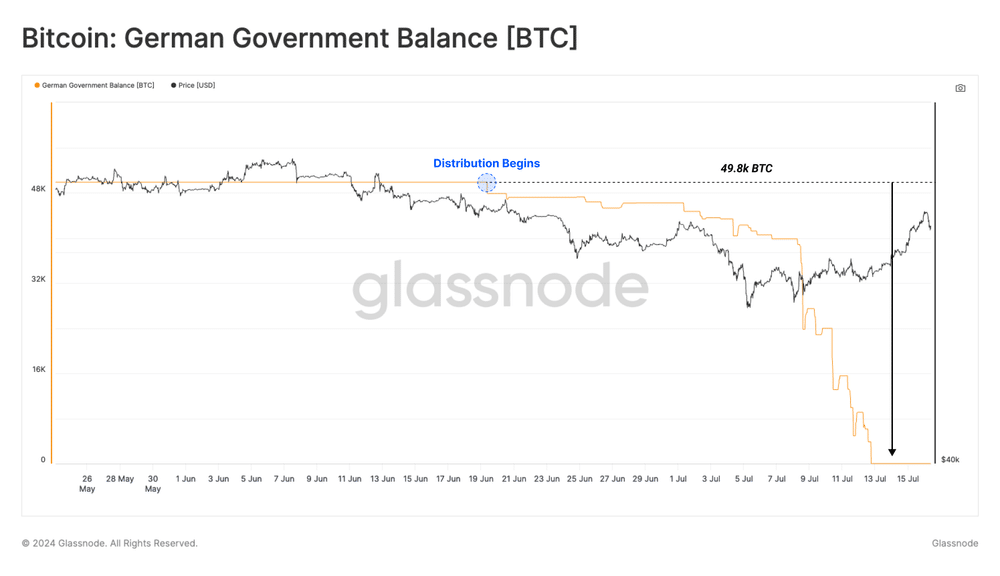

Glassnode says it’s been an exceedingly challenging time for Bitcoin’s price — with the German government offloading close to 50,000 BTC within a few weeks. However, it noted:

“The majority was distributed over a very short window between July 7 and 10, where over 39.8k BTC flowed out of labeled wallets. Interestingly, this sell-side occurred after the market had bottomed around $54,000 — suggesting market front-ran the news.”

Glassnode

While concerning to everyday investors, government sell-offs of crypto remain relatively rare.

Although it isn’t expected that ETH ETFs will have anywhere near as much demand as their BTC counterparts, Wall Street could end up having a huge influence on how Ether performs.

And given supply has already been squeezed considerably through staking, we could see the amount of ETH that’s in circulation rapidly diminish quite quickly.

Glassnode went on to note that, when compared with Bitcoin, there appears to have been “notably less interest” for Ether relative to the bull run in 2021, when daily ETH exchange flows were almost on a par with BTC.

“This suggests that the degree of speculative interest in 2024 has been comparatively muted, and aligns with the generally weaker performance of ETH relative to BTC since the 2022 cycle lows.”

Glassnode

Returning to Bitcoin, it’s also interesting to see that the number of HODLers in profit has remained “robust” — even when the German government sell-offs saw the world’s biggest cryptocurrency head to lows of $53,500. At that point, Glassnode’s estimates suggested that about 25% of coins were at an unrealized loss, meaning they were now worth less than what investors had paid for them.

“This suggests that the degree of speculative interest in 2024 has been comparatively muted, and aligns with the generally weaker performance of ETH relative to BTC since the 2022 cycle lows.”

Glassnode

The narrative gets even more interesting when you zoom in on so-called “short-term holders,” as 66% of the BTC they held was tipped into the red over this period — one of the biggest declines ever recorded.

“For the opposing cohort, the long-term holders, they have experienced a negligible shift in the proportion of their supply held in profit. This demonstrates that relatively few investors from the heights of the 2021 bull still hold onto their coins.”

Glassnode

There’s been something of an impressive recovery in Bitcoin’s price now the German government has finished dumping Bitcoin on the market — with BTC almost piercing $68,500 in the immediate aftermath of Joe Biden bowing out of the presidential race.

Analysts have likened this to “relief” that the worst of the selling pressure is over, but diminished trading volumes during the summer months could continue to pose a challenge.

All eyes now are on whether Bitcoin can pierce the psychologically significant barrier of $70,000 — a level that hasn’t been reached since June.

Beyond that, an even bigger challenge will be surpassing the all-time high of $73,750 that was established on March 14, 2014.

Setting a new record here will send Bitcoin back into an era of unprecedented territory — and this momentum would undoubtedly lead to a renewed surge in ETF inflows.