Explore the anticipated next crypto bull market in 2024-2025, its key driving factors, and determine which strategy is optimal for you.

The crypto market has experienced several bull and bear cycles since Bitcoin’s (BTC) inception in 2009 giving cues for the next crypto bull run 2024-2025.

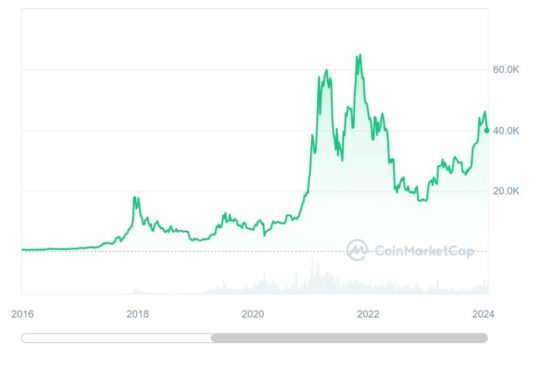

One of the earliest significant bull runs occurred in 2017, when Bitcoin saw a near 20x price increase, peaking close to $20,000 levels.

This was followed by a steep decline in what was later termed the “crypto winter” and saw BTC lose over 80% of its value, bottoming at around $3,200.

Another remarkable phase was the 2020-2021 bull run. Post a period of decline and stagnation, BTC, along with other major altcoins like Ethereum (ETH), surged to new heights.

During this period, Bitcoin’s value reached approximately $69,000 by Nov. 2021, while the overall market cap ballooned over $2.5 trillion before cooling off.

As we gaze into the future, several factors suggest another bull run could be on the horizon. So, when is the next predicted crypto bull run, and how should you prepare for it?

Factors that could trigger the next crypto bull run in 2024-2025

Mainstream acceptance of BTC ETFs

The launch of Bitcoin ETFs marks a significant step in the mainstream acceptance of cryptocurrencies.

These ETFs offer a regulated option for both retail and institutional investors to gain exposure to Bitcoin, potentially leading to broader adoption and increased liquidity.

Currently, the market has seen the introduction of several Bitcoin ETFs, including notable ones like Blackrock’s iShares Bitcoin Trust (IBIT), ARK 21Shares Bitcoin ETF (ARKB), etc.

Since their introduction, these ETFs have amassed substantial holdings, reflecting growing investor interest.

For instance, the 11 U.S. ETFs tracking Bitcoin’s price have collectively accumulated over 644,860 Bitcoins, valued at more than $27 billion, signaling a shift in Bitcoin’s position in mainstream finance.

Historically, the introduction of ETFs in other markets, like gold, has played a crucial role in making the asset more accessible to a broader range of investors, contributing to price appreciation.

For example, the launch of the first gold ETF in 2003 coincided with the beginning of a 10-year bull market in gold, where its price rose by more than 350%. In the first year post-launch, Gold Price increased by 20% with a yearly inflow of $15 billion into different ETFs.

Drawing parallels, the introduction of Bitcoin ETFs could have a similar impact, offering a more direct and regulated investment avenue into Bitcoin.

BTC halving

Historically, Bitcoin halving events have greatly impacted its price and market dynamics. The halving occurs approximately every four years, reducing the block reward for miners by half, leading to increased scarcity of Bitcoin.

The next halving is anticipated in April 2024, and if history is any guide, it could be a major catalyst for the next crypto bull run 2024-2025.

Examining past halvings, each event has been followed by a notable increase in Bitcoin’s price. For instance, after the 2016 halving, Bitcoin’s price surged significantly the following year. The 2020 halving also preceded the remarkable bull run of 2020-2021, where Bitcoin reached new highs.

The 2024 halving, therefore, is being watched closely, with expectations of it triggering a similar positive impact on the crypto market.

ETH’s Dencun upgrade and its impact on the crypto market

Ethereum’s Dencun upgrade, a major step in the network’s development, has been successfully implemented on the Goerli testnet.

This upgrade, featuring the implementation of EIP-4844 (proto-danksharding), is focused on increasing data availability for layer-2 rollups and enhancing Ethereum’s scalability.

The primary component, proto-danksharding, allows for the temporary storage of off-chain data, which is expected to significantly reduce transaction fees for decentralized applications (dapps), particularly benefiting layer 2 rollup chains.

The Dencun upgrade is anticipated to lower rollup transaction costs by up to 10 times, depending on blob space demand. This reduction in gas fees and faster transaction speeds are poised to open opportunities for more complex applications on layer 2 solutions.

With these technical achievements, Ethereum could become a more scalable and efficient blockchain, making ETH and ETH-based applications a strong contender to flourish in value in the coming months and years.

Macroeconomic factors influencing the expected crypto bull run

When is the next crypto bull run? The crypto market’s trajectory could be heavily influenced by various global economic factors.

Geopolitical tensions, particularly in regions critical to the world’s food and energy supply, like Eastern Europe and the Middle East, are major risk factors confronting the global economy.

Any escalation in these conflicts could lead to disruptions in energy markets and supply chains, impacting global economic growth and investor sentiment towards riskier assets like cryptocurrencies.

For instance, an escalation in the Middle East affecting oil production could lead to surging oil prices, which may stoke inflation and lead to risk-off sentiment among investors, potentially negatively impacting riskier assets like cryptocurrencies.

Moreover, a research report by blockchain analytics firm TRM Labs showed that nearly 80% of jurisdictions around the world have implemented measures to tighten crypto regulations in 2023.

In the absence of a comprehensive regulatory structure for cryptocurrencies in the United States, TRM Labs foresees significant decisions from federal courts in 2024 regarding the potential classification of certain crypto assets as securities.

In 2023, The European Union (EU) made significant strides in regulating the crypto market by establishing Markets in Crypto-Assets Regulation (MiCA), setting uniform rules for crypto-assets, including consumer protection and environmental safeguards.

The EU has also focused on anti-money laundering (AML) measures. New guidelines issued by the European Banking Authority (EBA) emphasize the need for crypto-asset service providers to manage risks related to money laundering and terrorist financing effectively.

These developments could have a significant impact on investor confidence and market stability, both of which are crucial factors in determining when the next crypto bull run will occur.

How to prepare for the next predicted crypto bull run

As we stand on the brink of what many anticipate to be the crypto bull run news of 2024-2025, it’s crucial to have a well-rounded strategy.

Reddit-inspired gradual selling strategy

One investor’s approach involves ceasing crypto purchases after April 2024 and implementing a gradual selling strategy from September 2024. This plan suggests selling a fixed percentage of holdings each month, starting at 4% and eventually reaching 10%. Additionally, 25% of the proceeds go into buying Bitcoin and 75% into a high-interest savings account. This strategy emphasizes discipline, especially during volatile market periods.

Diversification strategy

Diversification is key in any investment approach, especially in a volatile market like cryptocurrencies. This involves spreading your investments across various types of crypto assets, such as Bitcoin, altcoins, and tokens based on different technologies or with different use cases, and even considering non-crypto investments like stocks or real estate. The idea is not to put all your eggs in one basket, reducing the impact of any single asset’s performance on your overall portfolio.

Automated trading and dollar-cost averaging

Automated trading algorithms and dollar-cost averaging (DCA) can offer a more hands-off approach to your trading strategy. DCA involves investing a fixed amount into a particular asset at regular intervals, regardless of its price, reducing the impact of volatility. Moreover, you can set up automated trades using algorithmic trading tools based on specific market conditions or signals, helping you take emotion out of the trading process.

Conclusion

Each of these strategies has its merits and can be tailored to your risk tolerance and financial goals. The key is to stay informed, adapt to market changes, and maintain a disciplined approach.

As always, it’s wise to consult a financial advisor to align these strategies with your financial situation. Investing more than you can afford to lose is never a good strategy.