In the wake of the FTX collapse, formerly the second-largest exchange in the world, its competitors are taking over its trading volume and market share. The nascent sector is still suffering the consequences of recent events; many crypto companies filed for bankruptcy or are in the process of raising emergency liquidity.

The FTX’s fallout is taking its toll on the crypto market. Bitcoin, Ethereum, and other more prominent cryptocurrencies are trading in losses. No digital assets escaped the bloodbath recorded by the sector in the previous week.

The FTX Demise Creates New Winners In The Crypto Industry?

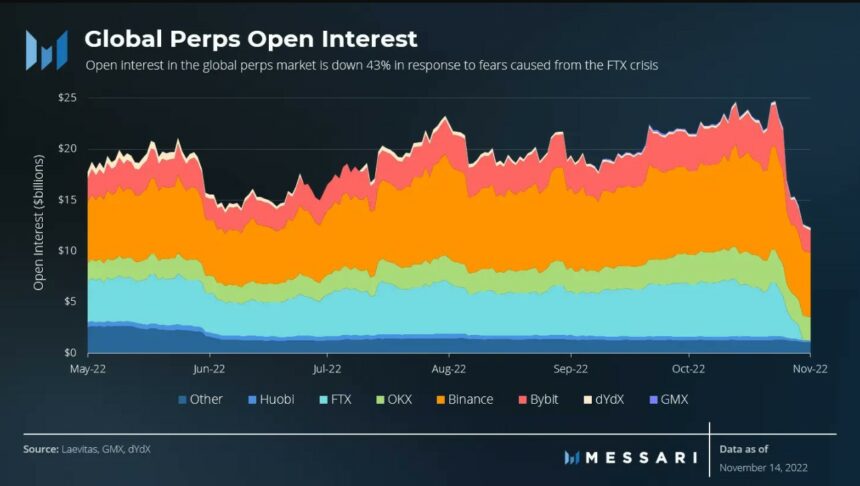

According to a report from analytics firm Messari, crypto trading venues saw a significant decline in aggregate interest following FTX’s bankruptcy. The trading venue represented about 25% of the crypto market’s global Open Interest.

As seen in the chart below, the dynamics in the crypto market changed amid the FTX crisis. This platform’s Open Interest has migrated to its competitors. Binance was the most significant benefactor; the platform absorbed most of FTX’s former Open Interest.

Nevertheless, the above chart hints at a tale of despair and panic rather than a race with one single clear winner. The Open Interest for crypto exchange platforms plummeted by over 43% in the past week. Messari noted:

Binance was the main beneficiary of the FTX Official collapse, gaining 9.6% in market share. DeFi failed to capture any meaningful volume in the fallout continuing to hover around 3%. A limiting factor for DeFi’s ceiling remains expensive transactions and slow block times.

In addition to capturing a critical portion of FTX’s Open Interest, market participants migrated to Binance to trade digital assets. The platform saw a spike in its market share for Perpetual Trading Volume. This metric increased from 57% to 67%.

Binance Dominates Crypto Exchange Sector

In the nascent industry, users believe Binance and its CEO Changpeng “CZ” Zhao capitalized on FTX’s vulnerability to take over the sector. CZ denied this claim by stating that the industry suffered from its competitor’s collapse.

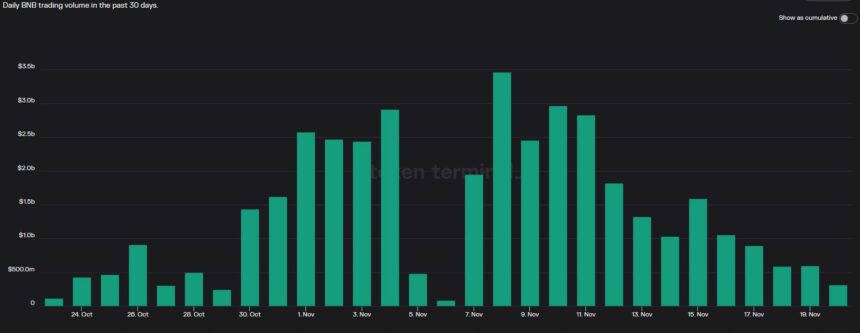

However, Messari’s data presents a different picture and hint at the formation of a new landscape in the industry. Additional data from Token Terminal indicates that Binance Coin (BNB) saw an uptick in its trading volume in November.

The turmoil created by FTX briefly benefited Binance’s native token. Although, BNB’s trading volume has declined following the general sentiment in the crypto market.