Prediction markets have made headlines recently after demonstrating an uncanny ability to forecast global events with a level of accuracy unseen by traditional bookmakers or even polling results.

With leading prediction market Polymarket predicting that Joe Biden would step out of the U.S. presidential race before it happened, people have become increasingly interested in the ‘wisdom of the crowd’ and the potential applications for these markets.

What is a prediction market?

A prediction market is a financial marketplace where people speculate on the outcome of all kinds of events, buying and selling shares that represent the likelihood of certain outcomes.

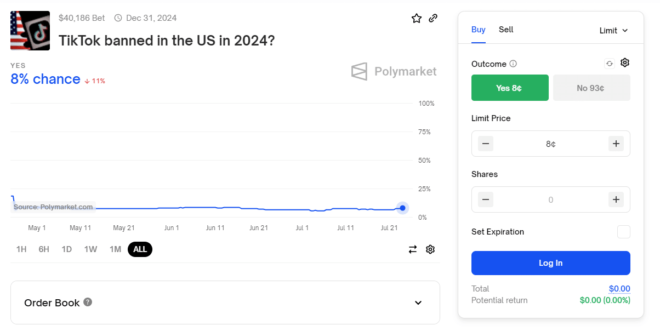

For example, the Polymarket prediction market allows users to buy and sell shares or contracts in events ranging from political elections, sports games, results in musical awards ceremonies, and crypto prices such as the likelihood of a Solana all-time high by the end of the year.

Because these prediction markets involve large numbers of skilled, methodical analysts publicly speculating on the outcomes of major events, with a financial incentive to indicate their true opinions, these markets may have a use case in indicating public sentiment and perhaps even offering accurate predictions in some cases.

Historical background of predictive markets

Predictive markets are by no means a new invention and date back to at least the 1500s when people used to speculate on the outcome of papal elections. Wall Street has been betting on political elections since at least the 1800s, and there is evidence of predictive markets betting on elections in Canada and Britain during the same time period.

However, in modern times, the nature of these markets has become significantly more complex and sophisticated.

Let’s take a look at how these predictive markets work.

How prediction markets work

Typically, a prediction market allows users to buy a contract or share representing an outcome. A market will have a specific set of events with two or more outcomes that users can trade on.

For example, a market might speculate on the outcome of an election with two possible outcomes. It will open with contracts available for purchase supporting the victory of either candidate, and these shares might begin trading at equal values.

So a victory for Candidate A will have a number of contracts priced at $0.50, for example, and a victory for Candidate B would have the same amount of contracts at the same price.

As users begin trading the contracts, the value will fluctuate in one direction or another, indicating the general sentiment of the crowd speculating on the event and giving onlookers an idea of what the market thinks will happen.

Unlike a traditional bookmaker that gives odds on these events, users in a prediction market can swing trade contracts, taking profit or hedging losses at set points throughout the lifecycle of the event.

In crypto, these markets often use a hybrid decentralized model. While the platform’s staff still decides which events are being traded, the community itself can provide liquidity to the market, attempting to profit in doing so.

We’ve written an extensive guide on the Polymarket prediction market, including the nature of profiting by providing liquidity.

Types of prediction markets

There are four main types of prediction markets in 2024. The following list refers to the general type of platform, whereas further down, we’ll explore specific types of betting models.

Fixed Odds Betting

Fixed odds betting is likely the kind of market that most people are familiar with, odds set on an event by a traditional bookmaker or sports betting website. Users place bets and cannot trade or sell their contracts, and the payout is calculated based on when the users place their bets.

Continuous Double Auction (CDA)

CDA markets allow users to buy and sell orders at any time, allowing for arbitrage and swing trading of contracts right up until the end of the event. Polymarket is one such market, as Iowa Electronic Markets uses fiat rather than crypto.

Automated Market Maker (AMM)

AMMs like Augur and Gnosis use algorithms to provide liquidity and automatically set prices based on the supply and demand of contracts. These are more decentralized than crypto prediction markets like Polymarket, which have more human oversight and can be considered hybrid-dencentralized, or perhaps simply centralized.

Parimutuel Markets

Parimutuel markets like the Hollywood Stock Exchange pools bets together and calculates the payout odds based on the distribution of bets across different outcomes. The winners share the final pool of earnings.

Types of contracts/betting available on prediction markets

There are several ways a contract can play out on a prediction market, or to put it simply, different types of betting models available.

Binary yes/no outcomes

A binary market is the most straightforward type of market or contract there is on a prediction market.

Categorical markets

Categorical markets have multiple possible outcomes rather than a simple yes or no, allowing for more diverse trading options.

Scalar markets

Scalar markets, or scalar betting, offer continuous outcomes within a range. For example, a market might trade based on the price of Bitcoin by the end of the year, with options ranging from $20,000 to $10,000. Instead of having multiple fixed options, users can buy contracts based on their estimate of the correct answer, and the closer they are to being correct when selling their contracts, the more their contracts are worth.

Best crypto prediction markets in 2024 and beyond

Now that we know how crypto prediction markets work, let’s take a look at some of the best crypto prediction markets available to use right now.

It’s worth noting that crypto prediction markets are still a relatively new addition to the ecosystem, and that none of the below markets offer advanced trading features like stop loss or take profit automation at this time.

Polymarket

Polymarket is a crypto prediction market built on both the Ethereum and Polygon blockchain networks and interfaces with Web2. Users trade contracts in USDC stablecoins. Polymarket is now the top crypto prediction market by trading volume.

Augur

Augur is a fully decentralized predictions market on the Ethereum market. Augur runs programmatically, meaning there is little to no human oversight involved. Smart contracts read oracles, autonomous tools which feed news and market info to the contracts, in order to determine what the outcome of an event is in order to pay out winnings.

Zeitgeist

Zeitgeist is a prediction market built on the Kusama network. Users can take advantage of a variety of betting models, and the market is decentralized. Like Augur, the platform uses real-time oracles to feed live data to pre-programmed smart contracts.

Will crypto prediction markets become priced in?

For some time, crypto prediction markets have flown under the radar, often allowing a niche community to take advantage of the so-called ‘wisdom of the crowd’.

However, with all the publicity around prediction markets recently, largely stemming from some prudent election campaign insights from Polymarket, the landscape has seen major changes, with mainstream investment and high trading volumes now taking over.

It will be interesting to see whether prediction markets become a more prevalent indicator for predicting crypto prices in the retail and institutional markets. If so, it’s possible that they will whether they will suffer from becoming priced in, meaning prediction markets may influence actual crypto prices, which in turn could cause the predictions to become inaccurate as the market adapts to them in real time.

Either way, the accuracy sometimes demonstrated by prediction markets is fascinating, and it’s likely that these markets will become a staple indicator for strategists and investors worldwide.