Financial scams are rising, with losses amounting to $8.8 billion in 2022 alone. According to the United States Federal Trade Commission, losses from financial fraud have increased by 30% from 2021 to 2023. This paints a dire portrait of the dark underbelly of digital advancement, with scammers now leveraging generative artificial intelligence (AI) to craft increasingly complex and realistic scams.

Multiple reports suggest scammers can create chatbots that mimic human conversation, ask for personal financial details, create malware, write sophisticated phishing emails and even mimic human voices. The immediacy of instant payments via digital banking also presents an opportunity for fraudsters to deceive users into transferring money instantly, leaving defrauded users with little to no hope of getting their money back.

Risk management platforms like Feedzai are part of the ongoing fight against financial crime. Powered by machine learning and big data, platforms like these boast advanced technology and high-level security to combat sophisticated financial scams.

What is Feedzai, and how does it work?

Feedzai is a risk operations (RiskOps) platform that leverages machine learning technology and AI to provide retailers, banks and payment providers with fraud prevention solutions. The platform has a global reach and aims to protect people from the risks associated with e-commerce and banking.

Initially founded in Portugal in 2011, Feedzai is now based in California and offers services in 190 countries. Considered a market leader in its field, the company was originally developed by its founders, Nuno Sebastião, Paulo Marques and Pedro Bizarro, to offer operational intelligence and fraud detection solutions.

Today, Feedzai has evolved into a suite of AI-based solutions specifically targeted at detecting fraud and preventing financial crime. Feedzai’s main clients are established banks and financial institutions like Citibank, Standard Chartered and Lloyds Banking Group.

Feedzai, a RiskOps platform that uses machine learning

Feedzai is based on the concept of RiskOps, a practice that operationalizes risk through fair and customer-centric approaches. RiskOps also empowers financial institutions to detect suspicious behaviors, identify scammers and combat fraud.

RiskOps helps financial institutions manage identity, data and foster collaboration across various systems more efficiently — allowing institutions to provide their customers with superior and reliable services.

Technically, what RiskOps platforms like Feedzai do is provide financial institutions with a framework for more effective financial risk management. Standardizing the risk management and fraud prevention approach makes it easier to assess abstract and difficult-to-define concepts like risk. As such, these institutions can confidently measure and analyze risk and make smarter decisions based on these findings.

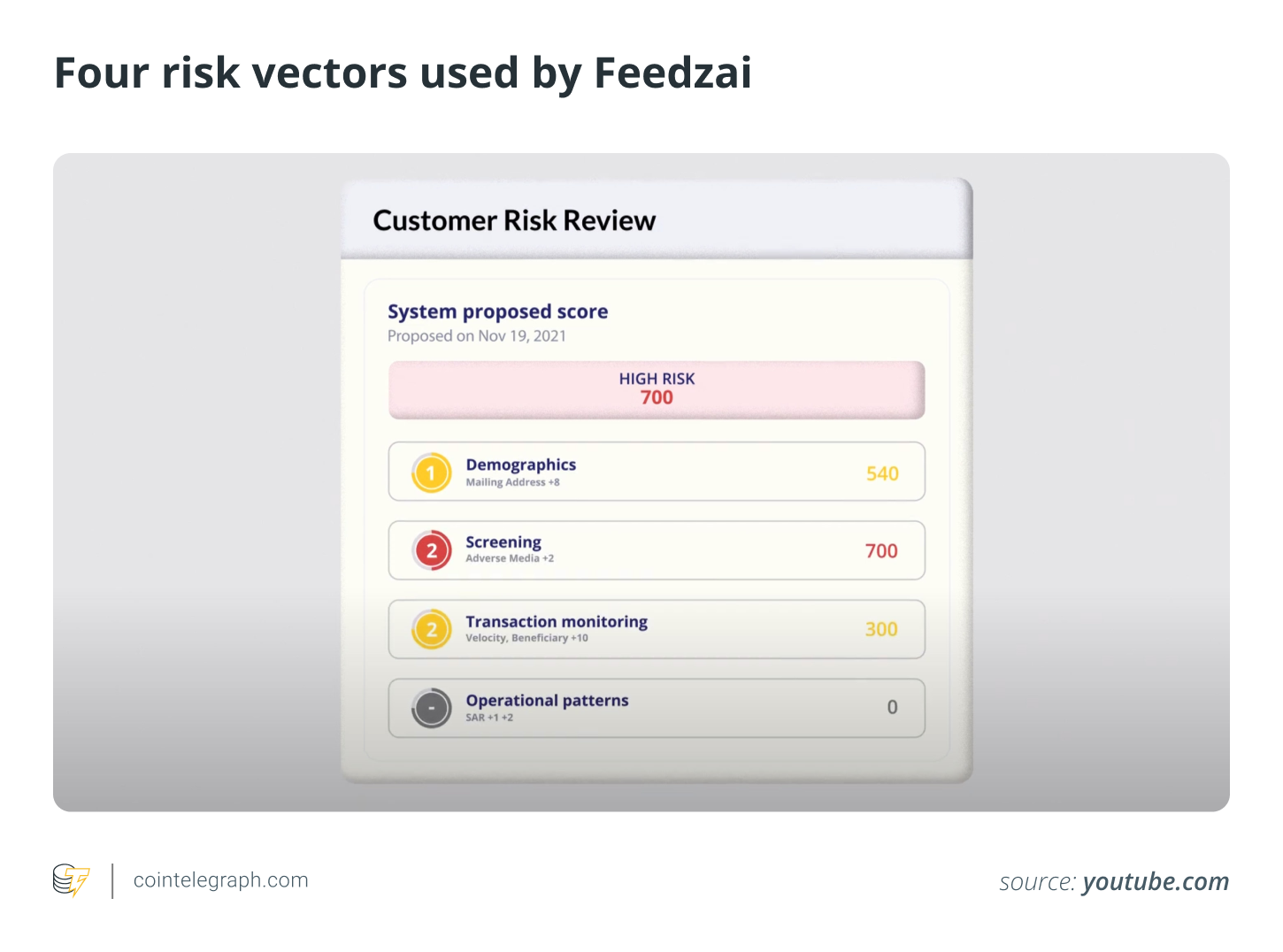

Feedzai’s platform uses machine learning to process events and transactions quickly while providing easily understandable results through an added human-readable semantic layer. Its learning model processes and transforms multiple data streams and insights from various sources to create highly detailed customer profiles, making identifying fraudulent activities and potential victims easier.

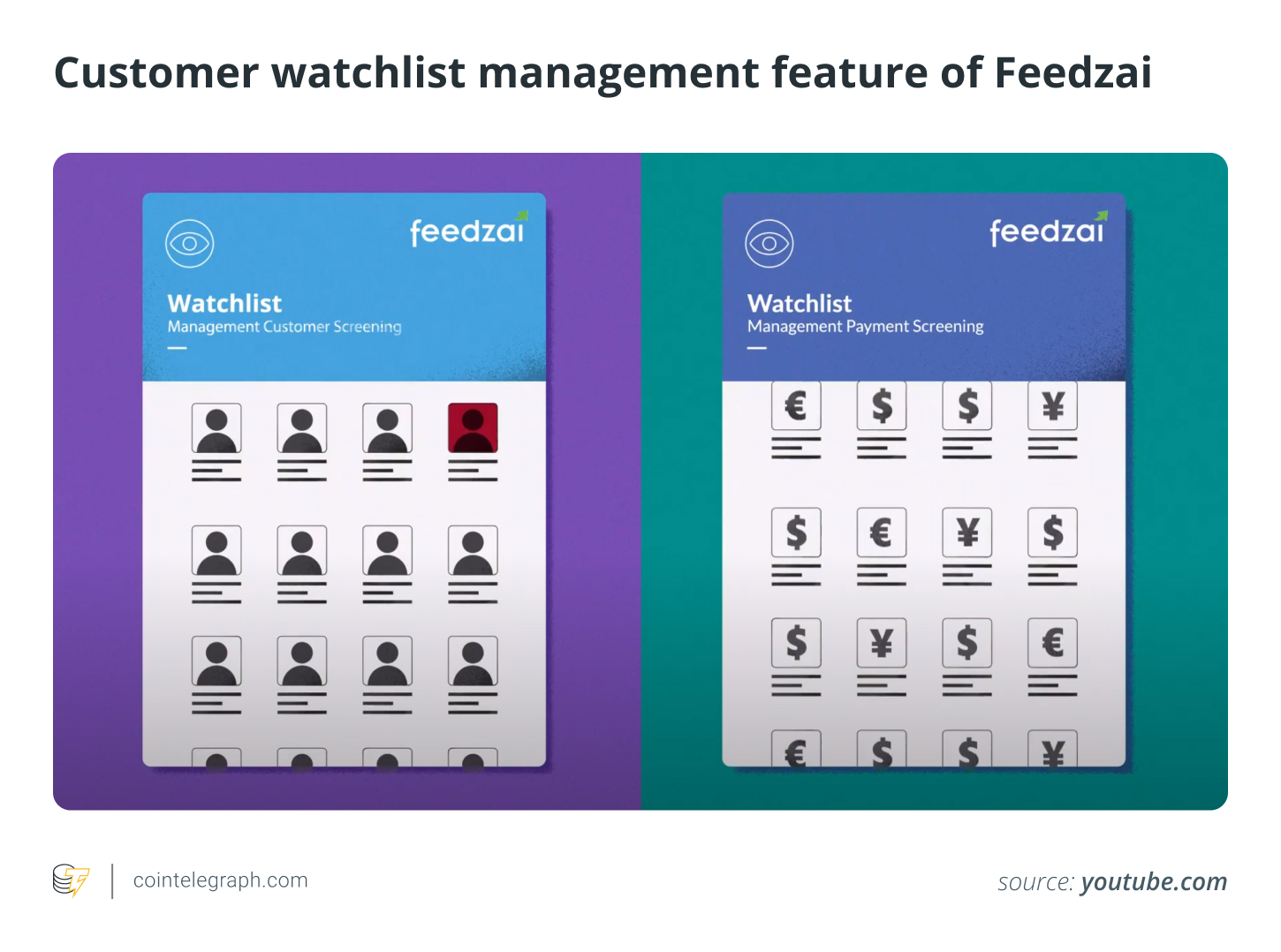

Feedzai minimizes the risk of fraud and money laundering for financial institutions by collecting data from various sources, such as cross-channel, cross-product and third-party data.

This helps to distinguish between authentic and fraudulent transactions, and it provides a comprehensive view of how each individual interacts with the bank. These profiles also make it easier to identify customers more likely to fall victim to scams — even before a scam targets them.

The platform detects fraud quickly and in real time for different payment types, such as cards, instant transfers, digital wallets, withdrawals and deposits. The solution also offers production-ready application programming interfaces (APIs) for various payments to give real-time transaction recommendations, such as whether to approve or decline them.

What is Feedzai used for?

There are several threats and weaknesses that Feedzai helps address:

Addressing the shortcomings of legacy solutions

Financial institutions often use several outdated point solutions that use rules-based approaches to detect fraud but do not specifically focus on scams. Traditional approaches have three main limitations. First, they are restricted to siloed channels, making them vulnerable to fraud schemes that spread across various banking products or payment platforms.

Second, legacy solutions detect fraud by analyzing either behavioral activity (like app and device usage patterns, malware incidence, biometrics and network activity) or financial activity (transactional data across banking platforms). However, their analysis does not consider both types of activity together, reducing the ability to quickly identify an ongoing scam.

Lastly, these fraud protection measures do not adapt quickly enough to counter new tactics used by scammers. Machine learning fills this gap by assimilating new data and providing real-time insights into customer behavior. Feedzai’s platform is designed to quickly detect financial fraud, money laundering and other illicit activities with AI-driven approaches tailored to different payment mechanisms’ nuances.

Combatting the creation of fake accounts to compound rewards

The rise of digital transactions, particularly for small but frequent purchases, has increased rewards for merchants and consumers. However, this growth also presents an opportunity for fraudsters to take advantage of the rewards system.

Fraudsters are taking advantage of the shift toward cashless transactions and increased gamification by creating fake accounts and moving the funds in circles to collect rewards.

Feedzai specializes in analyzing network transactions made by account holders to identify hidden fraudulent payment networks. This means they can detect fraudulent patterns that may not be immediately obvious.

Detecting SIM swaps

SIM swapping is a type of fraud where a perpetrator poses as the owner of a phone number and convinces a call center or branch employee to swap out the associated SIM card. This is done by providing the victim’s personal data to the carrier.

Fraudsters acquire data through hacks and data breaches, or they exploit information that users have publicly shared on social media. They use this information to deceive carriers into permitting them to replace the SIM card linked to a phone number with a SIM card they possess. By doing this, all incoming calls and text messages are re-directed to the fraudster.

Feedzai helps combat this by analyzing transactional data, which can be used to detect a SIM swap. For instance, when multiple transactions are attempted from different devices in quick succession, Feedzai’s algorithms will flag it as suspicious behavior and alert the financial institution of a potential scam.

What are the key features of Feedzai?

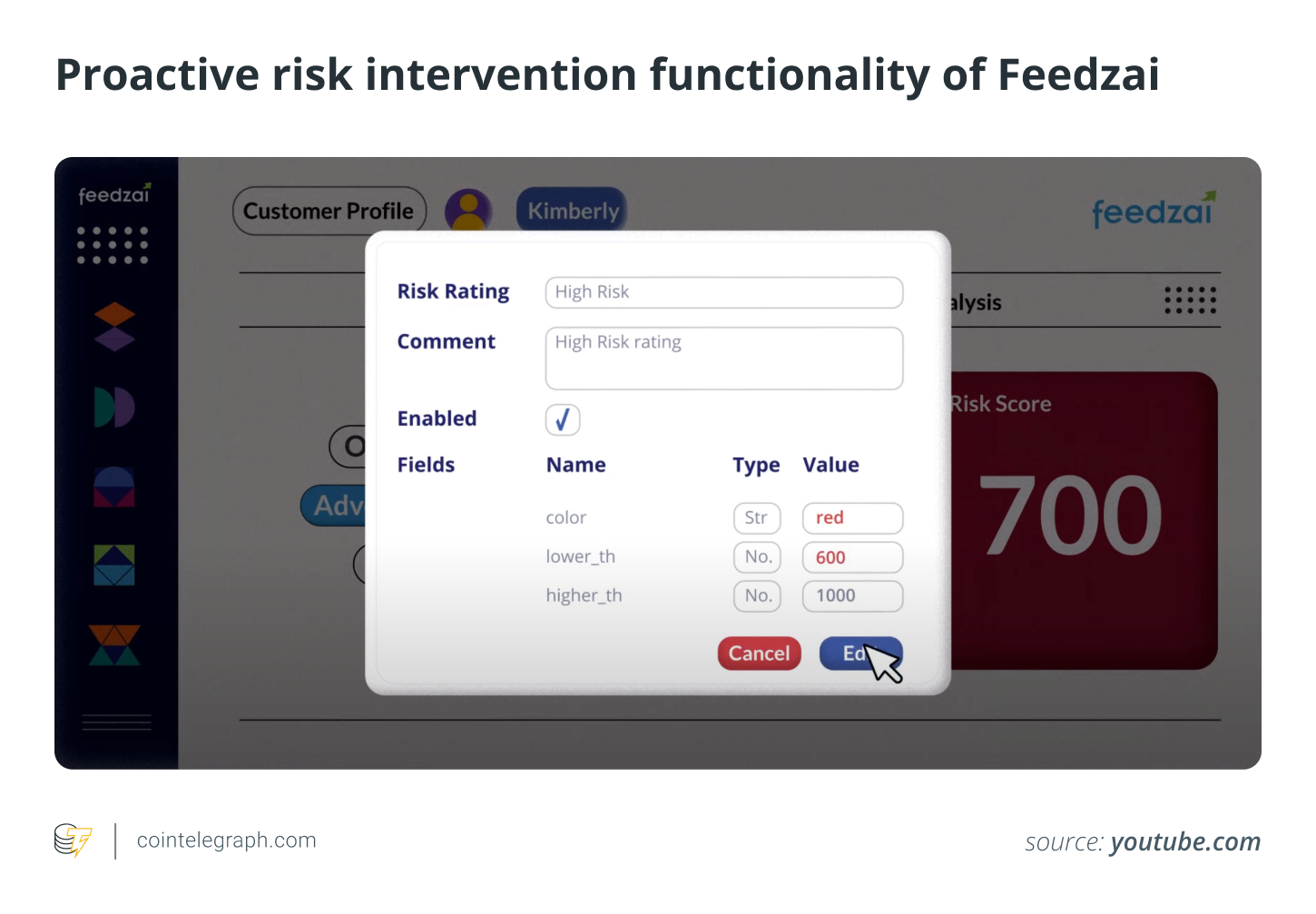

Feedzai has added new ScamProtect features to its RiskOps approach, which aims to help improve the platform’s ability to detect and prevent scams before they harm customers. Among the platform’s key features for fraud prevention are:

Comprehensive RiskOps architecture

Feedzai operates in real time and offers a singular centralized location for data ingestion and interpretation. Its comprehensive architecture provides institutions with a centralized hub to detect emerging fraud threats, identify new business requirements, and analytics on user experience and operational performance. By using Feedzai, banks can anticipate where their focus should be ahead of trends.

Early intervention and education

Feedzai’s early detection capabilities enable banks to identify digital signals such as behavior biometrics and other non-transactional patterns that may indicate a potential scam victim. This can help the banks intervene and educate customers earlier in the risk lifecycle before they make a payment.

To navigate the complexity of scam fraud, alerts can record detailed explanations and specific indicators. This information can then guide agents to have more effective conversations with customers.

Human-centered AI

Technology sometimes leads to added roadblocks for customers as they are viewed as data points. This can result in unfair classification into groups and unnecessary difficulties for bank customers (canceled transactions, incessant calls to verify purchases they make, etc.).

Feedzai uses multidimensional data that prioritizes customers through AI to address this issue. By creating hyper-accurate risk profiles based on individual behaviors, banks can identify changes and prevent financial crime with greater ease — while keeping customers satisfied.

Inbound payment monitoring

To successfully scam someone, a scammer needs to send the money to an account they control. However, with Feedzai, banks can now monitor both incoming and outgoing payments, giving them more chances to prevent a scam from taking place.

Triage behavior alerts

The platform’s constant surveillance of each customer builds intelligence to identify fraudulent behavior quickly. Feedzai Case Manager then allows key persons to instantly take action on alerts, automate processes and organize team workloads.

The platform can direct specific alerts to agent groups based on their training through role and queue management. Additionally, the platform includes dashboards and reporting that categorize fraud types, allowing for easier tracking of detection and alert management.

Customization

Feedzai can customize and categorize rules to incorporate particular clauses related to scams, which can be modified in response to changes in fraudulent schemes. Additionally, the platform can adopt a regional approach by using parameters such as bank codes, states or product types, allowing institutions to develop tailored strategies when necessary.

The future of AI-powered risk operations

Risk operations enabled by AI are expected to experience transformational growth in the future. Risk assessment, detection and mitigation across sectors will be revolutionized by cutting-edge machine learning algorithms and predictive analytics.

Rapid analysis of large data sets by AI will reveal complex patterns and anomalies, enabling proactive risk management. Response agility will be improved, reducing vulnerabilities, using real-time monitoring and adaptive algorithms. Sentiment analysis and natural language processing will improve knowledge of risk, including social and reputational factors.

Furthermore, collaborative AI-human workflows will optimize decision-making, and AI’s self-learning skills will enable it to continuously adapt to evolving risks. Ultimately, AI-powered risk operations will usher in an era of precision, efficiency and resilience, mitigating threats and fostering safer, more secure environments.