The Terraform Labs and UST crisis triggered a market crash, costing investors billions. Now, nearly two years on, what’s the current state of this cryptocurrency turmoil?

Do Kwon, the founder of Terraform Labs and the developer of TerraUSD (UST) and Luna tokens, continues to be a controversial and mysterious figure in the cryptocurrency world. In mid-March 2022, the value of UST and Luna plummeted to almost zero, quickly wiping out approximately $60 billion from investors’ holdings.

Since then, there have been major developments. Kwon is awaiting extradition, and attempts are being made to revive the formerly successful project. The ongoing situation with Terraform Labs and Do Kwon is still evolving.

How Terra ecosystem collapsed

In May 2022, concurrent with the investigation news, the price of UST fell to $0.98, losing its peg to the dollar. Do Kwon reassured investors, stating the situation was under control. Yet, the following day saw a further decline in the token’s value, dropping to $0.35.

Kwon then turned to Twitter, encouraging his followers to invest more in an effort to sustain the dollar peg. This strategy, however, proved unsuccessful.

Investors began actively dumping UST and Luna, causing Luna’s value to drop catastrophically to $0.10 – a decline of 96%. Do Kwon did not comment on this situation, and social media users became convinced that the Terra ecosystem was a regular pyramid scheme launched to steal investors’ money.

Terraform’s revival

In mid-May 2022, Kwon ended his silence and revealed plans for a new Terra blockchain, excluding UST. This proposal gained support from 65% of investors.

Terra 2.0 debuted on May 28, 2022. However, shortly after its launch, the value quickly dropped – Luna lost 77% of its value, followed by an additional 20% decrease on June 8. Amid these developments, Kwon restricted his Twitter account, limiting access to select followers.

Investigation of Terraform Labs by U.S. authorities

In June 2022, the U.S. Securities and Exchange Commission (SEC) initiated an investigation into Terraform Labs and its algorithmic stablecoin. The SEC’s inquiry focused on whether the marketing of UST breached federal investor protection laws before the stablecoin crash. Specifically, SEC prosecutors examined Terraform Labs’ activities for potential infringements of securities and investment product laws.

By February 2023, the SEC charged Terraform Labs and co-founder Do Kwon with conducting a “multi-billion-dollar securities fraud.” In December 2023, a court sided with the regulator, ruling that UST, LUNA, wLUNA, and MIR assets constituted investment contracts.

South Korea’s investigation into Terra

In late May 2022, the South Korean prosecutor’s office launched an investigation into the creators of the recently failed Terra cryptocurrency project. The focus was on determining if any intentional price manipulations or other illegal actions were involved in the collapse.

As part of the inquiry, former employees of Terraform Labs, who were involved in the early development of the Terra ecosystem in 2019, were summoned for questioning.

In September 2022, a South Korean court issued an arrest warrant for Do Kwon, along with five others, on charges of violating the country’s capital markets laws. At the time of the warrant, all were reportedly in Singapore.

At the same time, representatives of Terraform Labs believe that the Korean prosecutor’s office exceeded its authority in pursuing Terra founder Do Kwon.

Last June, journalists reported that Kwon could face legal repercussions in multiple jurisdictions, starting with South Korea. Dan Sung-han, the lead investigator in Kwon’s case, anticipates that Kwon could face a significant sentence, potentially over 40 years, in the financial fraud case.

According to Sung-han, prosecutors have already seized 246.8 billion won (approximately $190 million) related to Kwon’s case and intend to freeze an additional 31.6 billion won (about $24.25 million).

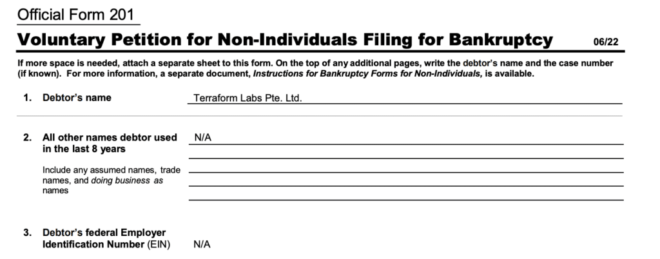

Terraform Labs bankruptcy

On Jan. 21, Terraform Labs filed for bankruptcy. According to court documents, the firm’s assets and liabilities are estimated to be between $100 million and $500 million, with the number of creditors varying between 100 and 199.

Terraform Labs has stated its commitment to fulfilling all financial obligations to employees and suppliers throughout the Chapter 11 process without the need for extra funding. Additionally, the company aims to keep developing its web3 offerings.

Do Kwon’s escape and extradition

Do Kwon was living in Singapore until mid-September 2022. At that time, South Korea issued an arrest warrant for him for alleged violations of capital markets law, and Interpol released a red notice, leading Kwon to flee.

For several months, Do Kwon allegedly hid in Serbia, but his exact whereabouts were unknown. In March 2023, authorities in Montenegro arrested him for trying to fly to Dubai with a fake passport, leading to a four-month prison sentence.

For almost a year after his arrest, there was ongoing debate about whether to extradite Kwon to the United States or South Korea. Montenegro’s government revisited the decision to deport the founder of Terraform Labs multiple times.

On March 5, the plan to hand over the entrepreneur to U.S. authorities was reversed. Montenegro’s Court of Appeal overturned the lower court’s decision, citing “serious violations of the provisions of criminal proceedings.”

Consequently, Montenegro’s Supreme Court resolved to extradite Do Kwon to South Korea. This ruling allows for a streamlined process to transfer the accused to South Korean officials for further legal action.

Summing up

Nearly two years have elapsed since the downfall of a once-prominent cryptocurrency project. While this chapter might seem to be closing, the unfolding events suggest otherwise.

The bankruptcy of Terraform Labs and the extradition of its founder, Do Kwon, mark the beginning of a new phase in one of the largest cryptocurrency collapses. The fate of investors who lost billions in the project remains uncertain, as does the specific nature of the penalties that Kwon may face.

With two years of investigation behind them, South Korean authorities are expected to take a firm stance against Kwon for his alleged deception, evasion, and failure to cooperate.