BSC saw more projects emerge than any other blockchain.

Data Source: Footprint Analytics –March 2022 Report Dashboard

GameFi projects showed strong resistance to the negative macro environment in February and March, with many areas of development not only growing steadily but breaking out against market trends.

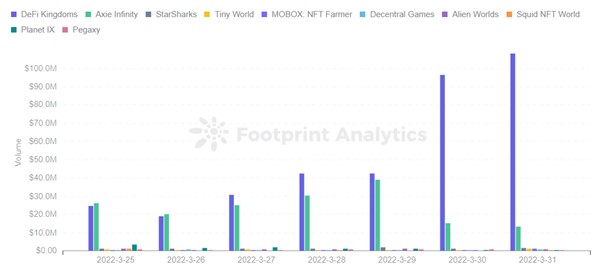

Footprint Analytics data shows that the number of GameFi game projects went up to 1,406, up 5% MoM. Trading volume at the end of the month was $129 million, up 154% MoM. Active users increased 56% from February. It is worth noting that the two game projects, Par War Online and DeFi Kingdoms , have increased by more than 25,000% in active users in the past 30 days.

The following will analyze the overall situation for GameFi in March using data.

GameFi Market Overview

GameFi Project Count Up 5% MoM, BSC Project Count Up 1303% YoY

Looking at the overall development of GameFi, many blockchains and gaming projects have emerged in the past year. According to Footprint Analytics, as of March 31, there were 35 blockchains participating in the GameFi sector, with 1,406 game projects in total, up 5% MoM.

Footprint Analytics – Number of GameFi Protocols by Chains

Although most of the early projects were concentrated on Ethereum, due to the impact of network congestion and high gas fees, the poor user experience slowed down the pace of development. Instead, on-chain gaming projects such as BSC, Polygon, WAX and EOS are gradually increasing.

Notably, BSC has the fastest growing project count, up 1303% YoY. It has low gas fees and a throughput 5 times higher than Ethereum, with 449 gaming projects deployed on BSC by the end of March.

At the same time, some chain’s have faced the problem of having one project driving the entire ecosystem.

For example, Splinterlands has single-handedly driven the development of Hive, which has been a Top 5 GameFi project by number of users for the past three months. There is also DeFi Kingdoms on Harmony, which surpassed Axie Infinity multiple times in March in daily trading volume the become the largest project according to this metric.

Footprint Analytics – Top 10 Games Ranking by Volume

GameFi’s Trading Volume Picks Up, Active Users Up 56% MoM

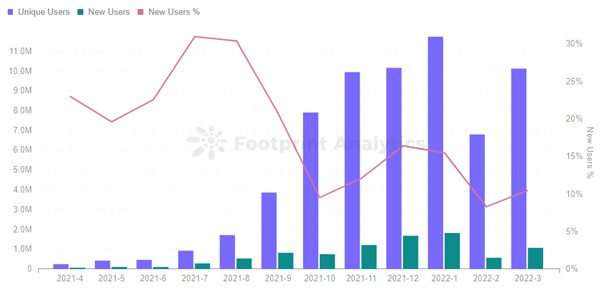

The number of users is the key to the healthy operation of the entire GameFi ecosystem. If there are no users, the game project will become worthless. As of March 31, the total number of active users was 10.96 million, including 1.27 million new users. Compared to February, the number of active users increased by 56%.

Footprint Analytics – Monthly Gamers Trend

Footprint Analytics – GameFi New Users by Chain

Par War Online and DeFi Kingdoms are the games that are driving GameFi’s rapid growth in active users. In the last 30 days, active user growth has been 28,931% and 25,319%, respectively. These two games are attracting users primarily because of their high revenue generation opportunities, such as the 300% to 400% APY LP for DeFi Kingdoms.

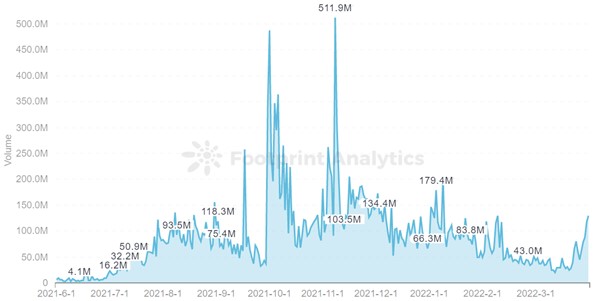

According to Footprint Analytics data, GameFi’s trading volume has been on a downward trend due to the Russian-Ukrainian conflict. It was only after March 21 that volume picked up quickly, ending the month at $129 million, up 154 percent from February. It gradually recovered from a per capita volume of about $30 to $105 per capita.

Footprint Analytics – GameFi of Volume Trend

Footprint Analytics – GameFi Volume and Transactions per User

As can be seen, although the GameFi market showed a downward trend in transaction volume due to the macroeconomic impact, it quickly rebounded after late March with more new users engaging in the GameFi sector. This means that sensible tokenomics and products can create games that engage users.

GameFi Monthly Investment Volume Increased 307% MoM

The data shows that GameFi investments in March were $458 million, an increase of 307% compared to February. In terms of investment sector, NFT and Web3 in the GameFi category saw the largest increases.

As the number of GameFi protocols increases, the influx of blockchains such as BSC has broken the slow pace of Ethereum in the GameFi sector, contributing to the continued inflow of funding.

Footprint Analytics – Gaming Financing distribution

The financing received by GameFi projects mainly comes from seed rounds, the main reason behind this phenomenon is that the GameFi industry is in the early stage, and the development cycle of quality game projects is long, which is also the trend cycle for investors to observe the industry.

Footprint Analytics – Monthly Number of GameFi Projects Funded

Game Projects That Accelerate GameFi’s out of the Circle in March

Footprint Analytics believes that GameFi is one of the most effective means of attracting new users into crypto. Opportunities with stronger gameplay and higher yields will become the main focus in GameFi in the future.

Footprint Analytics – Ranking of Daily Gamers (March 31)

Hot Game Projects

Having a multi-game ecosystem and interoperability between games is more attractive for user participation.

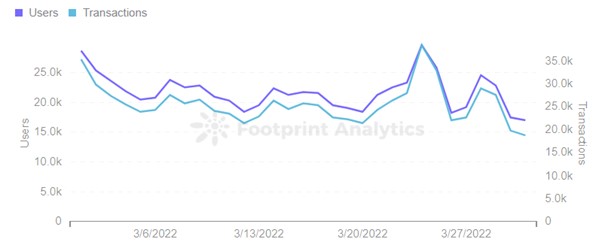

From the number of users and the number of transactions, it can be seen that in March, there were many GameFi projects in which users participated in transactions. But the more popular ones were DeFi Kingdoms, StarSharks and Thetan Arena . The number of users and transactions of the three game projects are on the rise.

Footprint Analytics – DeFi Kingdoms Users & Transactions

Thetan Arena has rapidly gained new users with its strong gameplay, mobile support, short game time (3 to 5 minutes per round), and low entry cost.

Starsharks is the BSC project with the largest user growth. It leverages the innovative Rent to Play model, where players can buy or rent NFTs through the platform’s native leasing feature to facilitate full utilization and liquidity of NFT assets.

Footprint Analytics – StarSharks Users & Transactions

Starsharks’ retention rate in March was 13%, and the overall user retention rate is declining. By comparison. Cryptokitties (a popular Ethereum chain game) had a retention rate of 1.2% in March.

This shows that innovation and project liquidity are important to retain users.

Footprint Analytics – Starsharks Monthly Retention Analysis

Footprint Analytics – Cryptokitties Monthly Retention Analysis

Game Items with a Crash in the Number of Users

According to Footprint Analytics data, MetaverseMiner’s user numbers and transactions are crashing. Once players earn less revenue (in terms of a stable token or fiat), highly experimental games like this often face the loss of traffic.

Footprint Analytics – MetaverseMiner Users & Transactions

March also saw one of the largest security breaches in GameFi history. On March 23, cybercriminals stole $622 million from Axie Infinity users in cryptocurrency. As a result, the number of users decreased.

Footprint Analytics – Axie Infinity Users & Transactions

Summary

Despite the tense situation in Europe and a negative market trend, the GameFi industry continued to expand in number of projects, transaction volume, users, and investments.

On the other hand, the industry suffered several setbacks, especially in terms of security. The news about Axie Infinity, considered extremely secure, shook confidence and highlighted the need for increased diligence and research when investing.

March Events Review

NFT & GameFi

- Axie Infinity Tokens AXS, SLP Reeling After $622M Ronin Hack

- Average weekly trading for NFTs fell 54% MoM

- Card game Cross the Ages completes $12 million seed round

- Fidenza #692 NFT Sold for 320 ETH, Worth Nearly $1M

- Estee Lauder to Distribute NFTs During Decentraland Metaverse Fashion Week

Metaverse & Web3

- Meta launches Metaverse Engineering Center in Canada, will recruit up to 2,500 staff

- Web3 portal project Mask Network announces a partnership with decentralized privacy protocol Mystiko

- Web3 Platform Op3n and Avalanche Foundation launch a $100 million creator fund

- Polygon Studios and Metaverse AI Enter into Strategic Partnership

- Web 3 Game Development Platform Joyride Raises $14M Ahead of Launch

DeFi & Tokens

- $100M Wave Financial Fund Offers Liquidity to New Cardano DeFi Platforms

- iZUMi Finance Lists Arbitrum, TVL on Arbitrum Chain Exceeds $16 Million Within 24 Hours

- Cashio attackers will refund users who lost less than $100,000

- New York Fed Brandon Neal appointed COO of DeFi protocol Euler Finance

- IoTeX Launches $100M Sustainable Ecosystem Fund

Network & Infrastructure

- Astar Network Total Value Locked (TVL) crosses $1 billion

- Terra’s market cap hits all-time high

- USDC issuance on the Avalanche chain exceeds $900 million

- The total amount of NFT transactions on the Avalanche chain exceeded $200 million, a record high

- Terra founder talks about “$10 billion Bitcoin reserve” plan again

Institutions

- Italian banking giant UniCredit fined $144 million for illegally closing accounts of crypto miners

- Crypto.com to run ads during Oscars in support of Ukraine

- Sequoia China plans to raise more than $8 billion through four new funds

- Fidelity Launches Two New Bitcoin ETPs on Swiss SIX Exchange

- Bank of America gives crypto bank Silvergate Capital a buy rating and $200 price target

Worldwide

- Indian MP proposes raising crypto tax higher than 30%

- The city of Rio de Janeiro plans to accept Bitcoin payments for real estate taxes starting in 2023

- Russia’s Central Bank Steps Up Monitoring of P2P Transactions Including Cryptocurrencies

- US Lawmaker Says Bitcoin Is Aligned With American Values, Will Strengthen the Dollar

- New U.S. bill bans crypto firms from doing business with sanctioned companies

This article was made based on data from Footprint Analytics.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.