Why are companies embracing Bitcoin as part of their corporate treasury strategy?

In recent years, an increasing number of companies has embraced Bitcoin as part of their corporate treasury strategy. This trend, initially seen as experimental, gained momentum when Strategy, a US-based software company, started converting its cash reserves into Bitcoin (BTC) back in 2020.

Strategy’s move sparked widespread interest among other businesses seeking a hedge against fiat currency debasement and the potential for Bitcoin’s price appreciation.

By mid-2025, over 220 public companies worldwide had adopted similar strategies, collectively holding about 592,100 BTC (roughly $60.03 billion in value as of June 23, 2025). This has led to the creation of what some call “Bitcoin proxies,” stocks whose values largely mirror Bitcoin’s price fluctuations. The attraction is clear: When Bitcoin’s price rises, these companies’ stock prices soar, giving investors an indirect route to gain exposure to Bitcoin.

For these companies, holding Bitcoin brings numerous benefits. During bullish crypto market cycles, the value of their Bitcoin reserves can rapidly appreciate, boosting their balance sheets and attracting investors looking for crypto exposure without buying the digital asset directly.

Some executives even tout Bitcoin as “digital gold,” presenting it as a long-term store of value that can protect against inflation. Strategy’s chairman, Michael Saylor, has argued that Bitcoin could outperform cash as a store of value over time. This strategy has paid off for some companies; Strategy’s stock price, for instance, has risen nearly tenfold since it began its Bitcoin acquisition in 2020.

However, despite the potential rewards, the risks are significant. Bitcoin is highly volatile, with its price subject to sharp fluctuations within short periods. Unlike traditional corporate assets, Bitcoin is not liquid or stable, which raises concerns about financial stability for companies that go beyond small allocations and make Bitcoin a central part of their business strategy.

VanEck warns of capital erosion risks for Bitcoin-heavy corporate treasuries

In June 2025, VanEck, a global asset manager renowned for its crypto investment products, raised a red flag regarding the increasing accumulation of Bitcoin by corporate treasuries.

Matthew Sigel, VanEck’s head of digital assets research, warned that some companies might be on the brink of “capital erosion.” In simple terms, capital erosion occurs when a company’s value (or shareholders’ equity) diminishes despite the company’s holdings in Bitcoin.

Sigel’s concern stems from how companies finance their Bitcoin purchases. Many Bitcoin-heavy firms issue new stock or take on debt to raise capital for Bitcoin acquisition.

If a company’s stock price is high enough (trading at a premium to its net asset value, or NAV), issuing new shares can benefit existing shareholders by raising more money than the underlying assets are worth. This was the strategy adopted by Strategy’s Michael Saylor, who issued stock and bonds to fund Bitcoin purchases when his company’s share price was high.

However, this model is sustainable only as long as the company’s stock price stays elevated. If the stock price starts to trade at or near its NAV, new share issuances will dilute existing shareholders without adding value.

This shift, from accretive to dilutive capital raising, could lead to “capital erosion,” where the company’s stock price falls as the value of its Bitcoin holdings is not enough to support new investments without harming existing shareholders.

Did you know? Net asset value (NAV) is a key measure used to assess a company’s value. It represents the difference between a company’s assets and liabilities. Essentially, it’s the “book value” of a company, showing what would be left for shareholders if all assets were sold and debts paid off.

How Semler Scientific’s Bitcoin-heavy strategy led to capital erosion

Semler Scientific’s Bitcoin-heavy strategy led to capital erosion, as its stock price plummeted despite Bitcoin’s rise, highlighting the risks of over-reliance on Bitcoin for corporate treasuries.

Semler Scientific, a US medical technology firm, saw its stock initially surge when the company adopted a Bitcoin-first treasury strategy, acquiring thousands of BTC.

However, by mid-2025, the company faced a significant issue: Despite Bitcoin’s price climbing, Semler’s stock price plummeted over 45%. At that point, Semler’s market capitalization was lower than the value of its Bitcoin holdings. Market capitalization means the total value of a company’s outstanding shares.

If Semler’s market capitalization is lower than the value of its Bitcoin holdings, it means that the market is undervaluing the company compared to its assets, which is a serious concern for investors.

This situation underscores the risks of over-reliance on a volatile asset like Bitcoin. While Bitcoin’s price can drive up the value of Bitcoin-heavy corporate treasuries in a bullish market, it also introduces volatility risk, sharp price fluctuations that can hurt the company’s overall stability and stock price.

If Semler’s stock continues to trade at a discount to its Bitcoin reserves (meaning the market price of the stock is lower than the value of its Bitcoin holdings), it could struggle to raise capital through equity issuances (issuing new shares to raise money). Typically, when companies issue new shares, they sell them at the current market price, which might dilute existing shareholders’ value if the stock price is low.

This scenario illustrates capital erosion, a term VanEck warned about, which occurs when a company’s financial strategy leads to a reduction in its value. For example, if Semler’s stock price remains low, it will become more difficult for the company to raise funds by issuing new shares or debt, especially if investors are uncertain about the company’s long-term stability. Essentially, the company risks losing investor confidence, which can have a lasting negative impact on its ability to grow or execute its business strategy.

The hidden risks companies overlook in Bitcoin treasury strategies

As Bitcoin becomes a popular treasury asset, many companies focus on its upside while ignoring scientific and behavioral warnings.

Behavioral finance research shows that executives often exhibit overconfidence and herd behavior, adopting Bitcoin without stress-testing long-term volatility. Studies also highlight loss aversion, where firms hesitate to sell underperforming assets, risking deeper losses instead of making rational exits.

Scientific models also reveal that Bitcoin’s price follows a “fat tail” distribution. This means extreme crashes are not rare outliers — they’re statistically likely. This means that a corporate balance sheet heavy with Bitcoin is exposed not only to the asset’s own turbulence but also to systemic turbulence across the blockchain sector.

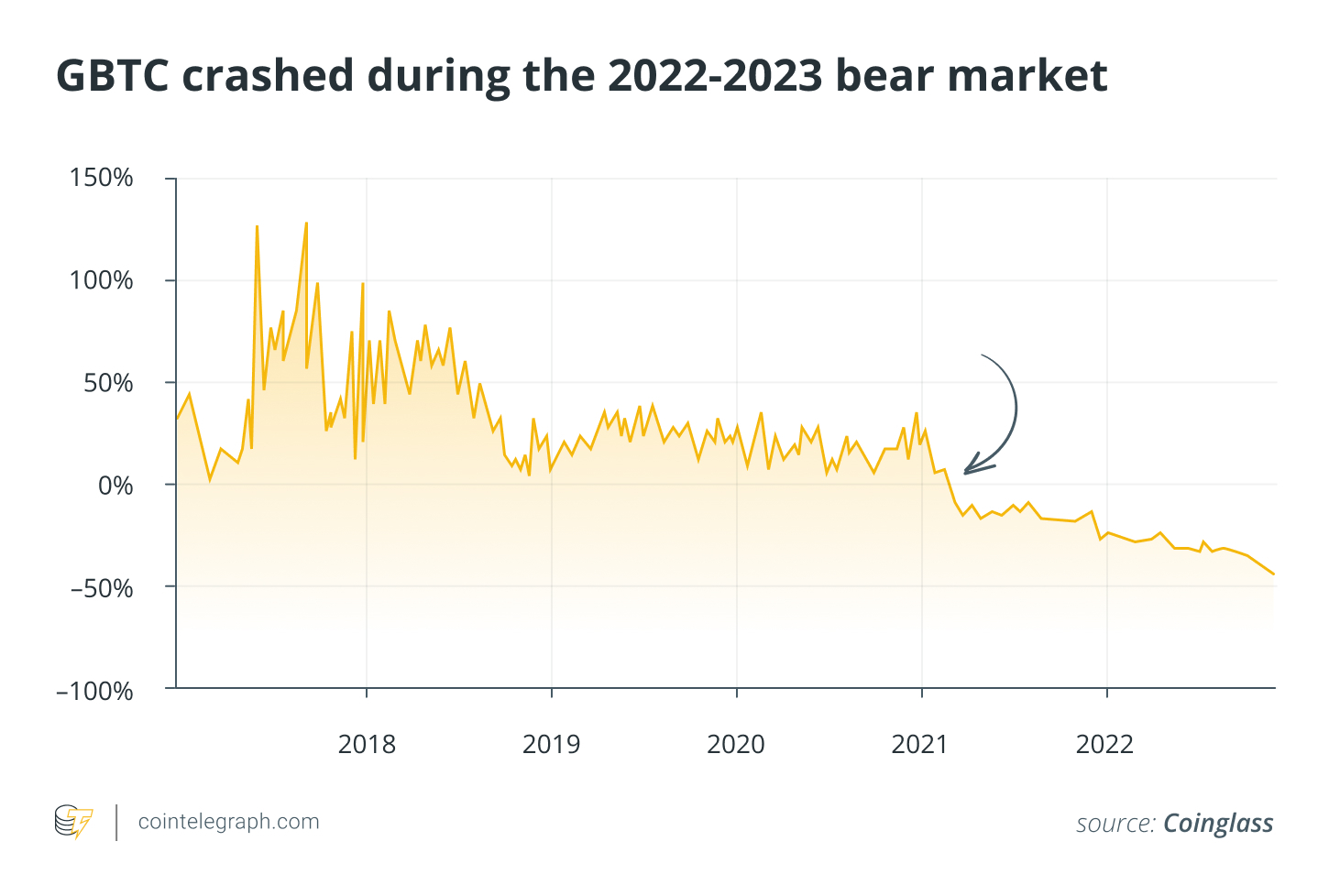

A case in point is Grayscale Bitcoin Trust (GBTC). For years, it traded at a premium to NAV, only to crash to a steep discount during the 2022-2023 bear market. Investors who entered at the peak saw massive losses even though Bitcoin’s price hadn’t dropped proportionally. The trust’s lack of a redemption mechanism trapped investors, a warning for treasury-heavy firms reliant on secondary market sentiment.

But why did the GBTC premium disappear?

The GBTC premium vanished as new, lower-fee Bitcoin investment products like ETFs from ProShares and Valkyrie entered the market, drawing investor interest away. At the same time, reduced demand and tighter arbitrage opportunities made GBTC less attractive, especially given its six-month lockup period and declining institutional participation.

A corporate treasury holding large BTC reserves without redemption mechanisms could suffer the same fate — i.e., being forced to sell at depressed prices to meet debt or equity obligations.

What’s often overlooked is blockchain’s systemic risk. Smart contract liquidations, token interdependencies and centralized exchange failures can trigger sharp price spirals. These risks are rarely factored into traditional treasury planning.

To navigate this landscape, companies need to go beyond hype and build rigorous risk models, stress-testing Bitcoin holdings under worst-case scenarios. Without these safeguards, firms risk capital erosion, investor dilution and strategic failure. The next wave of adopters would benefit from stress-testing their treasuries against extreme but plausible scenarios grounded in empirical data.

Did you know? Three Arrows Capital and BlockFi suffered massive losses in 2022 after GBTC flipped from a premium to a steep discount, dropping over 40% below its net asset value. Without a redemption option, these firms were trapped in a losing position despite Bitcoin’s actual market value being higher. This miscalculation contributed to their eventual collapse.

Lessons for Bitcoin treasury management from the 2008 financial crisis

The warnings about capital erosion for Bitcoin treasury companies are strikingly similar to the situation leading up to the 2008 global financial crisis.

During the crisis, many financial institutions relied on high leverage to fuel rapid growth. For example, Lehman Brothers and Bear Stearns used excessive leverage to take on risky subprime mortgages and financial products. When asset prices began to fall, these companies found themselves unable to meet their obligations, leading to mass insolvencies.

Lehman Brothers, in particular, filed for bankruptcy in September 2008, while Bear Stearns was forced to sell itself to JPMorgan Chase after a liquidity crisis. The leverage model worked only as long as asset prices kept rising. When they didn’t, the system collapsed.

Similarly, Bitcoin treasury firms that rely on issuing more stock or borrowing money to acquire Bitcoin are exposed to the same risks. If Bitcoin’s price falls sharply, these companies might find themselves overextended, unable to raise funds or cover liabilities, just as banks were during the 2008 crisis. Companies like AIG also relied on risky financial products, such as credit default swaps, and faced massive losses when the market crashed, ultimately requiring a government bailout.

The cautionary lesson here is not just about leverage but also the risks associated with excessive optimism. When investors become overly confident in an asset’s growth potential, they may overlook the risks of sudden market shifts. This kind of optimism can lead to significant financial instability if the market moves against expectations.

Therefore, it’s essential to consider the following:

- Prepare for volatility: Bitcoin’s value can fluctuate wildly. Be prepared for sharp declines, especially during market corrections or global financial shifts.

- Understand the risks: While Bitcoin has great potential, it is still a highly volatile asset. Don’t overexpose your portfolio to a single investment.

- Diversification is crucial: Avoid putting all your resources into Bitcoin. Diversify your investment portfolio to spread risk across various assets.

- Don’t rely on short-term gains: If you’re investing in Bitcoin for long-term growth, don’t panic over short-term price fluctuations; however, be aware that sudden drops can lead to significant losses.

- Risk management: Have a risk management strategy in place, including setting stop-loss orders or defining clear entry and exit points for your investments.

Did you know? A credit default swap (CDS) is a financial contract that provides insurance against the default of a borrower. It became widely known during the 2008 crisis when institutions like AIG faced massive losses due to their exposure to risky mortgage-backed securities.

Strategies to prevent capital erosion in Bitcoin treasury companies

VanEck’s Sigel emphasizes the need for Bitcoin treasury companies to act preemptively to avoid capital erosion.

Some of his key recommendations include:

- Pause stock issuance: If the company’s stock price falls below 95% of its NAV for 10 consecutive days, it should stop issuing new shares. This would prevent further dilution of shareholder value when the market is not pricing the company optimistically.

- Consider share buybacks: If the stock price underperforms relative to Bitcoin’s value, companies might consider buying back shares to reduce the NAV discount and concentrate the ownership among fewer shareholders.

- Reevaluate the strategy: If a company’s stock consistently trades below NAV, it may need to rethink its Bitcoin strategy. Options include mergers, spinoffs or even abandoning the Bitcoin-focused model to unlock shareholder value.

- Align executive incentives: Companies should ensure that executive compensation is tied to the per-share value of the stock rather than the total amount of Bitcoin holdings. This discourages excessive accumulation of Bitcoin for the sake of size and encourages executives to focus on sustainable value creation.

Thus, Bitcoin may offer corporate treasuries innovation, upside and headlines, but without disciplined strategy, it can also lead to irreversible capital damage. VanEck’s warnings are not speculative; they are rooted in hard-earned lessons from both traditional finance and crypto history.

In the end, it’s not who holds the most Bitcoin — it’s who survives the next downturn with their fundamentals intact.