Bitcoin remains stuck at its current levels. The number one cryptocurrency has been unable to push upwards and could be in danger of revisiting its yearly lows.

Related Reading | Outflows Rock Bitcoin As Institutional Investors Pull The Plug, More Downside Coming?

At the time of writing, Bitcoin trades at $20,700 with sideways movement in the last 24 hours and the past week.

According to crypto analyst Justin Bennett, Bitcoin is hinting at further losses. The cryptocurrency stayed rangebound even as the traditional market rallied.

Bitcoin has displayed a high correlation with traditional equities. In particular, the price of Bitcoin seems to be moving in tandem with the Nasdaq 100 and the S&P 500 Index.

However, this dynamic has been changing in short timeframes making BTC a lagger as equities trend upwards. Bennett believes this is an indicator of a fakeout, a false upwards movement before a re-test of previous support.

At the moment, the analyst claims, there is nothing more important for BTC’s price than equities. Via Twitter, Bennett wrote the following and shared the chart below:

Everything for #crypto boils down to this…Does the S&P 500 fail to hold above 3,880? If so, and we get a 1h close below, this latest rally becomes a fakeout, and we likely get the next leg lower for stocks and crypto alike. Everything else is just noise. You could literally trade BTC using nothing but the S&P chart above. As of now, it looks like this level will fail.

As seen in the chart above, the S&P 500 broke below a major trendline and seems to be heading towards critical support at 3,800. Bitcoin seems to be holding its levels despite the S&P 500 price action, but Bennett ruled out the possibility of a “fakeout” due to the overall weakness in the market.

I’ve seen a few comments stating that this could be a fakeout.

The fakeout to the upside already occurred. The last 1h close confirmed it.

No guarantees, but fakeouts of fakeouts are rare. pic.twitter.com/GQjKCwzRm9

— Justin Bennett (@JustinBennettFX) June 28, 2022

Bitcoin Levels To Watch In Case Of Further Losses

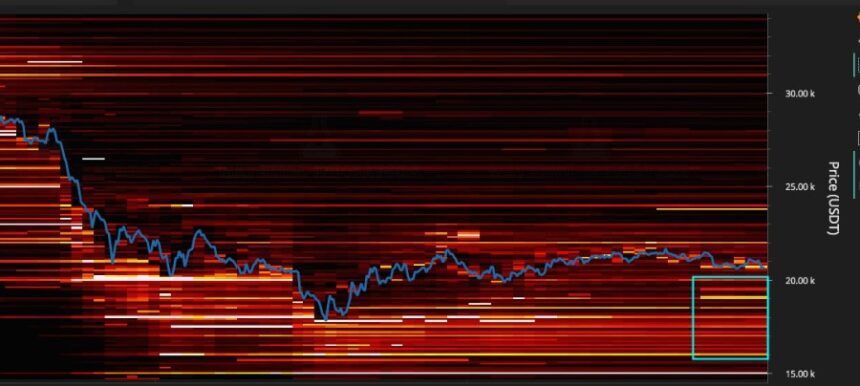

Data from Material Indicators shows liquidity on crypto exchange Binance has been constantly moving around current levels. There are over $30 million in bids orders below BTC’s price which could provide important support.

However, as seen below, asks orders to have been swelling which could prevent BTC’s price to break above $21,000 and get out of the danger zone. Analysts from Material Indicators identified the levels between $17,000 and $19,000 as the next potential area for Bitcoin.

Related Reading | Glassnode Deems 2022 Bear Market As The Most Atrocious For BTC And All Cryptocurrencies

At those levels, there are important pools of liquidity, and the price of Bitcoin tends to trend towards these levels. The analyst added:

This looks like a ladder of #BTC bids that intends to get filled. Time will tell if it gets filled where it rests or if it needs to adjust closer to the active trading range.