Solana’s native token (SOL) surged by 17% between Dec. 7 and Dec. 8, reaching its highest level since May 2022.

SOL’s fate changed dramatically on Dec. 1 when Brian Armstrong, CEO of Coinbase, revealed a plan to integrate the Solana network, including its tokens, although no specific date has been provided. This news sparked interest in Bonk (BONK), a Solana SPL meme token listed on Bybit, KuCoin, and Solana’s decentralized exchange, Orca, which gained 236% between Dec. 1 and Dec. 8.

On Dec. 6, Coinbase exchange announced the listing of Jito (JTO), an SPL token on the Solana network, which saw instant success as JTO doubled in price between Dec. 7 and Dec. 8. With the current circulating supply of 115 million, Jito’s market capitalization now stands at $422 million.

The governance token of the Solana-based liquid staking protocol Jito conducted an airdrop of 80 million tokens to early users, validators, and protocol contributors. In total, approximately 9,900 addresses staked SOL using Jito ahead of the snapshot date, resulting in an impressive distribution of 4,941 JTO tokens for each participant.

The decentralized finance (DeFi) application Jito allows users to benefit from SOL staking and receive a derivative JitoSOL token in exchange for additional flexibility and yields, a common practice in the Ethereum ecosystem through the Lido platform. According to Coingecko’s order book depth, Binance leads the JTO market with bids totaling $606,000.

To put things in perspective, using the same methodology, Uniswap (UNI), a $4.83 billion decentralized exchange governance token, has a similar liquidity of $598,000 at Binance. Investors quickly realized that more potential airdrops in the Solana ecosystem could yield similar gains, increasing the demand for SOL tokens.

Among the examples with a points system as cited by analysts and Solana experts, including Patrick Scott, are MarginFi (a lending platform), Tensor (an NFT exchange), Jupiter (an aggregator), Kamino (a lending platform), and Parcel (a real estate speculation platform).

Potential Solana ecosystem airdrops that you can still qualify for:

MarginFi – Borrowing/lending (active points system)

Tensor – NFT exchange (active points system)

Drift – perp dex

Kamino – Borrowing/lending (upcoming points system)

Parcl – Real estate speculation (upcoming…— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) December 8, 2023

For those interested, the Twitter thread posted by @Dynamo_Patrick, analyst and co-founder at CoinBeats, offers a step-by-step guide for each of the potential Solana airdrops.

Interestingly, SOL’s rally above $72 occurred shortly after Solana announced that its Saga smartphone had sold only 2,500 units, which is less than 10% of their minimum user base target.

Anatoly Yakovenko, Solana’s co-founder, hinted that the project is currently under review due to the evolution of progressive web apps that bypass the fees of Android and iOS stores. In essence, the need for a secondary phone specifically to generate seed phrases is greatly reduced when using “passkeys,” even though it lacks a trusted display, according to Yakovenko.

Despite the weak smartphone sales and the general stagnation in DeFi as a whole, SOL’s token gains have been supported by a significant improvement in the Solana network’s activity and deposits, as measured by the 12.65 million total value locked (TVL) in DeFiLlama. This number represents a 36% increase since Nov. 15, which marked the lowest level in more than 2 years.

Related: NFT trading volume nears $1B as markets turn bullish–Report

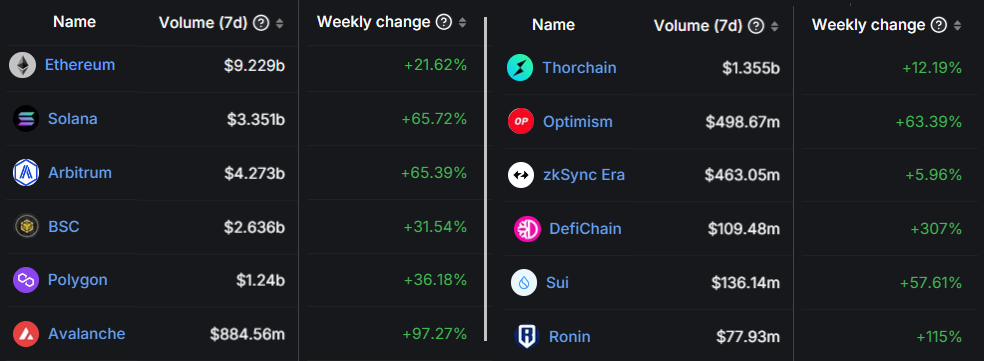

Further evidence comes from Solana’s decentralized exchanges (DEX) activity, which increased by 65.7% in the last 7 days.

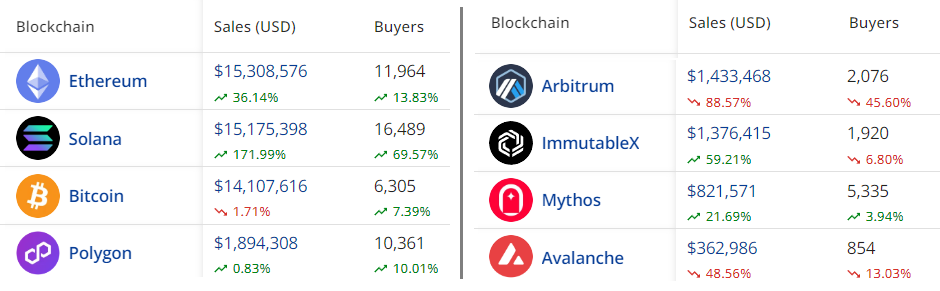

It’s worth noting that Solana’s direct competitors, Ethereum and BSC Chain, also saw significant gains of 21.6% and 31.5%, respectively, during the same period. Additionally, Solana’s non-fungible token (NFT) activity has soared in the last 24 hours, reaching an impressive $15.2 million in sales with 16,489 buyers.

For those curious, Solana’s NFT markets were dominated by the Tensorians collection with total sales of $4.6 million, followed by Mad Lads with $1.7 million in sales, and Quekz with $832,000.

SOL’s recent rally above $72 has been driven by SPL token listings on major exchanges, increased DeFi and NFT activity, and the anticipation of further airdrops following the success of Jito.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.