Solana (SOL) price is up today, buoyed by a significant recovery in the broader cryptocurrency market.

Data from Cointelegraph Markets Pro and TradingView shows SOL’s price is trading at around $134, up more than 6% in the last 24 hours. Solana price has rebounded roughly 20% from its local low of around $112 reached on March 11.

SOL/USD daily chart. Source: Cointelegraph/TradingView

Several factors driving the SOL price up today, including:

-

SOL price rally comes following the launch of the first Solana futures ETF.

-

Approximately $18 million in shorts were liquidated over the last 24 hours.

-

SOL’s strengthening technicals target is $220.

Launch of Solana futures ETF boosts SOL price

Today’s debut of Solana futures exchange-traded fund (ETF) by Volatility Shares has injected fresh enthusiasm into SOL investors.

🚨 BREAKING: The first-ever Solana futures ETFs are launching tomorrow.

Volatility Shares is debuting two ETFs:

• SOLZ: Tracks Solana futures

• SOLT: Offers 2x leveraged exposure pic.twitter.com/Wt2gt6oBPc— Cointelegraph (@Cointelegraph) March 19, 2025

Key takeaways:

-

Volatility Shares, a US-based investment firm, is set to launch the first-ever Solana futures ETFs on Thursday, March 20.

-

A filing with the Securities and Exchange Commission (SEC) reveals that two Solana-based ETFs issued by Volatility Shares ETFs will begin trading on Thursday, March 20.

-

These include Solana ETF (SOLZ), which will track Solana futures and the Volatility Shares 2X Solana ETF (SOLT), which offers leveraged exposure.

-

SOLZ will have a management fee of 0.95%, while traders will be charged 1.85% for SOLT.

-

The ETFs, following a path similar to Bitcoin and Ethereum futures products, signal growing institutional acceptance and provide easier access for traditional investors.

-

Market participants believe that the launch of these funds could be significant in the approval of a spot Solana ETF.

-

Several issuers, including Grayscale, Franklin Templeton and VanEck, have applied for spot Solana ETFs, which are yet to be approved by the SEC.

-

Bloomberg ETF analysts believe there is a 75% chance of approval by this year’s end.

-

Analysts see this as a regulatory green light, boosting confidence in Solana and across the broader market.

“Solana ETF dropping right after BTC/ETH ETFs? The TradFi gates are opening wide,” said crypto analyst Kolin in a March 19 post on X.

“Futures are just the start – spot ETF inevitable. $SOL’s just warming up and the Solana ecosystem’s about to get flooded with institutional liquidity.”

“This is wild,” asserted Bloomberg Senior ETF analyst Eric Balchunas in response to the developments, adding that it is probably a good sign as Solana futures “arguably bode well for spot ETF odds.”

Short liquidations push SOL price higher

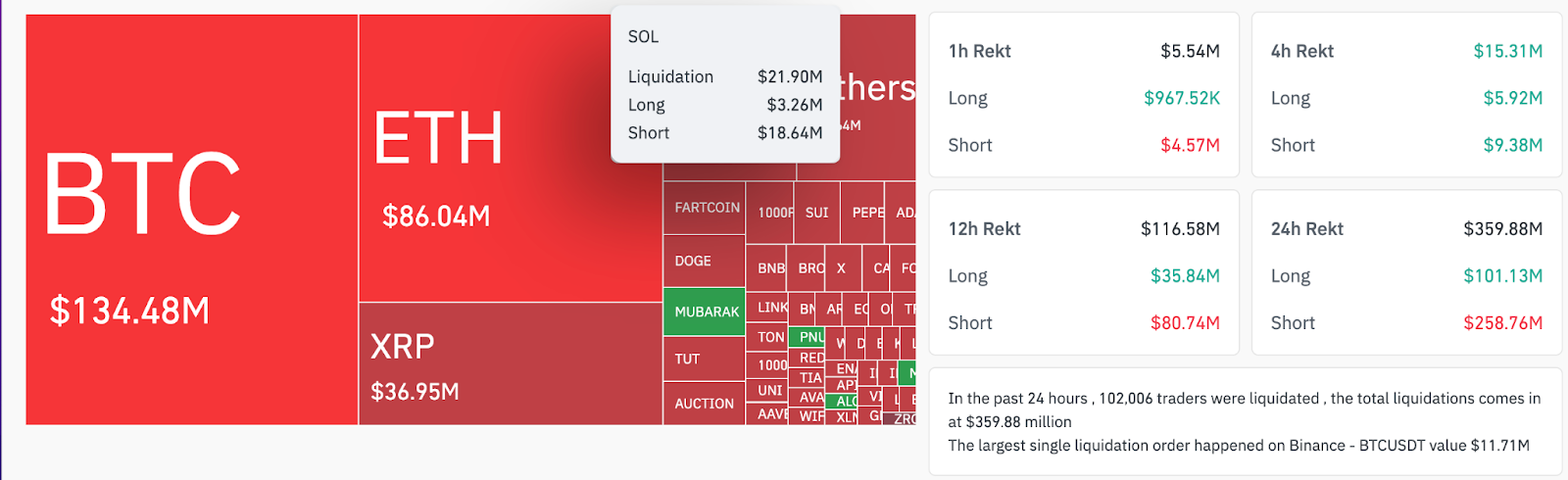

Solana’s price rise on March 20 is accompanied by significant liquidations in the derivatives market, according to data from CoinGlass.

-

The crypto futures market witnessed the liquidation of over $359 million worth of leverage positions in the last 24 hours, with $258.7 million being short liquidations.

-

Over $18.64 million short SOL positions have been liquidated against $3 million long liquidations over the same period.

Total crypto liquidations. Source: CoinGlass

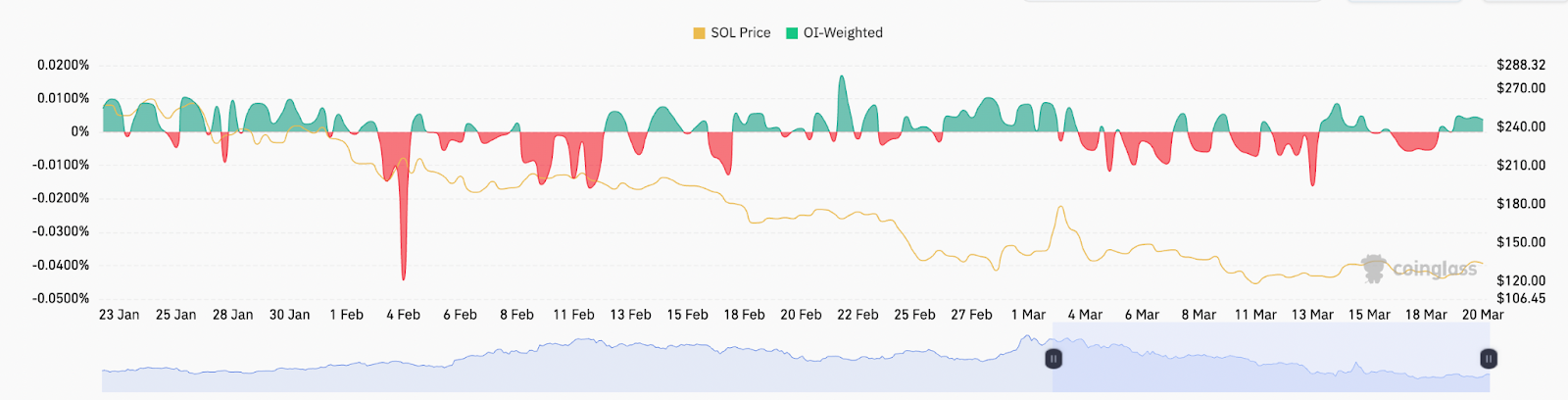

Furthermore, the SOL price gains accompany a recovery in its funding rates.

SOL funding rates performance. Source: CoinGlass

Related: ‘I am ashamed’ — Solana CEO breaks silence over controversial ad backlash

Can SOL price stage a recovery to $220?

SOL still trades well below its range high of $220 reached on Feb. 5. However, the bulls have established support around $110 and $125 at the upper boundary of a descending channel.

The daily relative strength index (RSI) has recorded higher highs since March 10 with no divergence, indicating that the upward momentum remains strong.

XRP/USD daily chart. Source: Cointelegraph/TradingView

The next immediate barrier sits at $140, which, if broken, SOL price would rise higher to confront resistance from the $165 to $190 supply zone—this is around where all the major moving averages sit.

Bulls will be required to flip this area into support to increase the chances of rising toward $220, where the price could pause for a while.

According to analyst Cryptobits, SOL’s recent low at $112 marked the local bottom for the altcoin. He added that Solana’s fundamentals remain strong, with increasing “investment interests from institutions” supporting its upside.

“With all the above remaining intact, I see $SOL returning above $200 and eventually breaking its ATH high at $296.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.