Anonymity became a barrier, standing in the way of cryptocurrency mass adoption by the traditional financial market. At the same time, abandoning confidentiality contradicts the core concept of digital assets. To satisfy interests of both cryptocurrency users and regulators, a trade-off was needed. The solution has already been created. Let’s dive deeper and learn how to remain anonymous in the crypto market without breaking a single law.

What is KYC and what does it have to do with cryptocurrencies?

The abbreviation KYC stands for Know Your Customer. This definition is often used in the context of the financial market. KYC refers to a range of processes aimed at ascertaining the identity of the person who plans to conduct a financial transaction.

Cryptocurrencies are a financial instrument that, by the covenant of the founder of Bitcoin Satoshi Nakamoto, should be anonymous. From regulators’ point of view, fully confidential transactions carry risks associated with money laundering, terrorist funding, and other illegal activities. That is why governing authorities need to pipe cryptocurrencies’ users through KYC procedures.

Crypto market participants are also interested in having convenience for all parties — users and regulators — relating norms for person identification. In fact, the government can not allow the spread of an anonymous financial instrument that they can not control due to its confidentiality.

Transacting with cryptocurrencies by following the KYC procedures can be seen as a two-way street: crypto community members can continue transactions with digital assets, while regulators will receive tools to control deals with such coins. That being said, users shall waive anonymity in that case.

What is wrong with KYC in the crypto industry and traditional market?

Crypto projects, including major exchanges, aspire to walk in a legal realm. For that, they need to be regulators’ “friends”. The best way to gain the trust of governing agencies when it comes to cryptocurrencies is to operate in accordance with KYC requirements.

The standard identity verification procedure in the crypto industry entails several steps, including the following:

- Providing a third party (the platform where the registration takes place) personal data, including surname, name, place of residency;

- Providing documents to confirm the user’s identity.

Also, platforms often ask users to take a selfie with a supporting document in hand.

Interesting! Many crypto projects motivate users to go through KYC procedures by implementing limits. For example, some trading platforms decrease operational limits for users that have not completed the verification procedure.

Crypto project representatives create KYC databases that might include identity supporting document scans or other magnets for fraudsters. As a result, cryptocurrency platforms became targets for wrongdoers.

The practice has shown that even major players can not safely maintain their clients’ KYC data. For example, in 2019 verification documents of Binance’s users were leaked to the internet. At first, the trading platform’s representatives denied the leak but they had to acknowledge it after the photos of the clients were posted.

The “apologetic” response of Binance’s team was to offer victims a lifetime VIP membership. Many market participants hold the opinion that it was not a fair response towards people that were at risk due to the vulnerabilities of the trading platform. In fact, fraudsters can use KYC data and photos for theft and other illegal activities.

Such incidents bear heavy cost to the companies’ goodwill. Fortunately, modern organizations can avoid such failures.

How to solve the KYC problem

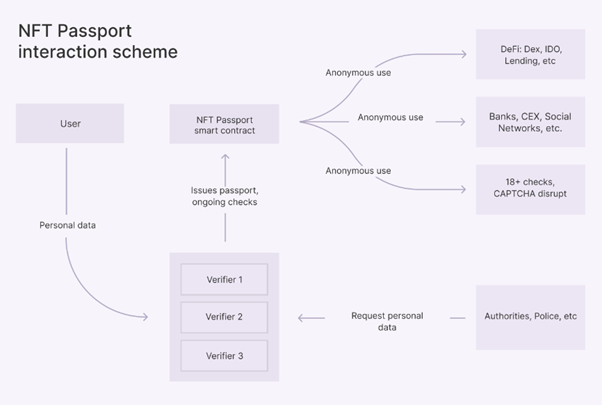

It appears that the crypto community can not waive KYC, otherwise cryptocurrencies would not be integrated with the traditional financial market. At the same time, as market experience shows, it might be dangerous to provide third parties with verification data and photos of the documents. A solution to this problem was offered by the Czech company Hashbon. This team was the first to develop the concept of the digital passport Hashbon Pass (NFT Passport). Here is how it works:

- A user that seeks to get the NFT Passport transfers the personal data to a group of approved and screened licensed verifiers.

- Verifiers conduct a check and, in case of absence of red flags, issue a digital NFT Passport. As a reminder, the non-fungible token format ensures that the information is fixed in the digital asset on the blockchain. The technology safeguards the register against any falsification, therefore data from the Hashbon Pass NFT passport is impossible to fake. Thus, guaranteeing the authenticity of verification records.

- The owner of the digital passport Hashbon Pass can present the document for verification on platforms that follow KYC rules. In this case, third parties will have no access to the users’ confidential data, and an NFT Passport doesn’t have any personal info from the document submitted. Instead, the service will be presented with the NFT Passport that verifies the identity.

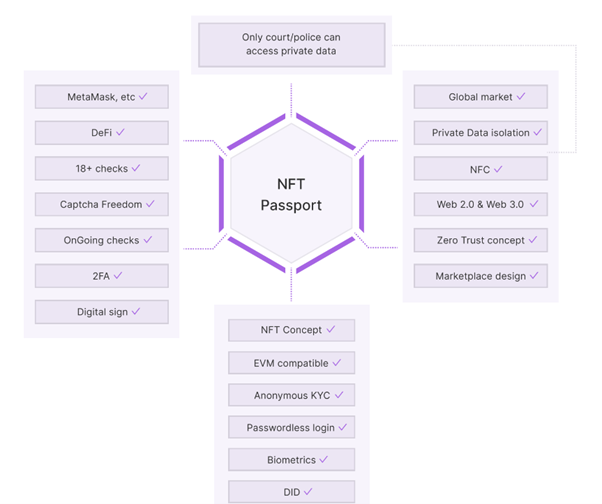

In that way, Hashbon Pass ensures anonymous usage of crypto platforms, including projects in the decentralized finance segment (DeFi). Also, NFT Passports can be used for confidential identity verification while working with platforms in the traditional financial segment like, for example, banks. Other use cases for the Hashbon Pass include anonymous lawful age confirmation and to bypass CAPTCHA.

NFT Passport Issuance and Use Cases

Interesting! If needed, for example, in the case of regulatory checks, government agencies can request KYC data from verifiers.

Here is the list of problems that the NFT passport Hashbon Pass solves:

- Protection against third party personal data leaks;

- Time savers: instead of filling through registration forms, Hashbon Pass holders can just present their NFT Passport.

Hashbon Pass opportunities

It appears that Hashbon Pass offers anonymous and completely safe KYC identity verification. Not only in the decentralized finance market, but also in the traditional financial industry. For companies, a partnership with Hashbon Pass allows for a simpler verification procedure and protects clients from data leakages. All these factors increase their appeal.

The Hashbon Pass launch is planned for the end of June 2022. Become the project’s partner to be among the first to offer clients an easy and safe way for anonymous KYC verification. Follow updates and request a demo on the official Hashbon webpage.