Bitcoin (BTC) struggled to continue its rebound at Tuesday’s Wall Street open as attention focused on $95,000 sellers.

Key points:

-

Bitcoin faces resistance as it approaches a large area of seller interest at $95,000.

-

BTC price action begins to weaken versus risk assets and precious metals.

-

Support on weekly timeframes remains intact, with $93,500 a key focus for the weekly close.

“Choppy” BTC price action follows $95,000 test

Data from TradingView tracked a loss of BTC price momentum after BTC/USD hit $94,800 the day prior — its highest since Nov. 17.

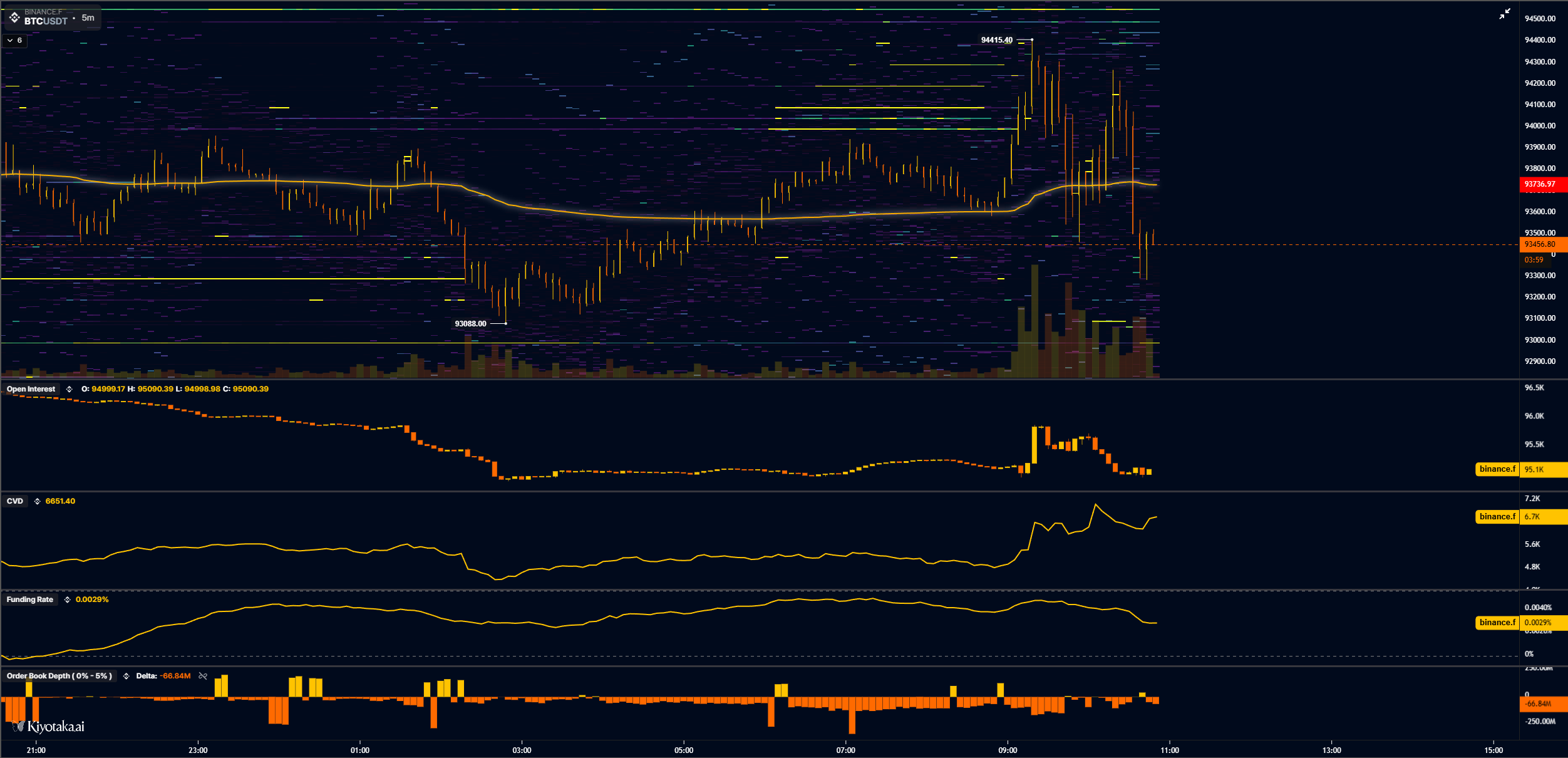

“Choppy price action starting to show up in market data especially here,” trader Skew reacted in part of his latest X analysis on the day.

Skew identified what he called a “passive seller” at $94,000 — an entity selling into price upside in a sustained manner.

“Longs realise the subtle cue around $94K the second time and bail from positioning only for late shorts to start positioning. Typically there’s a lot of decay on these days,” he added alongside a chart of exchange order-book data.

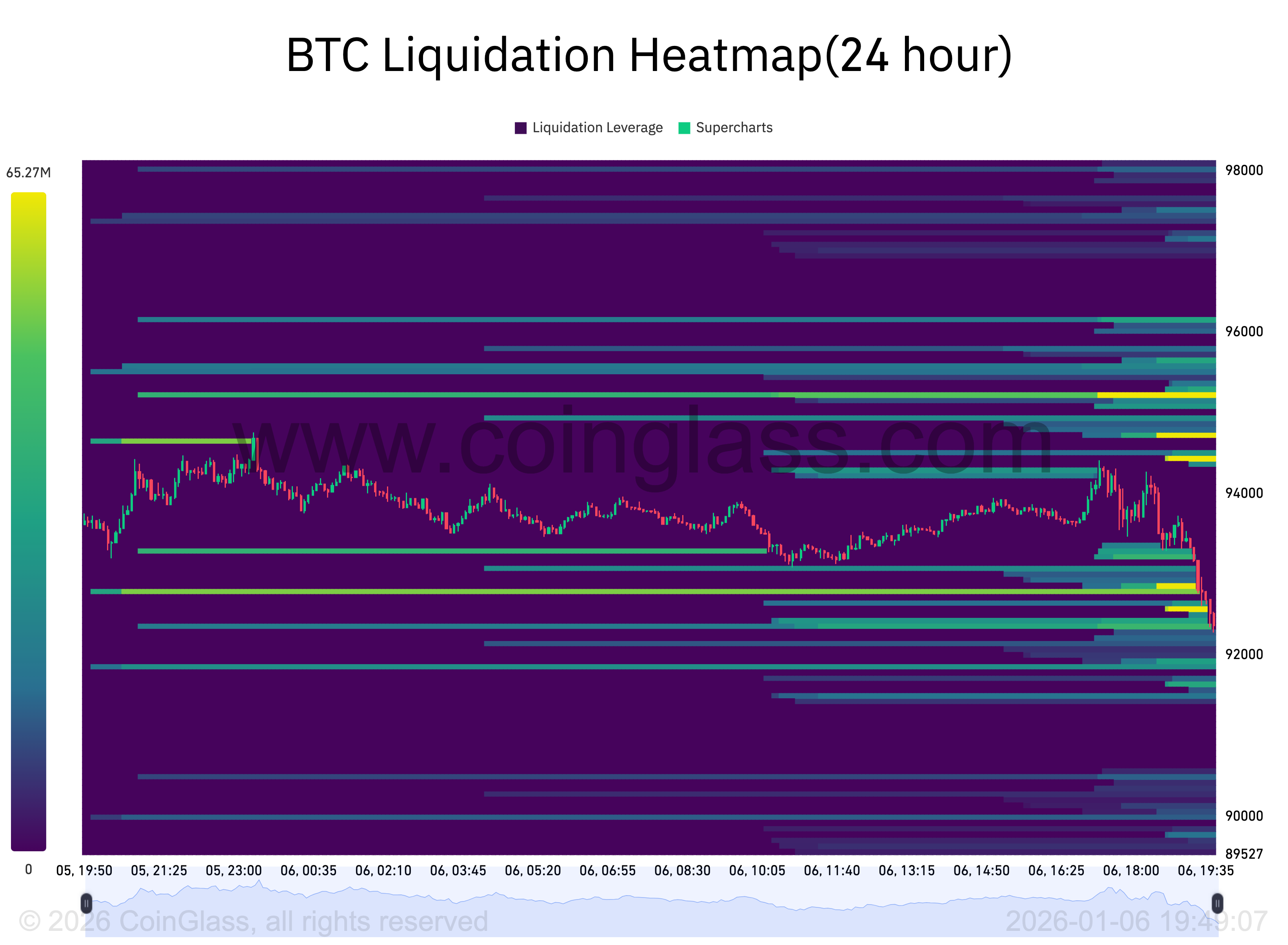

Commentator account Exitpump flagged a wall of asks at $95,000 keeping price in check.

“Big boy sell wall at 95K on spot orderbooks, today is the day price either smashes through it or rejects from it,” it summarized.

On macro, the party continued, with US stocks heading higher and gold reaching $4,491 per ounce, fueled by developments in Venezuela. Silver retook the $80 mark.

BREAKING: Silver extends gains above $80/oz, already up another +13% year-to-date. pic.twitter.com/1d9Sv7F61W

— The Kobeissi Letter (@KobeissiLetter) January 6, 2026

In its latest “Asia Color” market update, trading company QCP Capital referenced crypto falling back in line to follow major asset classes.

“Crypto’s recent alignment with broader risk assets may signal a regime shift and the strengthening of bullish narratives to start the year, especially with the year-end tax loss harvesting shenanigans out of the way and a new crypto bill on the horizon,” it wrote.

“While much of this narrative was likely already priced in, Washington’s Venezuela shock could serve as a near-term catalyst for BTC.”

Bitcoin nonetheless struggled against gold’s latest march higher on the day.

Analyst: Bitcoin needs $93,500 weekly close

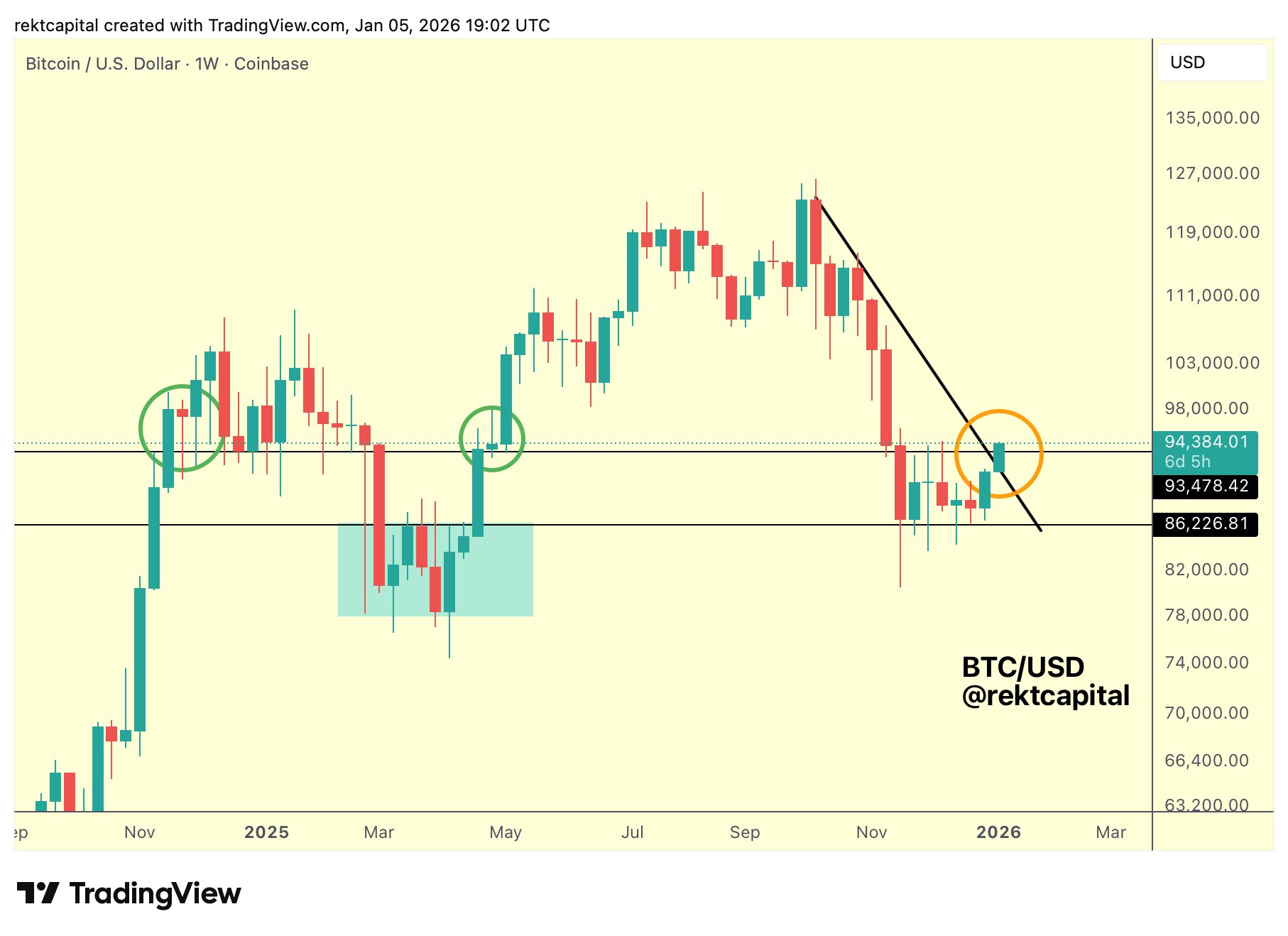

Adding optimism to the longer-term picture, trader and analyst Rekt Capital revealed that BTC/USD had protected the bottom of a key range on weekly timeframes.

Related: Bitcoin buying metric with average 109% gains flips positive at $88K

The pair now needed to close the coming weekly candle above range highs at $93,500 — the 2025 yearly open level.

“It would confirm a breakout from the Range and also end the Weekly Downtrend dating to mid-October 2025 (note: this Downtrend isn’t the most important one but it’s nonetheless noteworthy given its mid-term significance),” he told X followers Monday.

“Generally, ~$93500 needs to hold as support for mid-term bullish bias.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.