Polygon (MATIC) recorded user growth 50% higher than Bitcoin (BTC) in 2023, according to a Flipside Analytics’s industry report.

Flipside Analytics’ latest crypto industry report has shown that Polygon surpassed Bitcoin in user-growth for 2023, a feat that could impact MATIC price significantly action in 2024.

Polygon (MATIC) recorded 15 million new users in 2023

Polygon (MATIC) price performance has been tepid in recent months. As the crypto market rallied in Q4 2023, mega-cap altcoins like Solana (SOL), Cardano (ADA), Avalanche (AVAX) closed the year with triple-digit quarterly gains. In contrast, MATIC failed to reclaim a new yearly peak.

Markets have reacted skittishly to Polygon’s proposed transition to a new ‘POL’ native token, announced in July 2023.

However, a recent on-chain report by Flipside Analytics has cited fundamental growth signals that could impact MATIC price action positively in 2024. According to the report, Polygon attracted 15.2 million new user addresses in 2023, claiming top spot behind Ethereum.

The acquired user count tracks the number of new wallet addresses created on a blockchain network during a given period. This essentially serves as a proxy for measuring global adoption rate and user acquisition.

Polygon’s 15.2 million was 50% higher than Bitcoin’s 10.6 million acquired user count for 2023. But notably, Arbitrum (ARB), Optimism (OP) and Base also made the top 8 list of the best-performing projects in terms of user growth. This gives a nod to Layer-2 scaling projects as one of the fastest growing sectors in crypto.

A significant increase in new user count suggests that Polygon network is attracting new network participants at a rate higher than Bitcoin and its Layer-2 competitors. If sustained, this could evolve into increased market demand for the MATIC (POL) token as these new users intensify their network activity over time.

Polygon is attracting unusually high transactions from new users

As the 15.2 million new Polygon network participants begin to utilize MATIC in daily transactions, the organic growth in market demand could impact prices positively in the long run.

In confirmation of this stance, a vital on-chain data trend shows Polygon has begun to record a substantial number of transactions from new users.

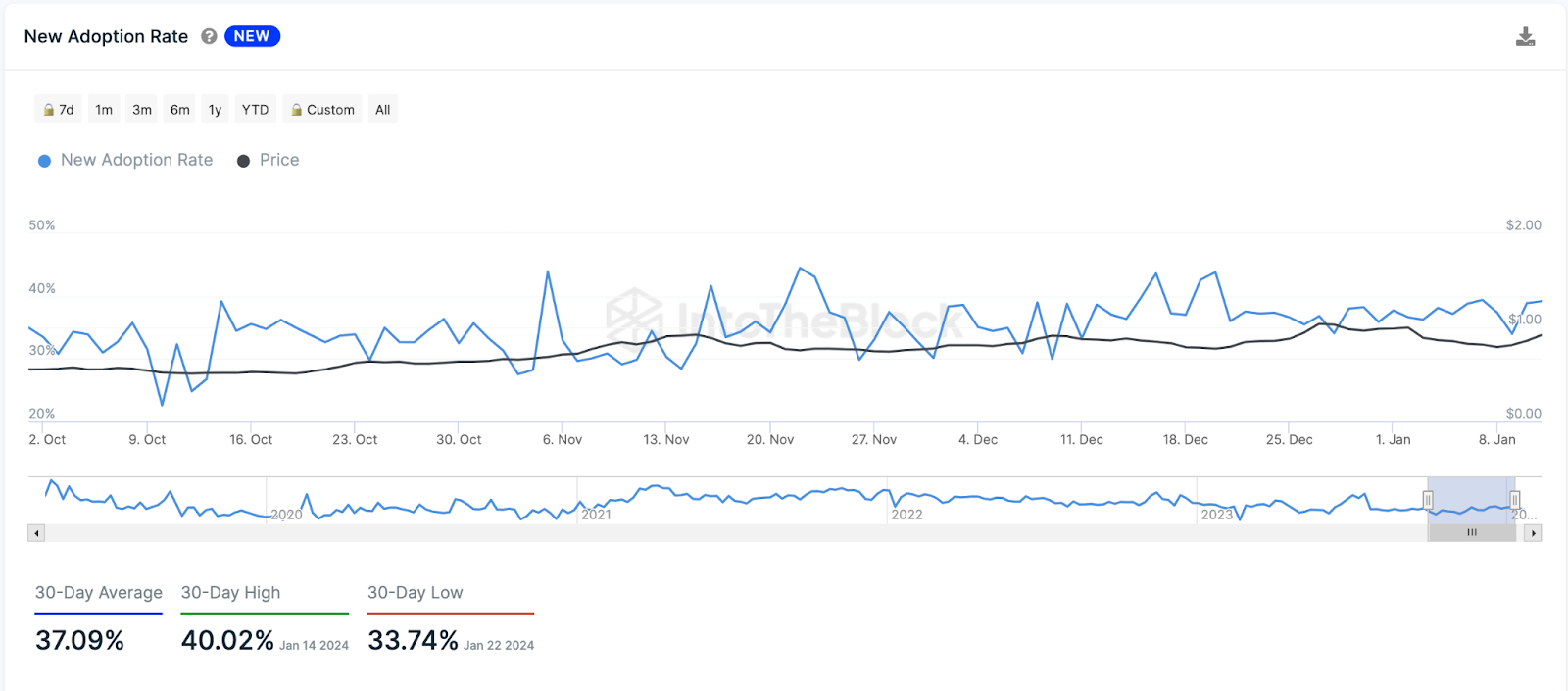

IntoTheBlock’s ‘new adoption rate’ metric, tracks the percentage of a network’s total daily transactions that is being executed by new users.

On average, 37% of Polygon (MATIC) daily transactions in the past month were from new wallets transacting for the first time, as depicted in the chart below.

This growth in Polygon new user transactions further affirms the stats presented in Flipside analytics report. It also shows that a significant portion of the 15.2 million new addresses recorded in 2023 are becoming active network participants.

What next for MATIC price in 2024?

Following Ethereum’s PoS transition in 2023, there were concerns that Polygon network scaling solutions could effectively become redundant. However, this uptrend in fundamental growth metrics signals long-term viability prospects of the Layer-2 scaling and Polygon network’s ubiquity and competitiveness within the sector.

Key network upgrades like the transition from the MATIC to a more decentralized POL token could further deepen the Polygon adoption in 2024.

In addition, the team recently announced a partnership with Chainlink (LINK), enabling developers to integrate off-chain price feeds into Polygon dApps.

Chainlink is a leading blockchain-based oracle network that feeds off-chain real-world data to on-chain smart contracts. DeFi developers on Polygon zkEVM would now have access to Chainlink’s real-time price feeds.

This partnership is expected to power the development of decentralized exchanges, liquidity protocols, and Real World Assets (RWA) projects on the Polygon chain.

This move could help Polygon network capture even more growth traction from the burgeoning Real World Asset (RWA) and tokenization wave in 2024.

In summary, the user growth overtaking Bitcoin and its Layer-2 competitors, as well as the rising number of new-user transactions are critical factors that could put MATIC price on an upward trajectory.

Also, the ongoing token upgrade and strategic partnerships to leverage the RWA narrative could further intensify Polygon network growth and drive positive price action in the months ahead.

MATIC short-term price prediction: $0.8 resistance looms large

Based on Polygon’s user growth, token upgrade and strategic partnerships, MATIC looks set for positive price movement in 2024. However, in terms of short-term price action, MATIC is currently trading at $0.73 at press time on Jan 25, as the bulls currently face an uphill climb at the $0.80 resistance.

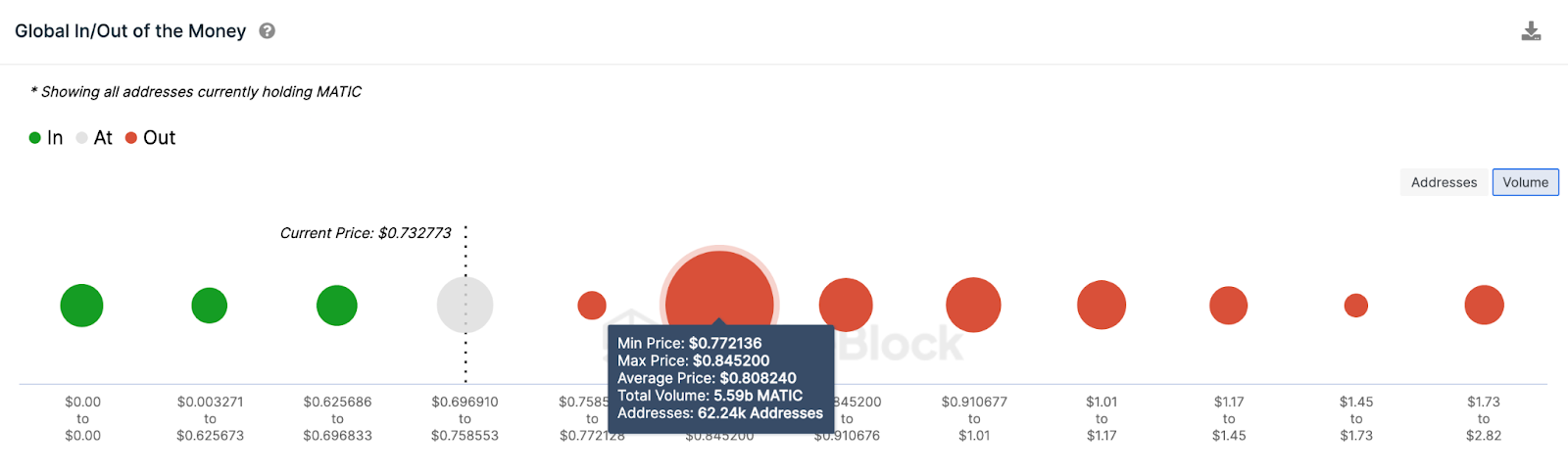

IntoTheBlock’s global in/out of the money around price data groups the current Polygon token holders by their historical entry prices.

It currently shows that 62,240 wallets had acquired 5.6 billion MATIC at the average price of $0.80. Notably, this is the largest cluster of current Polygon token holders. Without a significant momentum boost, the bulls could struggle to break above $0.80 in the short-term.

But on the flipside, if the bulls can scale $0.80, it could promptly open the doors to a retest of the $1 area.