The Chainlink price has not reflected positive changes despite a major development in the altcoin’s ecosystem. Over the last 24 hours, LINK has declined by over 4%. Even in the weekly window, the altcoin lost over 6% of its value.

LINK had charted considerable gains in the month of November. The bulls, however, could not sustain the price action as the coin moved southward at the beginning of December.

Chainlink’s price has dropped below the $7 mark. For the coin to turn bullish, it must break past the aforementioned price zone. Investor interest has yet to echo on the daily chart. Chainlink is a blockchain oracle network that has launched its staking feature. This shall help to enhance the economic security of the platform’s services as a whole.

This development is supposed to be a vital part of its “Chainlink Economics 2.0” effort, which is aimed at promoting better security and ensuring sustainable growth within the ecosystem. The technical outlook has displayed a fall in accumulation, and at the current price, LINK is trading at an 87% discount from its all-time high secured in 2021.

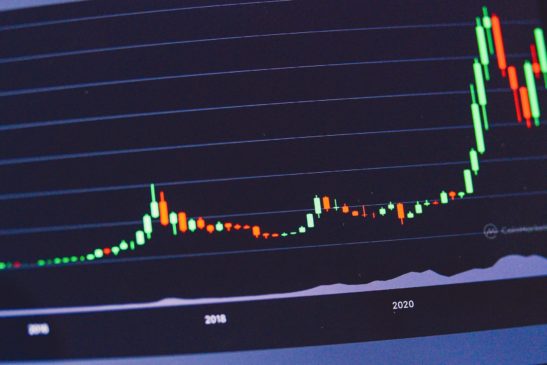

Chainlink Price Analysis: One-Day Chart

LINK was trading at $6.86 at the time of this writing. Although the altcoin was trading close to the crucial price resistance mark, it had to get past one important price ceiling to claim $7. Immediate resistance stood at $6.90. After breaking through the $7 mark, Chainlink may encounter a major barrier at $7.36, indicating a significant retracement.

If LINK falls below the present price level, it could land at the $6.22 mark and then at $5.90. The amount of LINK traded in the last session witnessed a dip, which meant that sellers were still in charge and that price sentiment was bearish.

Technical Analysis

LINK had managed to secure more buying pressure this month, but with constant volatility and price swings, the bulls have finally worn out. The Relative Strength Index dipped below the half-line, indicating falling buyer interest.

Reflecting the same sentiment, the Chainlink price peeped below the 20-Simple Moving Average line, which meant that sellers had started to drive the price momentum in the market. Buyers will be back for a considerable time period if Chainlink prices rise above $7.36.

Regarding declining buying strength, other technical indicators also presented similar readings. The buy signal on the daily chart started to fall. The Moving Average Convergence Divergence, which reads the price momentum and trend reversal, noted that the green histograms were shorter in size.

This is not good news for buyers, and buyers must refrain from accumulation at this point. Similarly, the Parabolic SAR, which depicts the price direction, formed a dotted line above the candlestick, signifying downward price action in the market.