Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

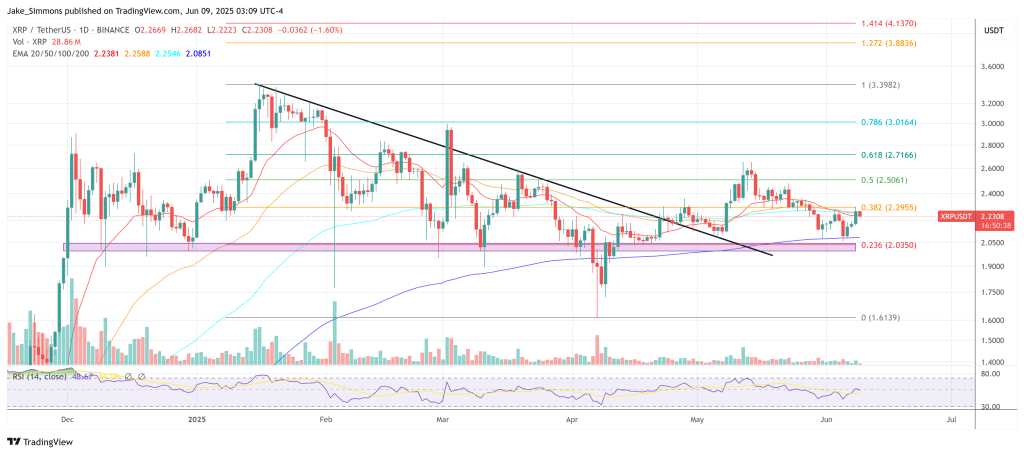

Pseudonymous analyst CryptoInsightUK has warned that the next major move for XRP could be a trap. In a video published on June 8, the analyst outlined a scenario where XRP surges toward $2.30–$2.40 in the short term—only to reverse violently into a sharp liquidity flush before any sustainable breakout occurs.

XRP Bull Trap Looming?

“I think XRP goes to sub-$2.0. I really do,” he said, adding: “It could come and sweep the highs here… could come up to like what, $2.30, and then push us down. That would be more pain for everyone, ‘cause everyone’s going to think we’re going to the upside.”

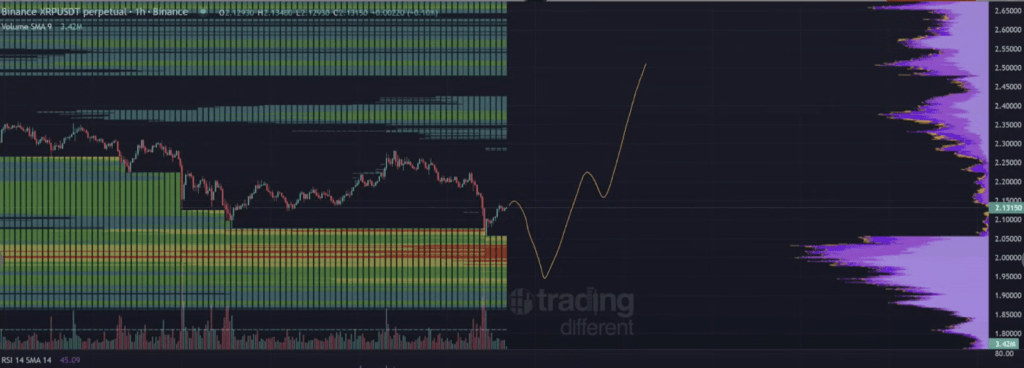

The setup he describes is based on market structure and liquidity dynamics, particularly the buildup of resting orders beneath XRP’s current range. “This here is a concern, a real concern for me,” he said, referring to the growing pool of liquidity below current prices. According to his internal models, such liquidity zones are statistically touched “80% of the time.”

Related Reading

“Someone’s trying to trick someone here,” he warned. “I’m cautious.” Despite his near-total XRP allocation—he states he’s “95%+, probably more like 98%” positioned in XRP—CryptoInsightUK emphasized that he’s not rooting for a correction. “I don’t want it to come down,” he said. “I’m just showing you what I see.”

The analyst proposed multiple structural paths: one in which XRP immediately breaks out, and another where it briefly rallies to sweep local highs before flushing downward to form a bullish divergence. “We’re in a range right now,” he said. “Do we come up, sweep the highs, then take the lows and go?”

He elaborated on the bullish divergence pattern he is watching, where price forms a lower low while the RSI (Relative Strength Index) prints a higher low—a setup he uses to identify bottoming structures. “That’s what I would like to see,” he explained.

Broader Macro Conditions Still Supportive

Despite the bearish tactical setup, the video struck an upbeat macro tone. Will cited four near-term catalysts: the Genius Act on stablecoin oversight, the imminent filing deadline in the SEC’s remedies phase against Ripple, the July decision window for a spot-XRP ETF proposal, and a renewed expectation of accommodative fiscal policy sparked by last week’s televised Trump-Musk dialogue.

“What this really tells us is there’s going to be money printing,” he argued. “Assets all over are going to explode to the upside and, for the other specific reasons, XRP probably does even better.”

Turning to Bitcoin, the analyst observed an ongoing decline in trading volume, suggesting indecision or exhaustion. “There’s been no volume. There’s been nothing,” he said of recent BTC price action.

Related Reading

He highlighted a CME futures gap around $92,000–$93,000 and added that fixed range volume analysis points to a possible pullback zone at $96,000–$97,000. “It’s probably coming imminently, maybe this week,” he said of a potential correction, projecting a scenario where BTC dips into this range before resuming its upward trajectory.

“Does this mean we squeeze to the upside or come down and take this low and put in that bullish divergence structure?” he asked, noting a similar divergence setup at $75,000 earlier this year.

XRP Spot Activity Raises Red Flags

In the final hour before the video, XRP had “squeezed up with some volume,” but the analyst urged caution. While open interest had risen sharply, funding remained green—suggesting net long positioning—and aggregate premium had turned red. “This indicates to me that even though there are still some shorts coming in, more longs than shorts have entered,” he said.

He warned that this imbalance could cause a sharp move lower if the market fails to hold current levels. “If we do now come down and lose this low, expect a more aggressive, faster move to the downside,” he said, pointing to the risk of liquidating leveraged positions.

XRP’s relative performance against ETH and BTC also came under review. While it had begun testing resistance zones, neither the XRP/ETH nor the XRP/BTC charts had decisively broken out. “We could still be in this range chopping about,” he cautioned. “Could lose strength until we start to see some confirmations to the upside.”

At press time, XRP traded at $2.23.

Featured image created with DALL.E, chart from TradingView.com