XRP trades back above $2, and soaring institutional investor flows suggest the altcoin’s rally is just getting started.

XRP (XRP) is holding above $2, but the move has yet to confirm a bullish shift, with a stronger technical validation expected at higher levels, according to an analyst.

Key takeaways:

-

XRP reclaimed its 50-day moving average in early January, signaling early signs of a trend reversal.

-

Institutional flows into XRP were the highest last week, diverging sharply from the market, which saw heavy outflows during the same period.

-

Onchain volume metrics suggest XRP’s move above $2 is driven by balanced participation rather than speculative excess.

XRP investment product inflows support price stability

XRP began 2026 by reclaiming a bullish position above its 50-day simple moving average (SMA) during the first weekend of January. The move aligns with a classic downtrend retest, a structure that leads to higher prices if buyers maintain control. However, the price action so far suggests stabilization rather than acceleration.

This stability appears reinforced by institutional investors’ participation. While the digital asset market experienced one of its worst weekly performances since mid-2023, with roughly $454 million in outflows, XRP price moved in the opposite direction.

CoinShares data showed $45 million in weekly inflows into XRP, a more than 400% increase week over week, that stood in contrast to broader market outflows.

This contrast has helped XRP hold above $2 even as liquidity conditions tightened elsewhere, highlighting that its recent strength is not purely sentiment-driven.

Related: SOL chart shows ‘masterpiece’ setup to $190 after key trend turns bullish

Volume data and trader outlook define the range

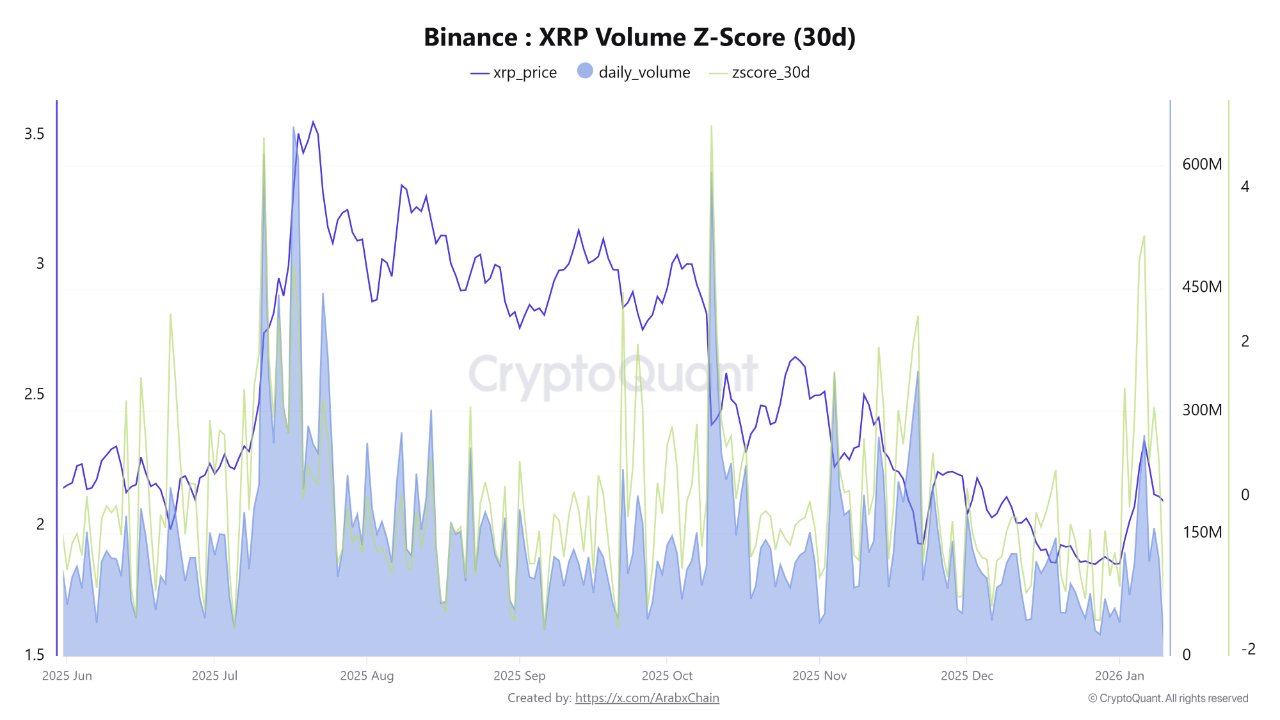

CryptoQuant data adds further nuance. Trading volume Z-Scores on Binance hover around 0.44, placing activity slightly above the 30-day average but firmly within a neutral range.

This suggests XRP’s price is not being pushed by speculation, but by balanced activity between buyers and sellers, a condition seen during accumulation phases.

Meanwhile, market analyst CrediBULL said that a completed “triple tap” at range highs leaves two paths: either a pullback toward $1.77 within a larger uptrend, or a defended base around $2 where dips continue to be bought. Given the current market, the analyst favors an uptrend, targeting higher, untapped levels at around $3.

However, futures trader Dom emphasized that while $2.10 has held for months, moves toward the mid-$2.40 range could only deliver a meaningful market shift on the daily chart. The analyst believed that strong price action likely begins once the altcoin establishes acceptance well above the $2.40 level.

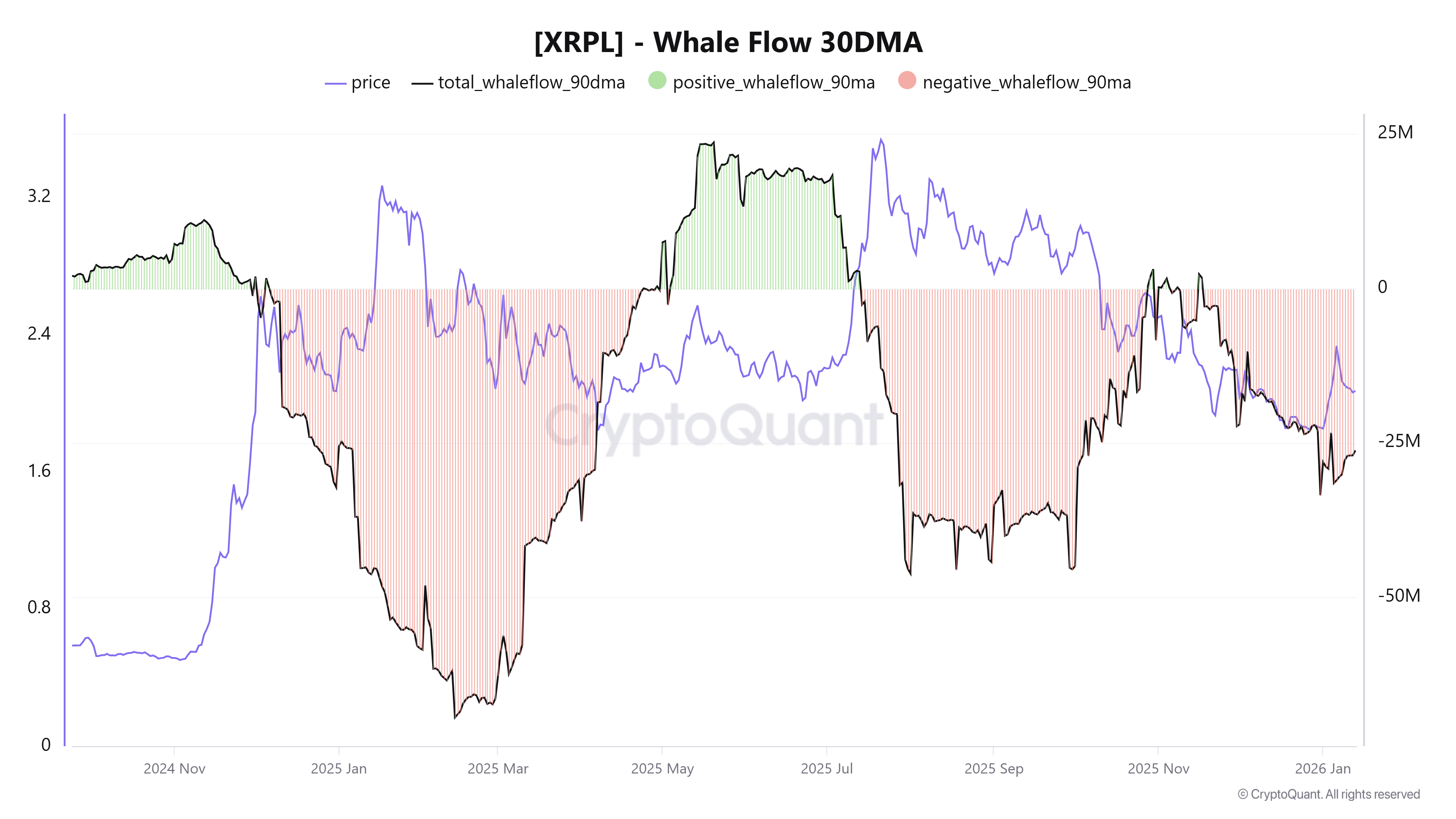

Coincidentally, XRP’s rally last week stalled just below $2.40, where the price was rejected on Jan. 6. The pullback followed more than $100 million in net whale selling between Jan. 4 and Jan. 7. While whale outflows remain elevated, a shift in behavior would need to be seen if XRP retests the $2.40 level.

Related: Ripple targets MiCA passporting in EU with Luxembourg e-money nod

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.