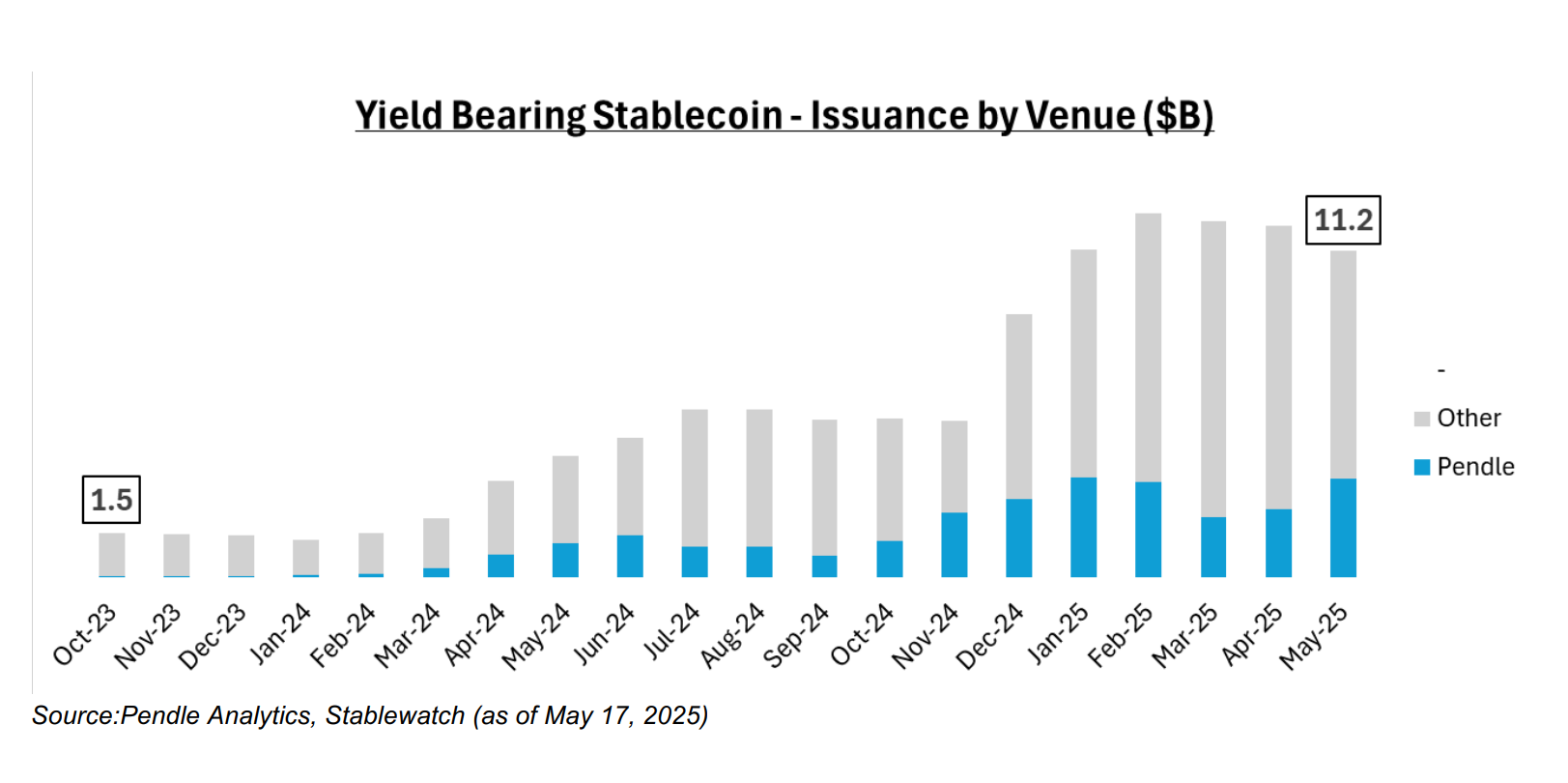

Yield-bearing stablecoins have soared to $11 billion in circulation, representing 4.5% of the total stablecoin market, a steep climb from just $1.5 billion and a 1% market share at the start of 2024.

One of the biggest winners is Pendle, a decentralized protocol that enables users to lock in fixed yields or speculate on variable interest rates. Pendle now accounts for 30% of all yield-bearing stablecoin total value locked (TVL), roughly $3 billion, the firm said in a report shared with Cointelegraph.

Pendle noted that stablecoins make up 83% of its $4 billion total value locked, a sharp rise from less than 20% just a year ago. In contrast, assets such as Ether (ETH), which historically contributed 80%–90% of Pendle’s TVL, have shrunk to less than 10%.

Traditional stablecoins like USDt (USDT) and USDC (USDC) do not pass on interest to holders. With over $200 billion in circulation and US Federal Reserve interest rates at 4.3%, Pendle estimates that stablecoin holders are missing out on more than $9 billion in annual yield.

Related: How to Use tsUSDe on TON for Passive dollar Yield in 2025

Growing regulatory clarity benefits stablecoins

The rise in yield-bearing stablecoins comes amid increasing regulatory clarity under US President Donald Trump’s administration.

In February, the US Securities and Exchange Commission approved yield-bearing stablecoins as “certificates” subject to securities regulation, rather than banning them. The approval allows yield-bearing stablecoins to operate under specific rules, including registration, disclosure requirements and investor protections.

Proposed bills like the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) signal a favorable direction.

Meanwhile, Pendle said it expects stablecoin issuance to double to $500 billion in the next 18 to 24 months. The firm also anticipates yield-bearing stablecoins to capture 15% of this market with $75 billion in issuance (7x growth from $11 billion).

Related: PayPal to offer 3.7% yield on stablecoin balances: Report

Pendle shifts focus to yield market

Initially focused on airdrop farming, Pendle has shifted toward serving as an infrastructure layer for decentralized finance yield markets.

Ethena’s USDe stablecoin currently accounts for about 75% of Pendle’s stablecoin TVL. However, newer entrants such as Open Eden, Reserve and Falcon have increased the share of non-USDe assets from 1% to 26% over the past year.

Pendle is also expanding beyond Ethereum, with plans to support networks like Solana and to integrate with Aave and Ethena’s upcoming Converge blockchain.

Interest in yield-generating strategies within the cryptocurrency sector has surged in recent years, driven by both retail and institutional investors seeking to maximize returns on their digital assets.

On May 19, Franklin, a hybrid cash and crypto payroll provider, announced the launch of Payroll Treasury Yield, which uses blockchain lending protocols to help firms earn returns on payroll funds.

Magazine: NBA star Tristan Thompson misses $32B in Bitcoin by taking $82M contract in cash