Authorities in South Korea have reportedly requested Terraform Labs co-founder Shin Hyun-Seong, also known as Daniel Shin, to appear as part of an investigation into the collapse of the firm. According to a Nov. 14 report from Hankyoreh, the Seoul Southern District Prosecutor’s Office’s Joint Financial and Securities Crime Investigation Team announced that Shin should appear before prosecutors sometime this week. Authorities reportedly alleged that the Terra co-founder held many LUNA tokens — since rebranded Lun Classic (LUNC) — without the knowledge of retail investors and earned roughly 140 billion won…

Day: November 14, 2022

BlockFi denies rumors that majority of its assets were held on FTX

Crypto lender BlockFi issued an official notice to its clients on Nov. 14 denying rumors that the majority of its assets were on FTX prior to the exchange’s collapse. According to an update shared by BlockFi, although a majority of its assets were not on FTX, it still has “significant exposure to FTX and associated corporate entities that encompasses obligations owed to us by Alameda, assets held at FTX.com, and undrawn amounts from our credit line with FTX US.” Despite its exposure, BlockFi assured clients that it has “the necessary liquidity…

FTX Hack or Inside Job? Blockchain Experts Examine Clues and a ‘Stupid Mistake’

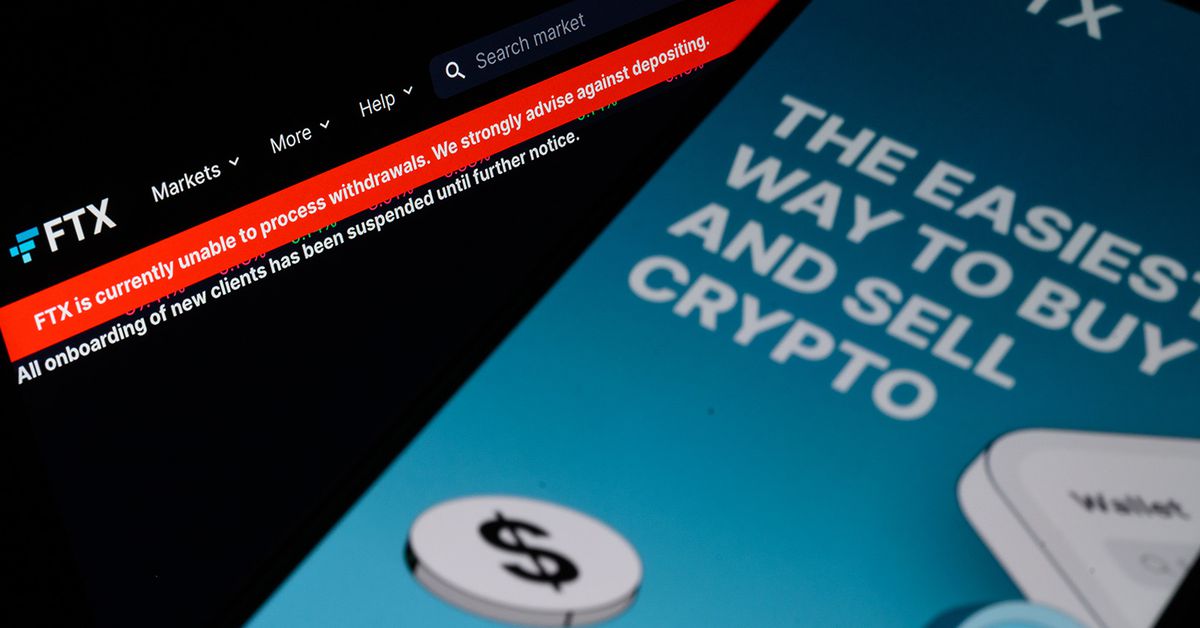

Insolvent crypto exchange FTX suffered a $600 million exploit late Friday after filing for bankruptcy protection. Source

Amid FTX collapse, crypto funds see largest inflows in 14 weeks

Inflows into cryptocurrency investment products rose sharply last week as institutional investors bought the dip amid the marketwide collapse triggered by FTX’s and Alameda Research’s bankruptcies. Digital asset investment products saw inflows totaling $42 million in the week ending Nov. 13, the largest increase in 14 weeks, according to CoinShares data. Bitcoin (BTC) investment products saw the largest inflows at $19 million, followed by multiasset and Ether (ETH) funds at $8.6 million and $5.9 million, respectively. Investors were also betting on a further deterioration in market conditions, with short Bitcoin…

🚨ইমারজেন্সি বিটকয়েন আপডেট‼️ bitcoin today update | Crypto market update

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io নিয়মিত মার্কেট আপডেট এবং ফ্রি সিগনাল পেতে আমাদের টেলিগ্রাম চ্যানেল এ জয়েন করুন👇👇 ================================== taki app: 🔅 আমাদের লাইভ ট্রেডিং কোর্সে ভর্তি হতে👇👇 ☎️ যোগাযোগঃ ================================== 🔰Bast crypto Exchange for BD👇 🥇Binance: ———————————————————- যেভাবে ট্রেডিং শুরু করবেন👇👇👇 ===================================== 📌: join us👇 🥇Telegram: 🥈Airdorp: =================================== Business inquiries 💠Telegram ID: 💠Email: kingsohan58@gmail.com ============================= Emergency Bitcoin Update‼️ bitcoin today update | Crypto market update bitcoin cryptocurrency bitcoin news today btc update Bitcoin market update crypto market update বিটকয়েন বিটকয়েন আপডেট Cryptocurrency News Bitcoin update bangla…

FTX’s Failure Is Sparking a Massive Regulatory Response

Lawmakers, regulators and criminal investigators are looking into FTX’s collapse, and Sam Bankman-Fried’s tweets aren’t helping. Source

Solana Foundation Invested in FTX, Held Millions in Sam Bankman-Fried-Linked Cryptos on Exchange

Bankman-Fried’s exchange and trading firm had purchased a total of 58,086,686 SOL tokens from the Foundation and sister entity Solana Labs from August 2020 onwards, the blog post said. The Foundation said it is unclear what will happen to those assets during bankruptcy proceedings. Source

Solana Foundation Invested in FTX, Held Millions in Sam Bankman-Fried-Linked Cryptos on Exchange

Bankman-Fried’s exchange and trading firm had purchased a total of 58,086,686 SOL tokens from the Foundation and sister entity Solana Labs from August 2020 onwards, the blog post said. The Foundation said it is unclear what will happen to those assets during bankruptcy proceedings. Source

Digital Asset Manager Valkyrie Lays Off 30% of Staff: Bloomberg

“Our management team did a thorough review of asset growth year to date and reviewed every employee’s role and contribution. Like many other companies in our industry, cuts needed to be made and ours were limited to sales and marketing,” Valkyrie CEO Leah Wald told Bloomberg. Source

Bitcoin derivatives data reflects traders’ mixed feelings below $17,000

Bitcoin (BTC) lost 25.4% in 48 hours, bottoming at $15,590 on Nov. 9 as investors rushed to exit positions after the second largest cryptocurrency exchange, FTX, halted withdrawals. More importantly, the sub $17,000 levels were last seen almost two years prior, and the fear of contagion became evident. The move liquidated $285 million worth of leverage long (bull) positions, leading some traders to predict a potential downside of $13,800. What an exciting time to be alive! Loving the volatility these elites are creating! They really wana buy LOW before the…