An eight-episode series based on the fall of Sam Bankman-Fried and his FTX crypto exchange is reportedly in the works at Amazon Prime Video. According to Variety, the online retail giant’s streaming service has tapped Joe and Anthony Russo’s production company, AGBO, to create the series about FTX’s implosion. The brothers are best known for directing four films in the Marvel franchise and could reportedly also direct the series. David Weil, the creator of Amazon’s Hunters series, is set to write the pilot episode. According to the report, the series…

Day: November 26, 2022

State Securities Regulators Probe Crypto Lender Genesis – Regulation Bitcoin News

State securities regulators are reportedly investigating Genesis Global Capital in a broad range probe into the “interconnectedness of crypto firms,” Barron’s reported on Friday. The report notes that the Alabama Securities Commission is looking into whether or not cryptocurrency firms have violated securities laws without filing the proper registrations. Report Says Financial Regulators Are Investigating Genesis Global Capital and the Interconnected Activities of Other Crypto Firms There’s been a lot of focus on Genesis Global Capital and its lending operation since Genesis announced on Nov. 16, 2022 it was temporarily…

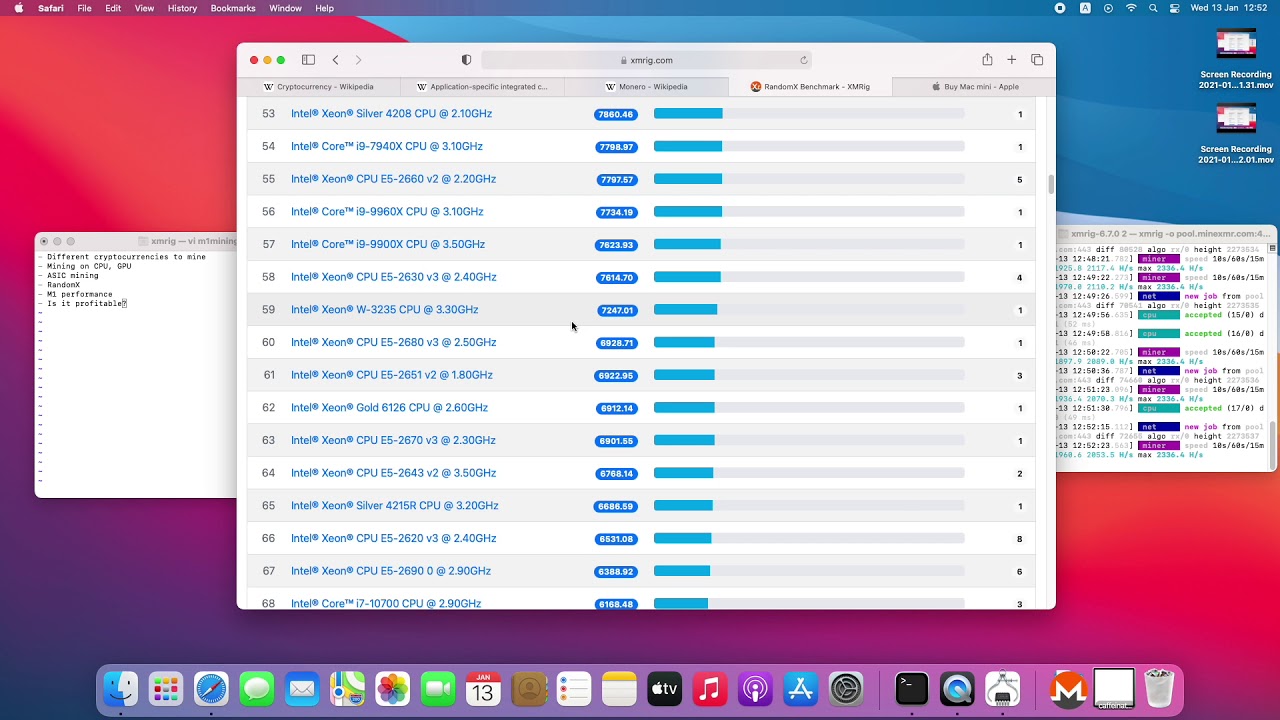

Apple M1 Mining Cryptocurrency — How good is it?

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Here are my thoughts on mining cryptocurrency using Apple Silicon M1 hardware. Spoiler — it is not good. ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Public vs Private Blockchain | Difference Between Public and Private Blockchain

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Get Certified in Blockchain Technology. Both tech and Non-Tech can apply! 10% off on Blockchain Certifications. Use Coupon … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Supply of Tokenized Bitcoin Dropped Significantly Since the Start of the Year – Blockchain Bitcoin News

This year, the number of tokenized bitcoins hosted on alternative blockchains like Ethereum, has dropped a great deal. Last January the number of wrapped bitcoin (WBTC) issued on the Ethereum blockchain was around 266,880 WBTC and since then, the number has dropped by more than 15% down to 225,962 WBTC. Similarly, the quantity of tokenized bitcoins minted on the Binance Smart Chain (BSC) dropped quite a bit over the last 11 months as well. Tokenized Bitcoin Supplies Shrank Significantly During the Last 11 Months At the time of writing, the…

Alameda Research withdrew $204M ahead of bankruptcy filing

Alameda Research withdrew over $200 million from FTX.US before it filed for bankruptcy, according to analysis from blockchain firm Arkham Intelligence disclosed on Nov. 25. In a Twitter thread, Arkham revealed that Alameda Research, FTX’s sister company, pulled $204 million from eight different addresses of FTX US in a variety of crypto assets, the majority of them stablecoins, in the final days before the collapse. Arkham analysed flows from FTX US in the final few days before the collapse, finding that Alameda withdrew the most funds, at $204M. Below is…

GUIA DEFINITIVO do THE MERGE da ETHEREUM

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Ethereum (ETH) é a criptomoeda que está prestes a passar pela maior atualização da história do mercado cripto: o The Merge … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

DOGE Hits 3-Week High on Saturday – Market Updates Bitcoin News

Dogecoin surged to a three-week high to start the week, as the token rallied for a second consecutive session. Overall, the meme coin has now traded higher for four of the last five days. Quant was another notable gainer in today’s session, moving to an eight-day peak. Dogecoin (DOGE) Dogecoin (DOGE) raced to a three-week high to start the weekend, as the meme coin moved to extend recent gains. Following a low of $0.08695 on Friday, DOGE/USD rallied to an intraday high of $0.09474 on Saturday. This gain in price…

How low can the Bitcoin price go?

Bitcoin (BTC) has spent over a year in a downtrend since its $69,000 all-time highs in November 2021. BTC price performance has given investors up to 77% losses, but how much lower can BTC/USD really go? Bitcoin traders and analysts have long agreed that 2022 is the year of the largest cryptocurrency’s newest bear market. After coming off all-time highs to start the year at around $46,000, BTC/USD has offered little relief and has since returned to levels not seen since November 2020, data from Cointelegraph Markets Pro and TradingView confirms.…

COINBASE Aktie Analyse☑️| Jetzt kaufen? Prognose für 2022 und Aktienanalyse

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io In der heutigen Aktienanalyse schauen wir uns die Coinbase Aktie an. Wir klären in der Analyse auch, ob man jetzt kaufen sollte … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version