According to a tweet by Ryan Selkis, CEO of blockchain research firm Messari, Grayscale Bitcoin Trust’s (GBTC) controlling shareholders Genesis Global and Digital Currency Group cannot simply dump their holdings to raise more capital. Selkis explained that Rule 144A of the U.S. Securities Act of 1933 requires that issuers of OTC-traded entities give advance notice of proposed sales, and imposes a quarterly sales cap of either 1% of outstanding shares or weekly traded volume. 2/ DCG bought nearly $800mm worth of GBTC shares since the premium flipped to a discount…

Day: November 28, 2022

US House committee sets Dec. 13 date for FTX hearing

The United States House Financial Services Committee has announced it will be holding a hearing to investigate the events around the collapse of crypto exchange FTX. House Financial Services Committee Chair Maxine Waters said Nov. 28 that lawmakers will explore the collapse of FTX at the Dec. 13 inquiry, expected to be the first in a series of hearings about the bankruptcy of a major crypto exchange. This one was first announced on Nov. 16 but not scheduled until now. Following the fall of FTX, the urgent need for legislation…

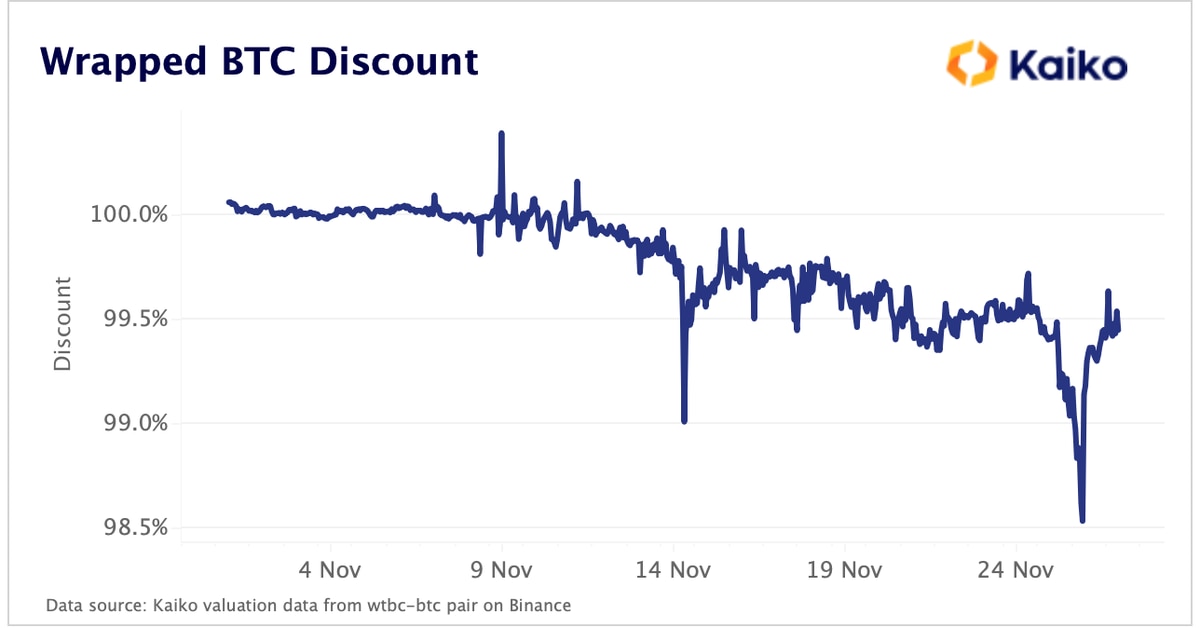

Wrapped Bitcoin Trades at Discount Amid Market Contagion

“Alameda was one of the most important market makers for some small-cap altcoins, while other major market makers registered losses and are likely to review their risk controls, which could impact liquidity in the short term,” the report from Kaiko said. Original

Staking tech firm Kiln closes $17.8 million, eyes future ETH staking demand

Staking technology provider Kiln has closed out a $17.8 million fundraising round featuring the likes of Consensys and Kraken Ventures. The company is eyeing ‘exponential’ growth in demand for ETH staking services from institutional clients in the future. Kiln is a software-as-a-service provider focused on enterprise-grade staking solutions across 16 different proof-of-stake blockchain protocols. Its infrastructure enables users to stake on-chain while maintaining asset custody on separate solutions as well as cloud platforms and validator clients. An announcement shared with Cointelegraph outlined growing institutionalization of cryptocurrency staking as a trend…

MakerDAO community votes against CoinShares’ $500M investment proposal

Decentralized lending protocol MakerDAO has voted against crypto investment firm CoinShares’ proposal to invest between $100 million and $500 million worth of the community’s funds into a portfolio of corporate debt securities and government-backed bonds for yield as an investment strategy. Ultimately, 72.43% of the votes went against the proposal. Had the community voted in favor, CoinShares would have provided “a variable APY above the SOFR interest rate (3.01% as of October 26, 2022) in the community’s preferred currency (DAI, USDC, USD…) to MakerDAO, which would have been withdrawable on-chain. …

MakerDAO community votes against CoinShares’ 500M investment proposal

Decentralized lending protocol, MakerDAO, has voted against crypto investment firm CoinShares’ proposal to invest between 100million and 500million worth of the community’s funds, into a portfolio of corporate debt securities and government-backed bonds for yield, as an investment strategy. 72.43% of the community votes went against CoinShares’ proposal to invest MakerDAO’s funds into various traditional assets. If the community had voted in favor of CoinShare’s proposal, the crypto investment firm would have provided “a variable APY above the SOFR interest rate (3.01% as of October 26, 2022) in the community’s…

Price analysis 11/28: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT

Turmoil in China, concerns over the global economy and BlockFi’s bankruptcy filing are all weighing on crypto markets this week. China witnessed a spike in COVID-19 cases and that has resulted in strict lockdown restrictions in several parts of the country. This triggered widespread protests in China and has possibly pulled the global stock markets lower. In addition to the turmoil in China, the cryptocurrency markets, which are already in a bear market grip, are reeling under pressure from the Chapter 11 bankruptcy filing by BlockFi and its subsidiaries. Bitcoin…

Michael Saylor – We're Finding Out How Corrupt FTX Really Was…| Bitcoin News

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Michael Saylor – We’re Finding Out How Corrupt FTX Really Was…| Bitcoin News Michael Saylor is an American entrepreneur and … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Kraken settles with US Treasury’s OFAC for violating US sanctions

The United States Treasury Department’s Office of Foreign Assets Control, or OFAC, has announced a settlement with crypto exchange Kraken for “apparent violations of sanctions against Iran.” In a Nov. 28 announcement, OFAC said Kraken had agreed to pay more than $362,000 as part of a deal “to settle its potential civil liability” related to violating the United States’ sanctions against Iran. The U.S.-based crypto exchange will also be investing $100,000 into sanctions compliance controls as part of the agreement with Treasury. “Due to Kraken’s failure to timely implement appropriate…

Crypto Lender Blockfi Files for Bankruptcy Protection to ‘Maximize Value for All Clients’ – Bitcoin News

On Nov. 28, 2022, the crypto lender Blockfi informed the public via a press release that the company has voluntarily petitioned for Chapter 11 bankruptcy protection. Blockfi is now one of many digital currency businesses dealing with significant financial hardships and bankruptcy proceedings in 2022. Blockfi Voluntarily Petitions for Chapter 11 Bankruptcy Protection Blockfi has officially filed for bankruptcy protection according to a press release distributed on Monday morning at 10:17 a.m. (ET). The Chapter 11 bankruptcy filings encompass the crypto lender Blockfi and eight of its affiliates. The crypto…