ALSO: Sam Reynolds writes that Taiwan-based technology conglomerate HTC is looking to take its virtual headset business public as part of a quest to help cultivate the metaverse. But is the company going in the wrong direction? Original

Day: December 6, 2022

US consumer watchdog probes crypto firms over deceptive ads

Several crypto firms are facing a probe from the United States Federal Trade Commission (FTC) over possible deceptive or misleading advertisements relating to cryptocurrencies. According to a Dec. 6 report from Bloomberg, FTC spokeswoman Juliana Gruenwald said the watchdog is investigating “several firms for possible misconduct concerning digital assets.” Gruenwald did not provide further details about which firms were the subject of the investigation or what had triggered the probe. However, deceptive advertising and promotion have been a trending topic in the U.S. this year. In October, reality TV star…

Bitcoin Price Lacking Momentum Above $17k, BTC Holders Are Safe: Here’s Why

Bitcoin price extended its increase and tested the $17,500 resistance. BTC corrected gains, but it remains well supported above the $16,800 support. Bitcoin extended its upward move above $17,100 and $17,300 resistance levels. The price is trading near $17,000 and the 100 hourly simple moving average. There was a break below a key bullish trend line with support near $17,050 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair must stay above the $16,800 support to start a fresh increase. Bitcoin Price Remains Supported Bitcoin…

Ripple CTO shuts down XRP conspiracy theory from ChatGPT

Ripple’s chief technology officer has responded to a conspiracy theory fabricated by Artificial Intelligence (AI) tool ChatGPT, which alleges the XRP Ledger (XRPL) is somehow being secretly controlled by Ripple. According to a Dec. 3 Twitter thread by user Stefan Huber, when asked a series of questions regarding the decentralization of Ripple’s XRP Ledger, the ChatGPT bot suggested that while people could participate in the governance of the blockchain, Ripple has the “ultimate control” of XRPL. Asked how this is possible without the consensus of participants and its publicly-available code,…

Kentucky to scrutinize contracts offering cheaper electricity to miners

The Kentucky Public Service Commission (PSC) has reportedly opened a formal investigation into two proposed contracts that would offer discounted electricity prices to new crypto-mining operations. According to a Dec. 5 statement from environmental law group Earthjustice, the government department would be looking to determine whether subsidizing crypto mining operations will raise electricity costs for Kentucky residents. The two mining contracts under investigation include one between Kentucky Power and Ebon International LLC, which runs a 250-megawatt mining facility in Louisa, as well as mining company Bitki-KY, which operates a 13-megawatt…

Bitcoin Mining Difficulty Drops Most Since July 2021 as Crypto Winter Cuts Profitability

At these “depressed profitability levels, even miners using energy-efficient machines like the Antminer S19j Pro need access to electricity priced lower than $0.08 per kWh,” said Jaran Mellerud, an analyst at Luxor. Even though the average energy price on the network is about $0.05 per kilowatt hour (kWh), many miners are paying about $0.07 – $0.08 per kWh, Mellerud said. Source

Bitcoin Could Fall to $5,000 Next Year – Markets and Prices Bitcoin News

Standard Chartered Bank says the price of bitcoin could drop to $5,000 next year. The bank’s analyst explained that cryptocurrencies could fall further and more crypto firms could “succumb to liquidity squeezes and investor withdrawals.” Standard Chartered Bank’s $5K Bitcoin Scenario Standard Chartered Bank published a note titled “The financial-market surprises of 2023” Sunday. The note outlines a number of possible scenarios that “we feel are under-priced by the markets,” wrote Eric Robertsen, Standard Chartered’s global head of research. One of the scenarios is bitcoin’s price dropping to $5,000 next…

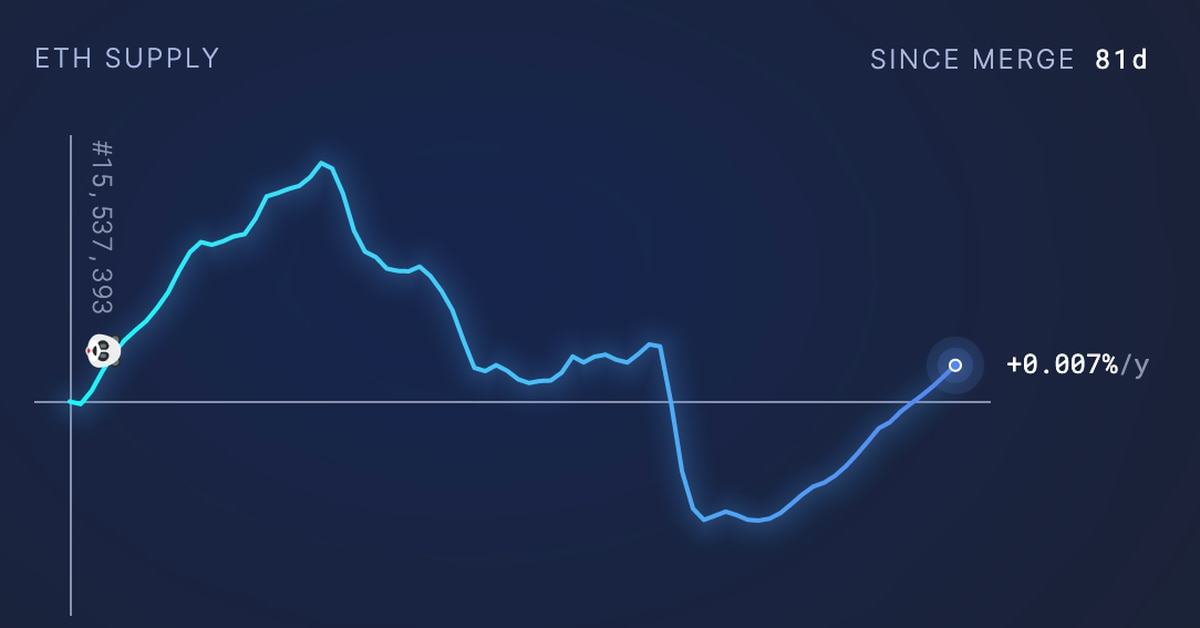

Ether Turns Inflationary as Network Usage Slows

Ether’s annualized inflation rate previously dropped below zero following the collapse of FTX-induced market volatility, which spurred a rise in Ethereum network usage. The positive inflation rate indicated ETH being minted outpaced being burned. Source

Bitcoin Now Undervalued For 170 Days, How Does This Compare With Previous Bears?

On-chain data shows Bitcoin has been undervalued for 170 days now, here’s how this figure compares with that during the previous bear markets. Bitcoin MVRV Ratio Has Been Stuck Under ‘1’ Since 170 Days Ago As pointed out by an analyst in a CryptoQuant post, the lowest point that the MVRV ratio has gone in this bear so far is 0.74. The “MVRV ratio” is an indicator that measures the ratio between Bitcoin’s market cap and its realized cap. Here, the “realized cap” is a BTC capitalization model where each…