Maple Finance is a decentralized credit market powered by blockchain technology. Instead of requiring overcollaterlization of loans, it instead allows managers, called “Pool Delegates” to issue loans from its lending pools based on a set of risk-management criteria, according to the protocol’s documents. Introducing Maple 2.0. Maple 2.0 is a fundamental overhaul of the smart contract architecture. The new contracts are modular and robust and will facilitate Maple bringing capital markets on-chain. pic.twitter.com/5GGsMXaXhv — Maple (@maplefinance) December 14, 2022 However, in the wake of FTX’s collap, the platform experienced two…

Day: December 14, 2022

Amid Withdrawals, Binance CEO Warns of Bumpy Months Ahead – Exchanges Bitcoin News

Binance founder Changpeng Zhao (CZ) has reportedly told staff to expect some difficult months as the leading cryptocurrency exchange is seeing customer withdrawals. The warning comes while the crypto industry is facing challenges after high-profile bankruptcies and amid tightening regulations. $3 Billion Pulled Out From Binance at Peak, Nansen Data Shows Binance, the world’s largest crypto exchange by trading volume, saw net outflows reaching $3 billion on Tuesday, Nov. 13, blockchain analytics firm Nansen revealed. The news comes as Changpeng Zhao, founder and chief executive of Binance, sought to assure…

Bitcoin Got REJECTED Hard!!! [new targets!!] Bitcoin Price Prediction 2022 // Bitcoin News Today

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin News Today – Bitcoin Got REJECTED Hard!!! [new targets!!] Bitcoin Price Prediction 2022 // Bitcoin News Today … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

US Regulation Heats Up; Bitcoin Rises, Then Falls

Ether (ETH): The second-largest cryptocurrency by market cap after bitcoin similarly followed BTC’s trajectory, sliding around 1% to $1,310 as of publication time. Earlier in the day, PayPal and MetaMask announced the payments company will integrate its buy, sell and hold crypto services with MetaMask Wallet as the companies look to broaden users’ options to transfer digital assets from their platforms. Users will be able to buy and transfer ETH from PayPal to MetaMask. Source

Bitcoin Miner CleanSpark Cuts 2023 Hashrate Outlook by Nearly 30%

In addition to the guidance cut, CleanSpark said that its fourth-quarter revenue rose 235% compared to the same period last year. Meanwhile, its net loss widened by 683% year over year, mainly due to the impairment of goodwill and bitcoin balances as well as non-cash charges due to modification of equity instruments, the company said in the statement. Original

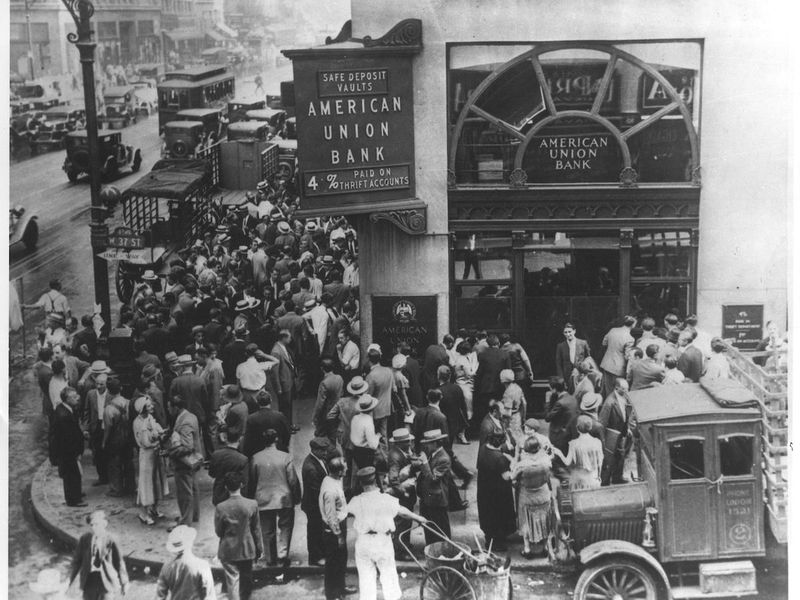

Explaining the Difference Between Liquidity and Insolvency

To be fair, it is not just crypto companies that say they are merely suffering from a “liquidity crisis” when they are actually insolvent. Traditional financial institutions are just as likely to say everything will be fine if only someone will lend them some more money. For example, RBS, the British bank whose disastrous collapse in October 2008 nearly took down the U.K.’s payments system, insisted it just needed more funding. But it eventually needed a U.K. government bailout costing some 46 billion British pounds (that’s $56.58 billion at today’s…

Bitcoin retraces intraday gains as bears aim to pin BTC price under $18K

On Dec. 14, Bitcoin (BTC) broke above $18,000 for the first time in 34 days, marking a 16.5% gain from the $15,500 low on Nov. 21. The move followed a 3% gain in the S&P 500 futures in 3 days, which reclaimed the critical 4,000 points support. Bitcoin/USD index (orange, left) vs. S&P 500 futures (right). Source: TradingView While BTC price started the day in favor of bulls, investors anxiously awaited the U.S. Federal Reserve Committee’s decision on interest rates, along with Fed chair Jerome Powell’s remarks. The subsequent 0.50%…

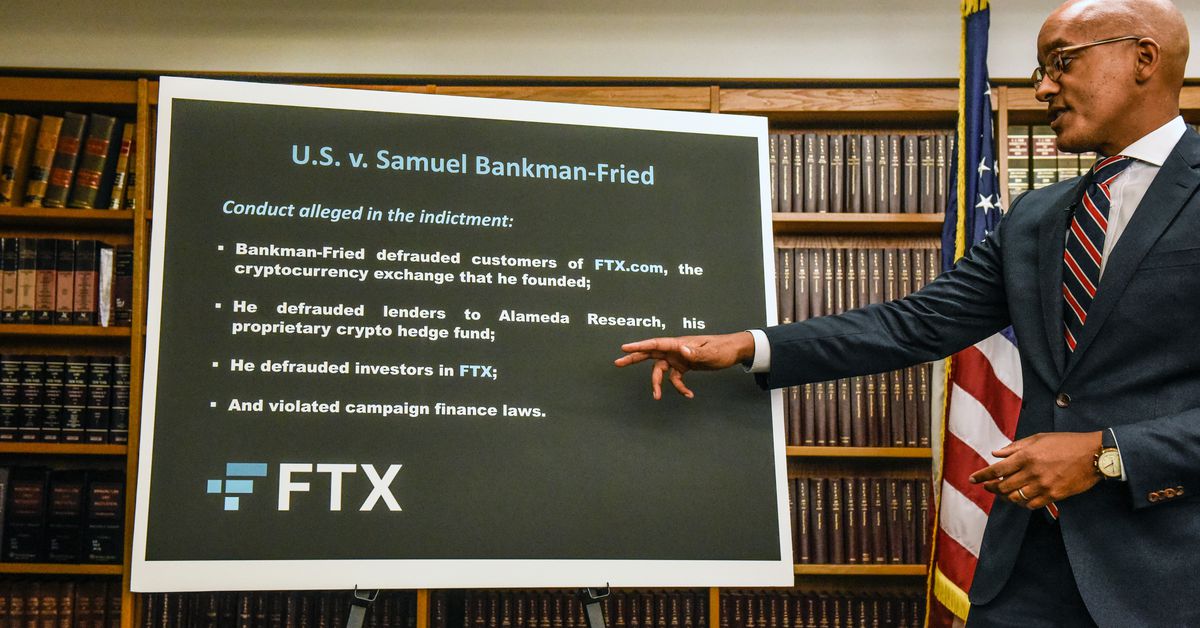

After Sam Bankman-Fried's Arrest, the FTX Show Goes On

Strap in folks: It’s a big week. Former FTX CEO Sam Bankman-Fried and current FTX CEO John J. Ray III were supposed to speak to the House Financial Services Committee. Obviously, things didn’t quite work out that way. Source

SBF’s Bahamian prison reported for ‘harsh’ conditions and ‘degrading treatment’ — US State Dept

After being denied bail in a Bahamas Magistrate Court, former FTX CEO Sam Bankman-Fried could spend up to two months in the country’s Fox Hill Prison, a facility with reported cases of physical abuse against prisoners and “harsh” conditions. Authorities in the Bahamas reportedly remanded Bankman-Fried to the medical wing of Fox Hill following a Dec. 13 hearing. SBF’s counsel said he had been taking medication prior to his arrest on Dec. 12 including Adderall and anti-depressants, but it’s unclear if the former CEO will serve his time at the…

New OECD report takes lessons from crypto winter, faults ‘financial engineering’

The Organisation for Economic Cooperation and Development (OECD) analyzed the crypto winter in a new policy paper titled “Lessons from the crypto winter: DeFi versus CeFi,” released Dec. 14. The authors examined the impact of the crypto winter on retail investors and the role of “financial engineering” in the industry’s current problems and found a lot not to like. The paper from the OECD, an intergovernmental body with 38 member states dedicated to economic progress and world trade, concentrated on events in the first three quarters of 2022. It placed…