Top US-based crypto exchange Coinbase has reached a settlement with regulators after bad actors stole $150 million using the platform. According to a memo from New York’s Department of Financial Services, Coinbase must pay $50 million in fines to the regulator, plus invest an additional $50 million in bolstering its internal compliance programs over the next two years. The memo says that Coinbase does the “bare minimum” to verify its customers and stifle illicit activities, which ultimately lead to a $150 million heist that occurred in mid-2021. The regulator says…

Day: January 4, 2023

BITCOIN & ETHEREUM SHORT SQUEEZE (important)! Bitcoin News Today, Ethereum Price Prediction, BTC,ETH

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io BITCOIN & ETHEREUM SHORT SQUEEZE (important)! Bitcoin News Today, Ethereum Price Prediction, BTC,ETH Welcome back … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Magic Eden Issue Leads to Fake NFT Listings

The unresolved issue is allowing unverified NFTs to be added to high-priced collections like Y00ts and ABC. Source

Digital assets inflows reached $433M in 2022: Report

Digital assets funds saw inflows totaling $433 million during 2022, the lowest level since 2018, when inflows in the crypto industry reached $233 million, according to the cryptocurrency investment firm Coinshares. Investors’ appetite for digital assets seems not to have been fully affected by the crypto winter, but otherwise encouraged investments in crypto assets in a year marked by a price decline and the collapse of many industry players. James Butterfill, researcher at CoinShares, noted in the weekly report that: “In a year where bitcoin prices fell by 63%, a…

Bitcoin Coinbase Inflows Spike, Is This Bearish For BTC?

On-chain data shows the Bitcoin inflows to Coinbase have spiked recently, a sign that may turn out to be bearish for the crypto. Bitcoin Exchange Inflows To Coinbase Register High Values As pointed out by an analyst in a CryptoQuant post, a total of 20k BTC was transferred to Coinbase recently. The “exchange inflows” is an indicator that measures the total amount of Bitcoin currently being transferred to an exchange (which, in this case, is Coinbase). When this metric’s value is high, investors send many coins to the exchange right…

How laws for digital assets changed in 2022

Effective regulations are one of the key gateways to cryptocurrency’s mainstream adoption. Due to greater compliance, crypto businesses saw broader acceptance from regulators worldwide. While the crypto ecosystem was awarded countless operational licenses and exposure to new markets, the fall of Terraform Labs, FTX and Celsius, among others, had a negative impact on the industry’s reputation with investors and regulators alike. As we look back on 2022 and all it brought for the cryptocurrency industry, we’re highlighting how the regulatory landscape has changed for cryptocurrencies and the blockchain industry as…

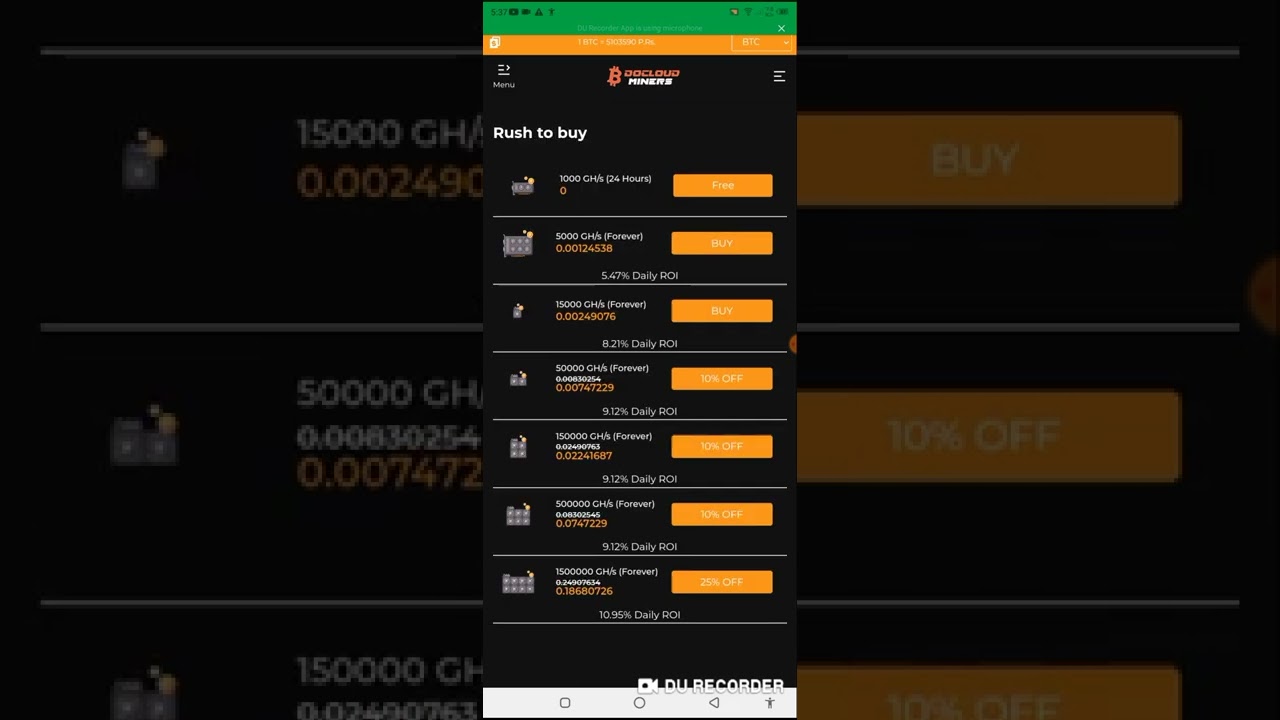

FREE BITCOIN MINING (NO INVESTMENT)$ FREE CRYPTO LOOT

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Free Bitcoin mining site Click this link … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Indicted FTX Co-Founder Sam Bankman-Fried Discussed ‘Pandemic Prevention’ With Biden Administration Officials – Bitcoin News

According to public filings, former crypto billionaire and FTX co-founder Sam Bankman-Fried met with senior Biden administration officials before he was indicted for financial fraud. When asked about the visits, White House press secretary Karine Jean-Pierre told the press the meetings involved discussions about “pandemic prevention.” Senior White House Staff Met With Former Billionaire Sam Bankman-Fried to Discuss ‘Crypto Industry’ and ‘Pandemic Prevention’ The disgraced FTX co-founder Sam Bankman-Fried (SBF), who is currently charged with eight counts of financial fraud and misconduct, met with the senior White House adviser Steve…

Price analysis 1/4: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Bitcoin and select altcoins are showing signs of starting a sustained recovery over the next few days. Gold made a strong start to the new year and is trading close to a seven-month high on expectations that the United States Federal Reserve may slow down and hike rates only by 25 basis points in its next meeting on Feb. 1. Cryptocurrency markets have also shown a mild uptick but are yet to make a decisive move higher. One of the reasons could be renewed fears regarding Digital Currency Group’s liquidity…

This 25-Year-Old Traded $2 B In Crypto From Parents’ Home

Per public filings with the Australian Securities and Investment Commission, a 25-year-old registered a million-dollar-worth trading company at his parents’ house. According to a report, the company successfully traded over $2 billion in Bitcoin and other cryptocurrencies. The trading desk is PO Street Capital, and its founder Darren Nguyen lives in an Australian suburb. The report claims that Nguyen and his company tried to keep a low profile and avoided attracting attention over the past two years. However, public records were discovered by journalists showcasing a $7 million profit in…