Paxos issues the Pax dollar (USDP) and Binance USD (BUSD) tokens, the latter is a Binance-branded stablecoin. Binance, on its part, told CoinDesk on Monday: “BUSD is a stablecoin wholly owned and managed by Paxos. As a result, BUSD market cap will only decrease over time.” Source

Day: February 13, 2023

Wormhole Bridge Exploiter Supplies $46M to Crypto Lending Platform Maker, Buys Wrapped Ether

The exploiter is probably earning yields on staked cryptocurrency. Source

Income Tax Applies to Crypto Trading in Bosnia, Tax Administration Says – Taxes Bitcoin News

Individuals are expected to pay income tax on gains from cryptocurrency trading, the tax authority of Bosnia has determined. In the absence of dedicated regulations, the federal government in Sarajevo has set up a working group to assess various risks associated with digital assets. Income Tax Is Due on Profits From Crypto Trades, Bosnia Tax Officials Tell Finance Ministry The taxation of crypto assets is not explicitly prescribed by Bosnia’s current legislation but the country’s tax authority has addressed the matter in communication with the finance ministry. The latter is…

SEC lawsuit against Paxos over BUSD baffles crypto community

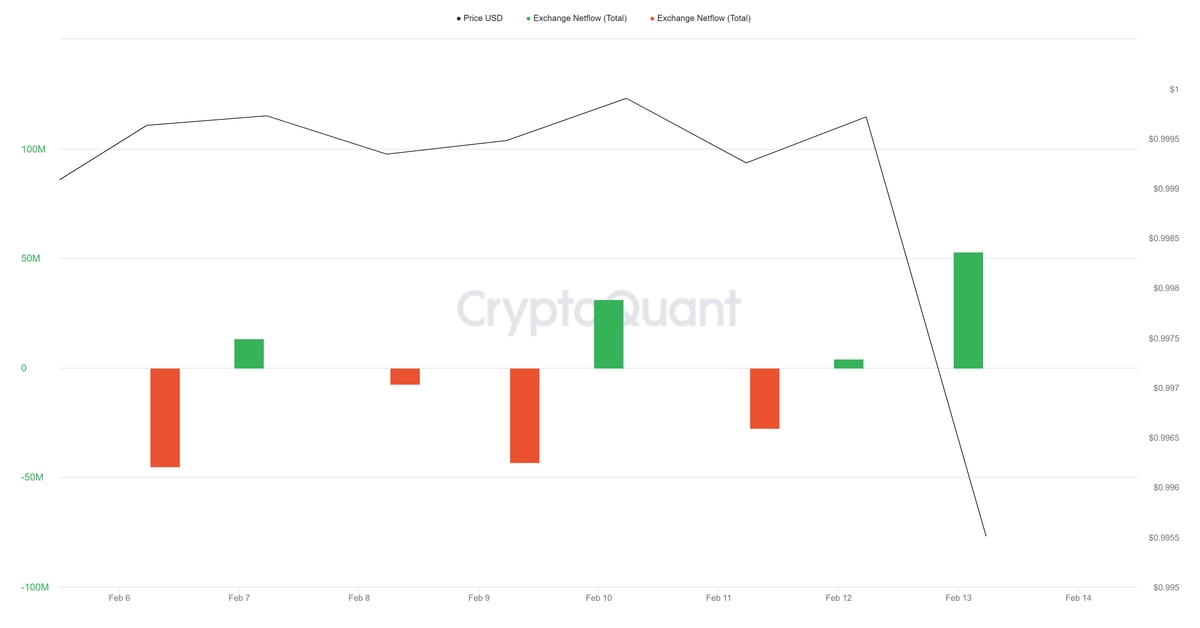

Paxos and Binance USD (BUSD) being in the sights of United States regulators sparked various reactions from the crypto community. On Feb. 13, the U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to Paxos, alleging that BUSD is unregistered security. On the same day, the New York Department of Financial Services (NYDFS) also ordered Paxos to halt the issuance of BUSD. As Paxos faces regulatory scrutiny on several fronts, various members of the crypto community went to Twitter to give their takes on the situation. From disregarding the…

Correlation Between Crypto Market and Nasdaq Turns Positive Ahead of US CPI Release

“Wages have decelerated in all meaningful forward-looking gauges, while housing is printing at extremes relative to reality in the CPI, meaning that we see a larger downside risk/reward in core relative to headline,” Larsen noted, while forecasting positive contributions from energy component, prices for goods, including used cars, and fatigue in good prices. Source

Bernstein Says Regulatory Backlash Will Lead to More DeFi and Offshore Crypto

“The question remains whether the regulator would go after all staking programs, even if they provide specific disclosures around yield, allow users to actively stake and un-stake their crypto and operate on a pass-through basis, both on returns and costs,” analysts Gautam Chhugani and Manas Agrawal wrote. Source

Restrictive Crypto Rules for EU Banks Confirmed in Published Legal Draft

“The potentially increasing involvement of [financial] institutions in crypto-assets related activities should be thoroughly reflected in the Union prudential framework, in order to adequately mitigate the risks of these instruments for the institutions’ financial stability,” said an explanatory text by the parliament’s Economic and Monetary Affairs Committee. “This is even more urgent in light of the recent adverse developments in the crypto-assets markets.” Source

UAE Plans to Issue a CBDC to Promote Digital Payments

“These digital payment initiatives will drive financial inclusion, promote payment innovation, security and efficiency, and achieve a cashless society,” the announcement said, adding that a digital dirham will “address the problems and inefficiency of cross-border payments and help drive innovation for domestic payments respectively.” Source

Coinbase Argues Its Staking Services Are Not Securities, Criticizes SEC Regulatory Approach – Bitcoin News

Coinbase, one of the biggest cryptocurrency exchanges in the U.S., has stated that the staking services offered on its platform do not constitute securities. The statements, made in the wake of the $30 million settlement that Kraken, another U.S.-based crypto exchange, completed with the U.S. Securities and Exchange Commission (SEC), also criticize the institution’s approach to the issue. Coinbase Defends Its Staking-as-a-Service Program Coinbase, one of the leading U.S.-based cryptocurrency exchanges, has published a blog post differentiating its staking-as-a-service program from others in the market, and clarifying that, for the…

Exchange pulls plug on DeFi multi-token wallet

Cryptocurrency exchange Huobi has announced that it will discontinue its Huobi Cloud Wallet platform in May 2023 citing ‘strategic and product adjustments’. As per an announcement on Huobi’s support page, maintenance and upgrades of the multi-token wallet service will officially stop on Feb. 13. Users that are still using the Cloud Wallet are being encouraged to transfer cryptocurrency and nonfungible tokens (NFTs) to their main Huobi accounts or other wallet addresses. Huobi Cloud Wallet’s withdrawal and transfer functions will work for the next three months, while users are cautioned not…