The U.S. Securities and Exchange Commission (SEC) has charged Terraform Labs and its CEO, Do Hyeong Kwon, with fraud, alleging that Kwon and his company orchestrated “a multibillion-dollar crypto-asset securities fraud.” The securities watchdog insists that Kwon raised billions from investors by creating an “interconnected suite of crypto-asset securities,” many of which were involved in unregistered transactions. SEC Charges Terra’s Do Kwon and Terraform Labs With Defrauding Investors Nine months after the entire Terra blockchain ecosystem collapsed, the U.S. Securities and Exchange Commission (SEC) charged the Singaporean company Terraform Labs…

Day: February 16, 2023

Bankman-Fried $250M Bond Is a ‘Joke,’ Claims Securities Lawyer

On Wednesday, Judge Lewis Caplan of the Southern District of New York (SDNY) disclosed the names of the two additional bond co-signers, Stanford University’s Andreas Paepcke, a senior research scientist; and Larry Kramer, once a dean of the university’s law school. They had agreed to pay $200,000 and $500,000, respectively. However, said Murphy, only if Bankman-Fried decided to skip town would “they have to write a check.” Source 250MBankmanFriedBondClaimsJokeLawyerSecurities CryptoX Portal

Shiba Inu Big Pump Soon | Shibarium Good News

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Hey Everyone Kaise hain aap Sab Telegram Channel – Binance … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin price derivatives look a bit overheated, but data suggests bears are outnumbered

Bitcoin (BTC) price rallied over 12% on Feb. 15, marking the highest daily close in more than six months. Curiously, the movement happened while gold reached a 40-day low at $1,826, indicating some potential shift in investors’ risk assessment for cryptocurrencies. A stronger than expected U.S. inflation report on Feb. 14 presented 5.6% growth year-over-year, followed by data showing resilient consumer demand caused traders to rethink Bitcoin’s scarcity value. U.S. retail sales increased by 3% in January versus the previous month — the highest gain in almost two years. On-chain…

US Senator Calls for Comprehensive Crypto Regulation to Protect Consumers – Regulation Bitcoin News

The chairman of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, Sherrod Brown, has called for a comprehensive regulatory framework for cryptocurrencies. “Recent crypto meltdowns have made clear that we need a comprehensive framework to regulate crypto products to protect consumers and our financial system,” said the senator. US Lawmaker Wants Comprehensive Regulatory Framework for Crypto U.S. Senator Sherrod Brown (D-OH), chairman of the Senate Committee on Banking, Housing, and Urban Affairs, talked about crypto regulation Tuesday in his opening statement at the congressional hearing titled “Crypto Crash:…

DeFi platforms can comply with regulations without compromising privacy — Web3 exec

Decentralized finance (DeFi) has been a rapidly growing sector of the cryptocurrency industry, but it has also faced significant regulatory challenges. With regulators struggling to keep up with the pace of innovation, the lack of clarity around regulations tends to create uncertainty for DeFi projects. Cointelegraph spoke to Alastair Johnson about regulatory challenges facing the DeFi industry. Johnson is the CEO of an identity “super-wallet” called Nuggets that seeks to deliver verified self-sovereign decentralized identities to users. He said that one of the main regulatory challenges is DeFi platform anonymity,…

SEC sues Do Kwon and Terraform Labs for fraud

The United States Securities and Exchange Commission (SEC) has filed a lawsuit against Terraform Labs and its founder Do Kwon for “orchestrating a multi-billion dollar crypto asset securities fraud.” In a Feb. 16 statement, the SEC said Kwon and Terraform offered and sold an “inter-connected suite of crypto asset securities, many in unregistered transactions” pointing to its algorithmic stablecoin, TerraClassicUSD (USTC) and its connected cryptocurrency Terra Luna Classic (LUNC). In a statement, SEC Chair, Gary Gensler, said: “We allege that Terraform and Do Kwon failed to provide the public with…

Platypus DeFi faces flash loan attack, according to CertiK

Blockchain security firm CertiK reported on Feb. 16 that it has spotted a flash loan attack on Avalanche-based stableswap platform Platypus DeFi. The blockchain security firm posted the news in a tweet, alongside the attacker contract address. #CertiKSkynetAlert We are seeing a #flashloan attack on @Platypusdefi resulting in a potential loss of ~$8.5M. Tx AVAX: 0x1266a937c2ccd970e5d7929021eed3ec593a95c68a99b4920c2efa226679b430 Stay Frosty! pic.twitter.com/AM2HOM5M2r — CertiK Alert (@CertiKAlert) February 16, 2023 According to the source, nearly $8.5 million has been already been moved. As a result, the Platypus USD stablecoin became depegged and dropped 52.2%…

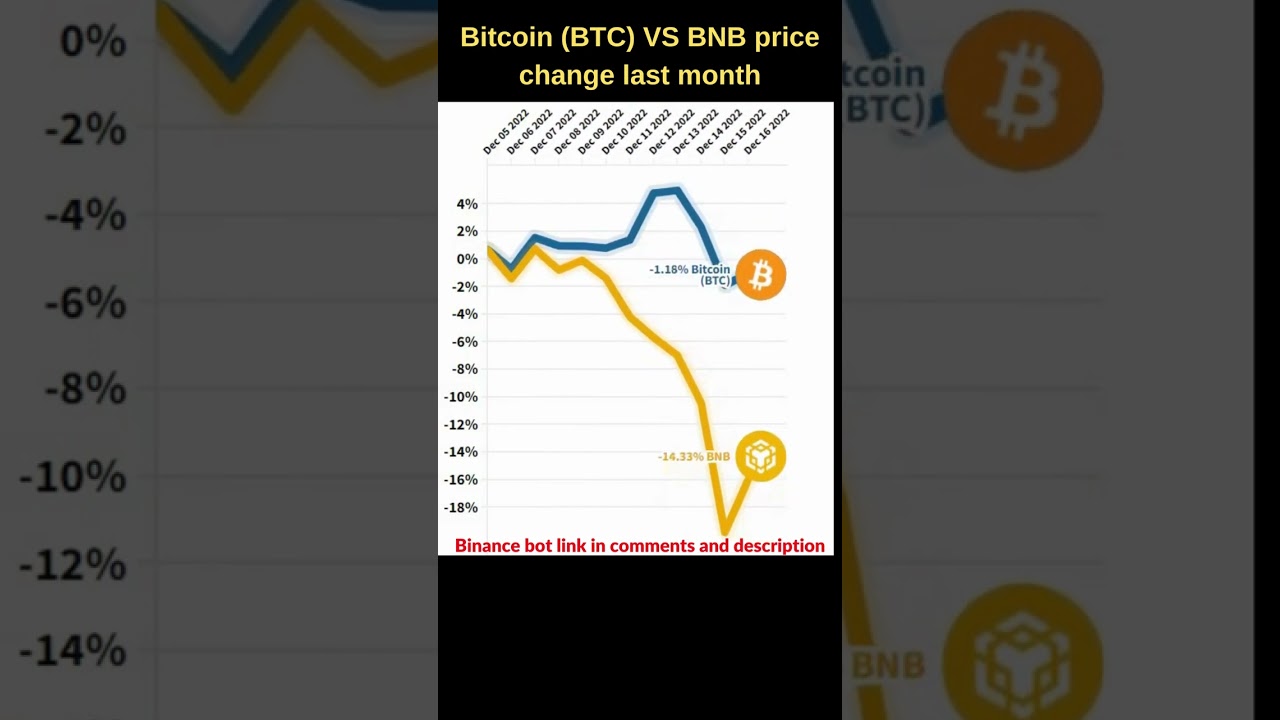

Bitcoin VS BNB crypto 🔥 Bitcoin price 🔥 bnb price 🔥 Bitcoin news 🔥 btc price 🔥 bnb coin together bnb

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io BNB price Bitcoin price Bitcoin VS BNB crypto btc price bnb coin together bnb Bitcoin news btc price change … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

SEC Sues Terraform Labs, Do Kwon for Misleading Investors on TerraUSD Stablecoin

“Terraform and Kwon also misled investors about one of the most important aspects of Terraform’s offering – the stability of UST, the algorithmic ‘stablecoin’ purportedly pegged to the U.S. dollar,” the suit said. “UST’s price falling below its $1.00 ‘peg’ and not quickly being restored by the algorithm would spell doom for the entire Terraform ecosystem, given that UST and LUNA had no reserve of assets or any other backing.” Source